Mobileforce

- Blog, General Resources

Table of Contents

Toggle“Revenue Lifecycle Management? Oh, that’s just fancy talk for our sales process, right?”

Wrong. Dead wrong.

If you think RLM is simply CRM 2.0 or another way to dress up your existing sales funnel, you’re missing the forest for the trees. Revenue Lifecycle Management isn’t just another three-letter acronym competing for space in your tech stack—it’s a complete rethinking of how revenue actually flows through your business.

Here’s what most people get wrong about RLM. They see it as a sales tool when it’s actually an orchestration platform. They think it’s about closing deals faster when it’s really about maximizing every dollar that walks through your door. They assume it’s another CRM feature when it’s actually the missing link between your marketing spend and your bottom line.

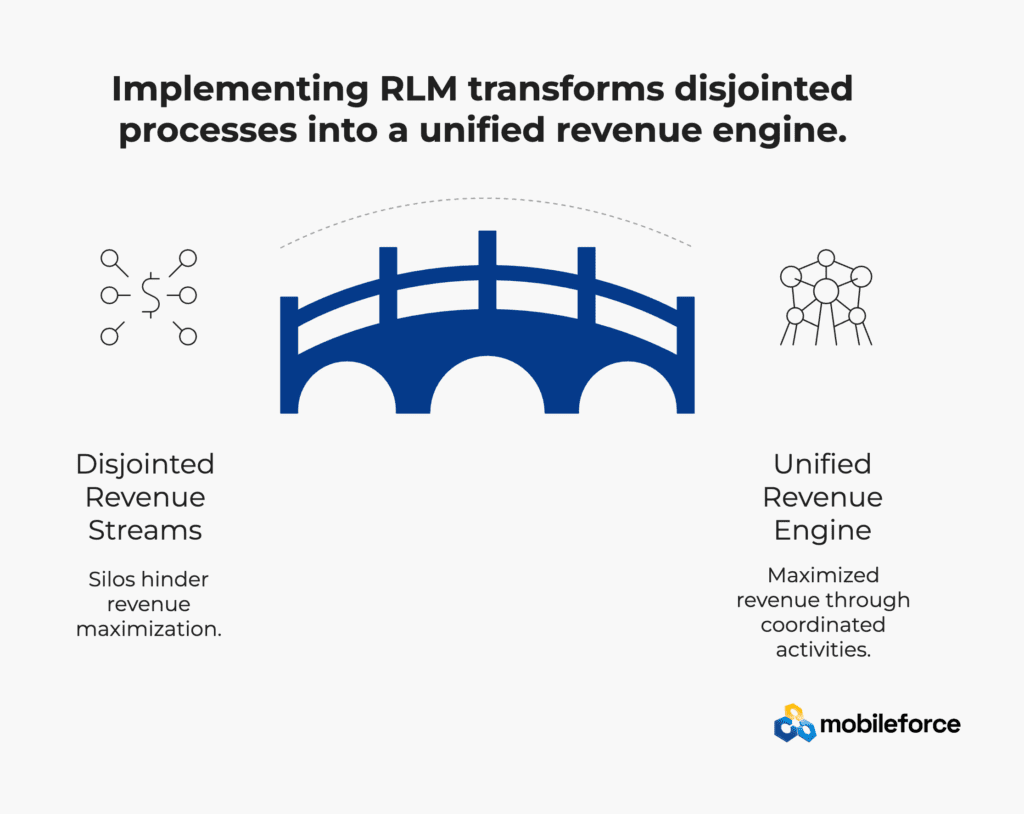

The real story? RLM connects the dots between every revenue-generating activity in your organization. While traditional approaches treat sales, marketing, and customer service like separate kingdoms, RLM breaks down those walls and creates a unified revenue engine. This isn’t just feel-good organizational theory—it’s practical business necessity in a world where digital technology finally makes this level of coordination possible.

🚀 Ready to stop leaving money on the table? See how RLM can transform your revenue operations →

SaaS companies figured this out first. When your entire business model depends on recurring revenue, you can’t afford to treat customer acquisition and retention as separate functions. Solutions like Salesforce’s RLM platform didn’t emerge by accident—they solve real problems for businesses where the quote-to-cash process determines whether you thrive or merely survive. Done right, RLM doesn’t just increase customer satisfaction—it eliminates the revenue leakage that kills profitable growth.

Sound familiar? The disconnect between what your revenue process looks like on paper versus how it actually works in practice? That gap is exactly what we’re about to fix.

This guide cuts through the marketing noise to show you what Revenue Lifecycle Management really means, how it differs from the solutions you’ve already tried, and why it might be the strategic advantage your competitors haven’t figured out yet.

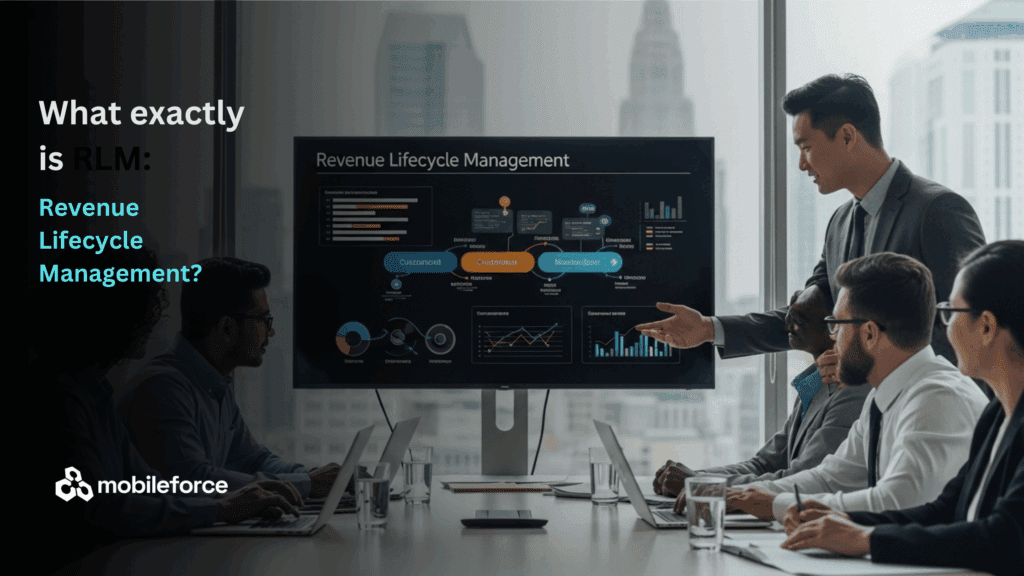

What is Revenue Lifecycle Management?

Revenue Lifecycle Management is what happens when you stop treating your revenue process like a relay race and start treating it like a symphony. Instead of passing the baton from marketing to sales to finance and hoping nothing gets dropped, RLM orchestrates every revenue-generating activity throughout your entire customer journey.

Here’s the fundamental difference: most businesses manage revenue in chunks. They generate leads, then hand them off. They close deals, then throw them over the fence to fulfillment. They collect payments, then file them away. RLM says that’s backwards—every interaction is connected, and the connections are where the real money lives.

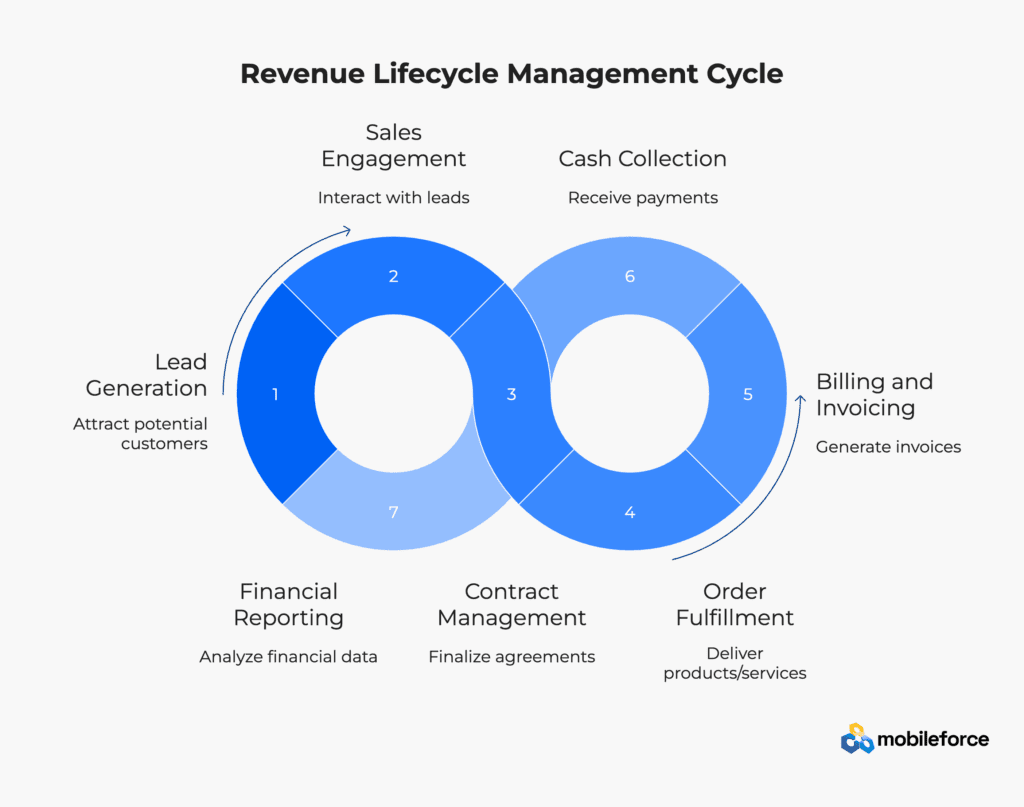

Understanding the revenue life cycle

The revenue lifecycle isn’t just a flowchart—it’s your entire business model in motion. Think of it as seven interconnected stages that most companies treat as separate processes: lead generation, sales engagement, contract management, order fulfillment, billing and invoicing, cash collection, and financial reporting. The magic happens in the spaces between these stages, where traditional approaches create gaps and RLM creates opportunities.

Unlike the old approach where marketing, sales, finance, and operations work in their own worlds, RLM connects these functions into one streamlined journey. This isn’t just about better communication—it’s about fundamentally different business architecture. Whether you’re selling products, services, or subscriptions, RLM adapts to handle changing contract values and evolving customer relationships without breaking a sweat.

🚀 Ready to stop leaving money on the table? See how RLM can transform your revenue operations →

How RLM differs from traditional revenue models

Traditional revenue models operate like separate companies under one roof. Marketing generates leads and tosses them to sales. Sales closes deals and hands them to operations. Finance bills customers and reports numbers. Each department optimizes for their own metrics, creating what feels efficient locally but is actually chaos globally.

RLM flips this script entirely. Forrester defines it as a “customer-centric growth strategy that helps businesses align their customer lifecycle with revenue opportunities and buying motions. Translation: instead of optimizing for departmental efficiency, you optimize for customer value across the entire relationship.

The numbers tell the story. 45% of organizations report time-consuming manual tasks and 34% struggle with data integration across systems. These aren’t just operational headaches—they’re revenue killers. RLM solves this by creating a single source of truth that every department can access and contribute to, eliminating the data silos that cause deals to slip through the cracks.

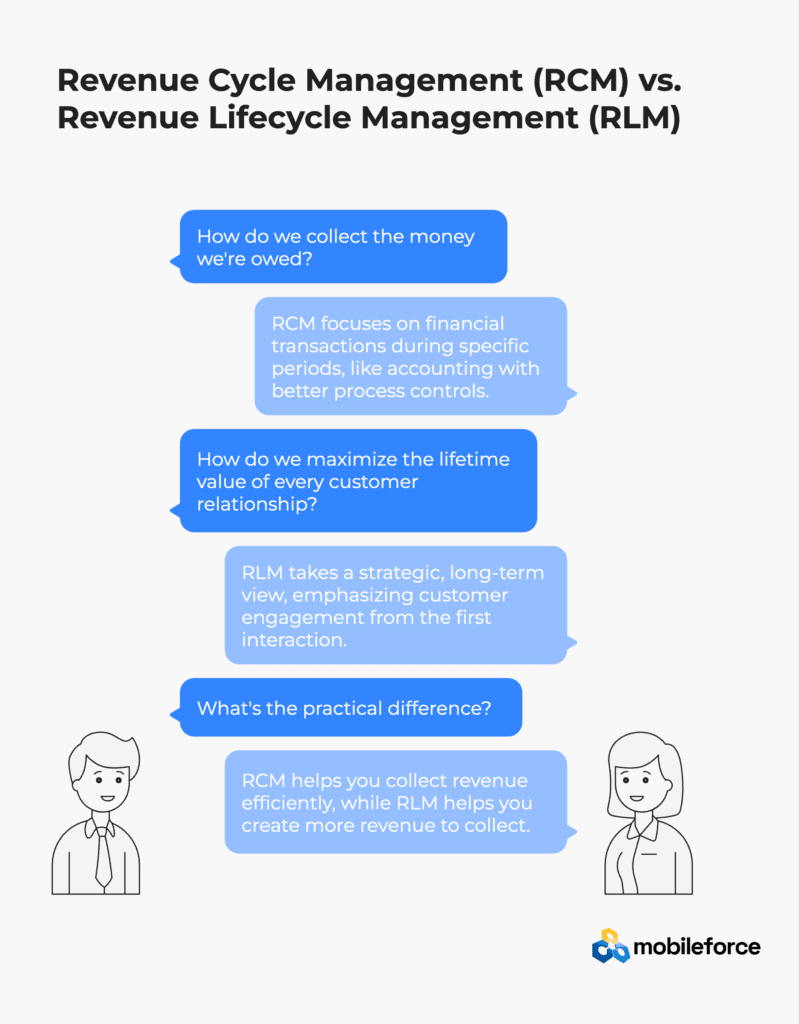

Revenue cycle management meaning vs lifecycle management

Revenue Cycle Management (RCM) and Revenue Lifecycle Management sound similar, but they’re solving different problems. RCM focuses on financial transactions during specific periods—think of it as accounting with better process controls. In healthcare, RCM tracks everything from appointment scheduling to payment collection. It’s tactical, short-term, and primarily concerned with billing accuracy.

RLM takes a strategic, long-term view. While RCM asks “How do we collect the money we’re owed?” RLM asks “How do we maximize the lifetime value of every customer relationship?” RCM emphasizes billing accuracy; RLM emphasizes customer engagement from the first interaction.

The practical difference? RCM helps you collect revenue efficiently. RLM helps you create more revenue to collect. Both are important, but only one drives sustainable growth.

🚀 Ready to stop leaving money on the table? See how RLM can transform your revenue operations →

Why RLM Is Gaining Momentum

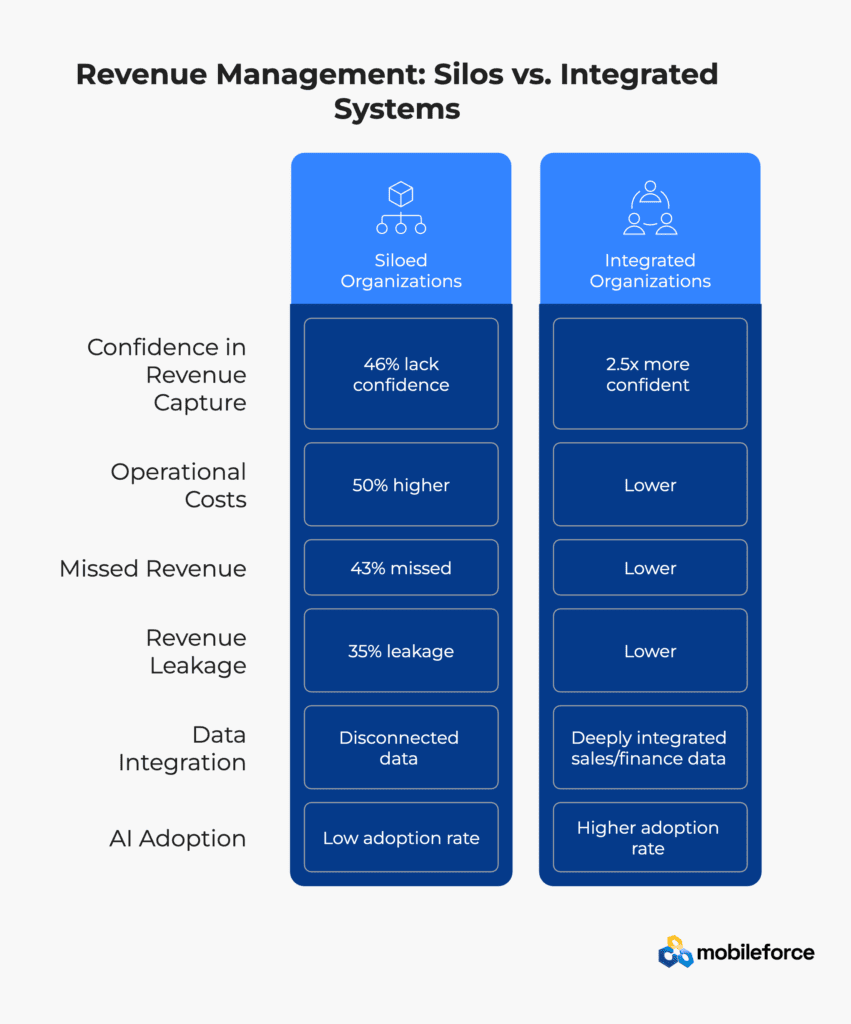

Here’s a sobering statistic: 46% of business professionals lack confidence in their organization’s ability to identify and capture all possible revenue opportunities. Let that sink in for a moment. Nearly half of all businesses are essentially flying blind when it comes to their own revenue potential.

This isn’t just a confidence problem—it’s a crisis of disconnected systems and siloed thinking that’s bleeding companies dry. The fallout is measurable and painful: 50% higher operational costs, 43% missed revenue opportunities, and 35% revenue leakage. These aren’t rounding errors. They’re the difference between thriving and merely surviving in today’s market.

Smart organizations are waking up to this reality. Companies are abandoning the old playbook of departmental fiefdoms and embracing unified revenue models that actually work.

The Silo Problem Is Killing Your Growth

Traditional departmental silos don’t just create inefficiency—they create blind spots that competitors exploit. Your marketing team generates leads that sales can’t properly qualify. Your sales team closes deals that finance can’t properly bill. Your customer success team identifies expansion opportunities that never make it back to sales. Sound familiar?

The organizations breaking free from this dysfunction are seeing dramatic results. Companies with fully integrated tools and systems are 2.5 times more likely to be confident in their ability to manage and capture revenue. Those with high confidence in capturing revenue? They’re 4 times more likely to have deeply integrated sales and finance data.

Digital Technology Finally Makes Integration Possible

Digital transformation isn’t just a buzzword—it’s the enabler that makes effective RLM implementation possible. Emerging technologies allow businesses to refine their revenue models, increase value generation, and reduce operational costs. For the first time in business history, the technology exists to connect every revenue touchpoint in real-time.

AI adoption is accelerating this trend. While 87% of professionals are confident in AI’s ability to improve business performance, only one in four currently utilize AI to enhance revenue management processes. But change is coming fast: 66% of those who haven’t yet adopted AI report a high likelihood of adoption within the coming year.

SaaS Companies Led the Way (And Everyone Else Is Catching Up)

Subscription-based businesses didn’t adopt RLM by choice—they adopted it by necessity. When your entire business model depends on recurring revenue, you can’t afford to treat customer acquisition and retention as separate functions. 100% of decision-makers agree that understanding the entire revenue lifecycle is important, but subscription businesses live this reality every day.

The growth of SaaS companies has influenced this trend across industries. As one industry expert noted, “since the cloud has come into play, the relationship with the customer is changing”. Cloud businesses resemble service businesses because engagement must be continuous and focused on value realization rather than merely deploying technology.

This shift reflects broader market dynamics where customer expectations have changed permanently. 81% of respondents stated that customers now expect vendors to engage with them continuously after the initial sale. The one-and-done transaction model is dead. The relationship economy has arrived.

🚀 Ready to stop leaving money on the table? See how RLM can transform your revenue operations →

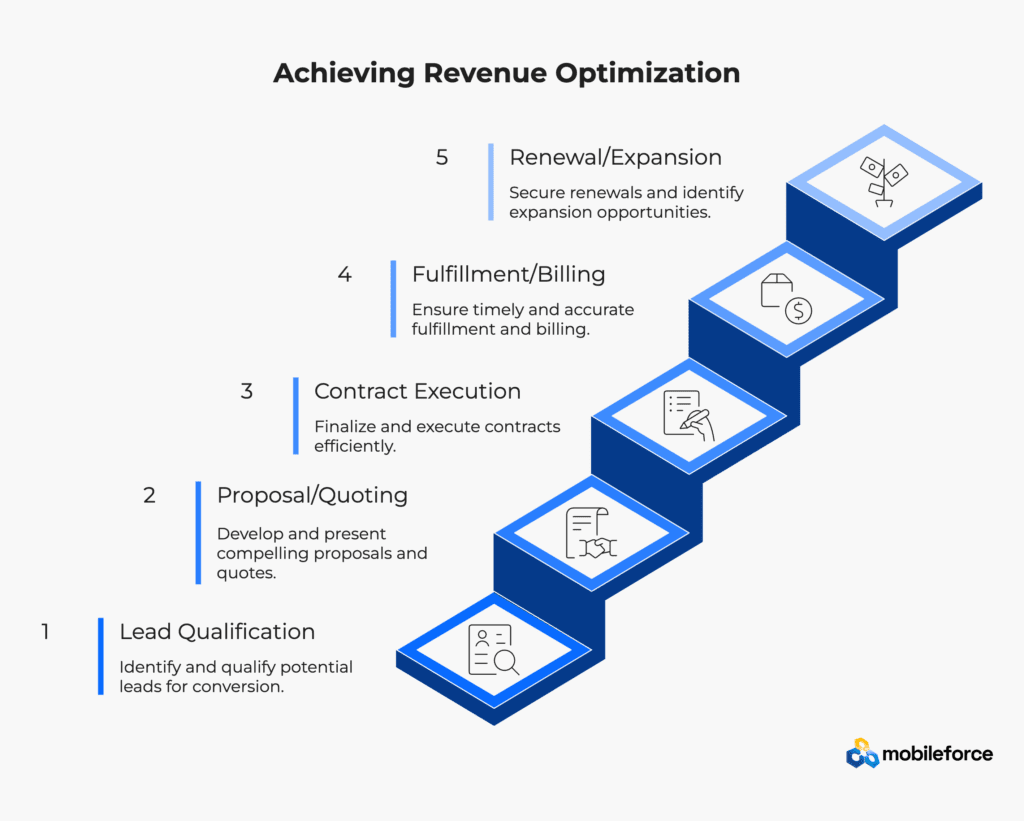

Breaking Down the Revenue Lifecycle Stages

Your sales rep just closed a \\$50K deal. Champagne time, right? Not quite. That signature is actually just the beginning of a complex journey that determines whether you’ll see that revenue hit your bank account—or watch it evaporate through operational chaos.

Most organizations think about revenue in terms of “before the deal” and “after the deal.” That’s like thinking about a marathon in terms of “before mile 1” and “after mile 26.” You’re missing the entire race. The revenue lifecycle isn’t a handoff—it’s a relay race where every runner needs to execute flawlessly.

Here’s how the stages actually work when they’re optimized for real business results:

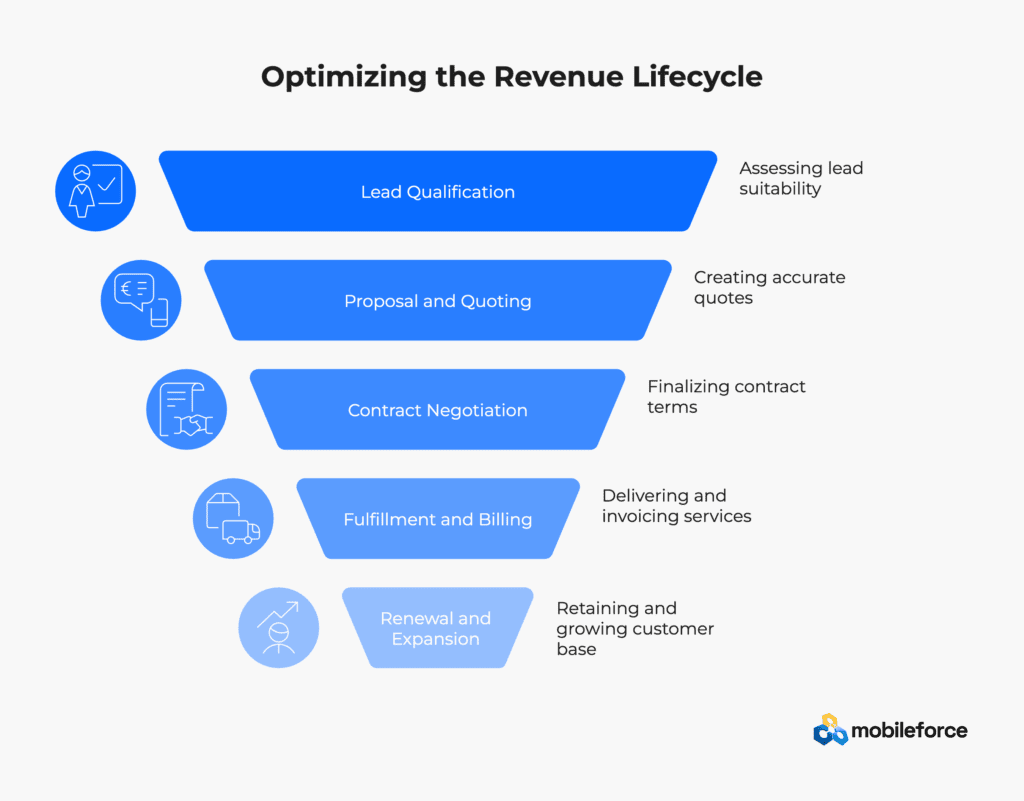

1. Lead Generation and Qualification

This isn’t about casting the widest net possible. Smart organizations start with surgical precision—understanding exactly who their ideal customers are through buyer persona research, analyzing past purchase patterns, and collecting feedback that reveals what really drives buying decisions.

The qualification piece is where most teams stumble. They either qualify too little (wasting time on tire-kickers) or too much (analysis paralysis that kills momentum). Effective lead qualification evaluates prospects based on budget reality, purchase timeline, and genuine fit with your offerings. The goal isn’t to find perfect prospects—it’s to identify which leads deserve your sales team’s focused attention.

2. Proposal and Quoting

Nothing kills deal momentum quite like the quoting black hole. Complex configurations, unique pricing rules, and approval workflows that belong in a Kafka novel. One pricing mistake can torpedo an entire deal—or worse, create unprofitable contracts that haunt your margins for years.

Modern RLM solutions attack this problem head-on. Configure, Price, Quote (CPQ) functionality handles thousands of line items, rule configurations, and discount scenarios with surgical precision. The result? Organizations reduce time-to-quote while improving margins by preventing the rogue discounting that slowly bleeds profitability.

3. Contract Negotiation and Execution

Here’s where good deals go to die. Traditional contract processes involve email chains, version control nightmares, and approval workflows that turn urgent deals into bureaucratic purgatory. Sound familiar?

Effective RLM simplifies this chaos through customized contract authoring, collaboration tools that actually work, intelligent approval management, seamless e-signatures, and obligations tracking that prevents things from falling through the cracks. Organizations implementing these solutions report reducing contract processing time from 30-45 minutes to just 3-5 minutes. That’s not just efficiency—it’s competitive advantage.

4. Fulfillment and Billing

The handoff from sales to operations is where revenue often gets lost in translation. Coordinating, scheduling, building, and installing products and services based on contract information while ensuring customers receive accurate, timely invoices requires orchestration that most organizations haven’t mastered.

Here’s the breakthrough: Automation at this stage does more than expedite revenue recognition—it frees your sales teams to focus on what they do best: building customer relationships instead of chasing down billing discrepancies and fulfillment delays.

5. Renewal and Expansion

The final stage is actually your biggest opportunity. Proactive renewal management identifies accounts approaching renewal dates, enabling timely interventions that prevent churn before it happens. But smart organizations don’t stop at retention—they use this stage to maximize customer lifetime value through strategic upselling and cross-selling.

The numbers don’t lie: It costs 5-25 times more to acquire a new customer than to retain an existing one. Organizations that master this stage turn customer relationships into compounding revenue engines that grow stronger over time.

Each stage builds on the previous one. Get lead qualification wrong, and you’re wasting time on prospects who’ll never buy. Stumble on quoting, and qualified leads disappear to faster competitors. Mess up contracts, and closed deals stagnate in legal limbo. Miss the renewal, and you’re back to expensive customer acquisition.

The businesses that thrive understand this isn’t just process optimization—it’s revenue architecture that determines whether you’re building a sustainable growth engine or just staying busy.

🚀 Ready to stop leaving revenue on the table? Get your personalized RLM assessment today →

RLM vs CPQ: What’s the Real Difference?

Here’s the question that lands in our inbox every week: “We already have CPQ. Why do we need RLM?”

It’s like asking why you need a car when you already have an engine. CPQ is powerful, but it’s just one component in a much larger system. Revenue Lifecycle Management isn’t CPQ with extra features—it’s the entire vehicle that gets you where you need to go.

Revenue Lifecycle Management vs CPQ

Think of CPQ as your sales team’s precision tool. It handles the complex dance of product configuration, pricing calculations, and quote generation with surgical accuracy. CPQ excels at turning complicated product catalogs into clean, professional proposals. It’s the Swiss Army knife of the sales process.

RLM? That’s the entire workshop. While CPQ focuses on the critical moment when prospects become customers, RLM orchestrates every revenue-generating activity from the first marketing touchpoint through contract renewals and expansion opportunities. The scope difference isn’t incremental—it’s fundamental.

CPQ asks: “How do we quote this deal accurately?” RLM asks: “How do we maximize revenue from this relationship over time?” Both questions matter, but they require different answers.

The integration story tells you everything. CPQ tools typically plug into your existing sales process, improving efficiency within defined boundaries. RLM platforms eliminate those boundaries entirely, creating unified revenue operations where marketing, sales, and customer success work from the same playbook.

When to Use CPQ vs Full RLM Platforms

CPQ makes perfect sense when your revenue challenges live in a specific box. Complex product configurations giving your sales team headaches? CPQ solves that. Pricing rules that require PhD-level mathematics? CPQ handles it. Quote generation taking days instead of hours? CPQ fixes it.

But here’s where CPQ hits its limits:

Your business runs on recurring revenue streams that demand continuous optimization. Revenue leakage happens at multiple touchpoints, not just during quoting. Marketing and sales operate like separate companies instead of integrated teams. You need analytics that span the entire customer journey, not just the sales cycle.

When these scenarios sound familiar, you’ve outgrown CPQ. Full RLM platforms become necessary when the problem extends beyond quote generation into revenue optimization across the entire customer lifecycle.

How RLM Extends Beyond Quoting

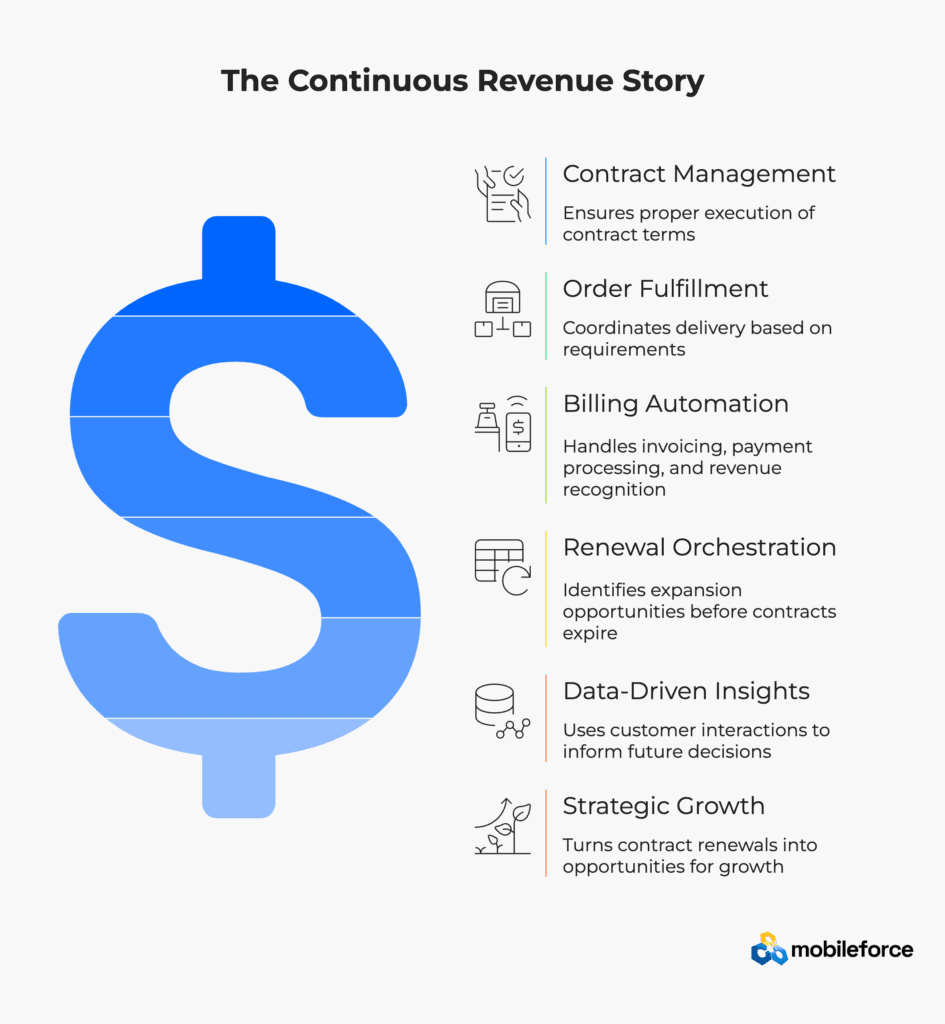

Revenue Lifecycle Management doesn’t stop when the contract gets signed—that’s when the real work begins. Contract management ensures terms get executed properly. Order fulfillment coordinates delivery based on negotiated requirements. Billing automation handles the complex dance of invoicing, payment processing, and revenue recognition. Renewal orchestration identifies expansion opportunities before contracts expire.

The magic happens in the connections. While CPQ creates individual quotes, RLM creates a continuous revenue story. Every customer interaction becomes data that informs future decisions. Every contract renewal becomes an opportunity for strategic growth. Every billing cycle becomes intelligence that improves the next deal.

Most importantly, RLM provides what CPQ can’t: a single source of truth for all revenue data. Instead of making strategic decisions based on fragmented information scattered across different systems, you get complete customer insights that reveal opportunities hidden in departmental silos.

The result? Revenue optimization that works across the entire customer relationship, not just the moment when they say yes to your quote.

🚀 Ready to stop leaving revenue on the table? Get your personalized RLM assessment today →

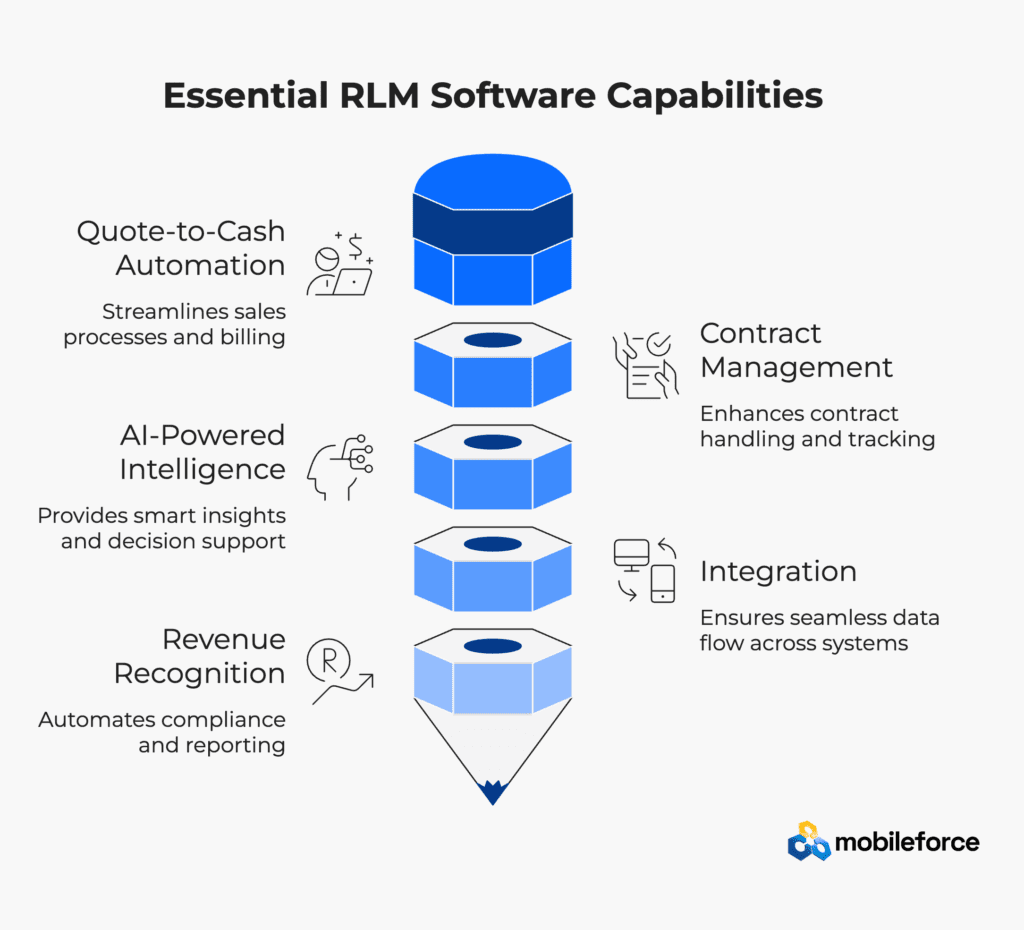

Top Features to Look for in RLM Software

Here’s the thing about shopping for RLM software: most vendors will dazzle you with feature lists longer than a CVS receipt. But smart buyers know that bells and whistles don’t matter if the core functionality can’t handle your actual business requirements.

After watching countless RLM implementations succeed and fail, five capabilities separate the platforms that actually work from those that just look good in demos.

Quote-to-Cash Automation That Actually Works

Your sales rep shouldn’t need a computer science degree to generate a quote. The best RLM solutions make complex product configurations feel effortless—pulling data directly from your CRM, applying the right pricing rules, and handling currency conversions without breaking a sweat.

What this looks like in practice: A rep configures a multi-year subscription with usage tiers, applies customer-specific discounts, and generates a professional quote—all in under five minutes. The system automatically triggers the approval workflow for anything outside standard parameters and routes the quote to the right stakeholders without anyone having to remember who approves what.

But here’s where most solutions fall short: billing complexity. Your platform needs to handle subscription billing, usage-based pricing, and multi-currency transactions without creating headaches for your finance team. If your billing process still requires spreadsheet gymnastics, you’re not getting the full value from your RLM investment.

Contract Management That Doesn’t Suck

Contract management is where deals go to die. Traditional approaches involve endless email chains, version control nightmares, and approval processes that make waiting at the DMV seem efficient by comparison.

Smart RLM platforms turn contract management into a competitive advantage. Pre-built templates eliminate the need to start from scratch. Automated workflows route contracts through approval processes without creating bottlenecks. Version control ensures everyone works from the same document.

The game-changer: obligation management that actually tracks what you’ve committed to deliver. When your system automatically alerts you about upcoming deliverables, renewal dates, and pricing escalations, you’re no longer playing defense against your own contracts.

AI-Powered Intelligence That Earns Its Keep

Not all AI is created equal. While some platforms slap chatbots on their interface and call it “AI-powered,” the real value comes from AI that makes your quoting process smarter and more accurate.

Look for systems that guide pricing decisions based on historical data, suggest optimal contract terms for specific deal types, and identify approval requirements before you hit send. The best AI features work behind the scenes—preventing pricing errors, recommending product bundles, and flagging potential compliance issues before they become problems.

What actually matters: AI that learns from your successful deals and helps replicate those patterns. Generic AI recommendations are nice. AI that understands your business model and customer base is game-changing.

Integration That Doesn’t Require a PhD

Your RLM platform needs to play nicely with your existing tech stack. This means real-time data synchronization with your CRM, seamless connections to your ERP system, and automated handoffs to your billing platform.

The litmus test: Can your sales team access everything they need without switching between multiple systems? If they’re still copying and pasting data between platforms, your integration isn’t working.

The best RLM solutions create a unified view of your revenue data—quotes, contracts, invoices, and customer interactions all living in harmony. This unified approach eliminates the data silos that plague most revenue operations and provides the real-time visibility that executives actually need to make decisions.

Revenue Recognition That Keeps the Auditors Happy

Nobody wants to explain revenue recognition errors to their board. Modern RLM platforms automate compliance with ASC 606 and IFRS 15, ensuring your revenue reporting meets regulatory requirements without requiring a dedicated compliance team.

The bottom line: Your platform should handle revenue recognition automatically, provide audit trails for compliance reviews, and generate the reports your finance team needs without manual intervention.

When these five capabilities work together seamlessly, you get an RLM platform that doesn’t just manage your revenue process—it accelerates it. The question isn’t whether you need these features; it’s whether your current solution actually delivers them in practice.

🚀 Ready to stop leaving revenue on the table? Get your personalized RLM assessment today →

Choosing the Best Revenue Lifecycle Management Software

Here’s the uncomfortable truth about RLM software selection: most companies get it spectacularly wrong.

They fall for flashy demos, get caught up in feature comparisons, and completely miss the fundamental question that determines success or failure. The question isn’t which RLM platform has the most bells and whistles—it’s which one actually fits how your business operates today and where you’re headed tomorrow.

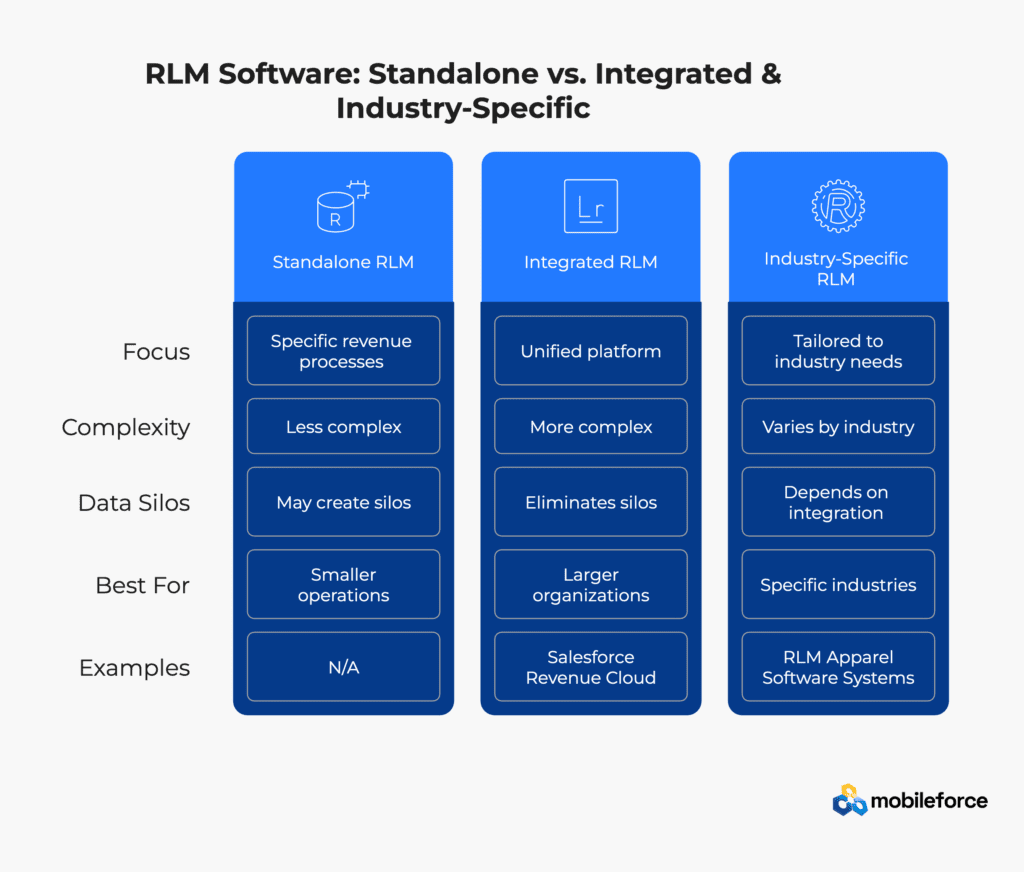

Standalone vs Integrated Systems

Let’s start with the fork in the road that trips up most buyers.

Standalone RLM solutions do one thing well: they focus on specific revenue processes without getting tangled up in your existing tech stack. Think of them as the specialty tools in your workshop—precise, efficient, and typically easier on your budget upfront. If you’re a smaller operation with straightforward revenue management needs, these focused solutions often deliver exactly what you need without unnecessary complexity.

Integrated systems play a different game entirely. They connect every piece of your revenue puzzle into a single, unified platform. Yes, they’re more complex to implement. Yes, they require more investment upfront. But here’s what makes them worth considering: they eliminate the data silos that kill revenue optimization efforts before they even get started.

The plot twist? Many enterprises with substantial investments in multiple ERP and CRM systems find that independent applications enable RLM adoption while preserving existing system investments. Sometimes the best integration strategy is knowing when not to integrate everything.

Industry-Specific Solutions That Actually Work

One size fits none when it comes to RLM software.

The fashion industry learned this lesson the hard way. RLM Apparel Software Systems provides specialized solutions that track and manage business processes while enabling collaboration with global teams and suppliers. Brands like Alexander Wang, Johnny Was, and U.S. Polo Association didn’t choose this platform because it was trendy—they chose it because it understood their unique challenges.

For broader business applications, Salesforce Revenue Cloud (formerly RLM) offers AI-powered platforms that streamline quoting, enhance decision-making, and accelerate contract cycles. The platform’s native architecture allows selective adoption of billing and contract lifecycle management, supporting 50% transaction volume growth. But here’s what the marketing materials don’t tell you: it works best for companies already committed to the Salesforce ecosystem.

The Real Evaluation Framework

Skip the vendor-provided checklists. They’re designed to make every platform look perfect for your needs.

Instead, assess your organization’s specific requirements through this lens: functionality, ease of use, scalability, integration capabilities, and return on investment. But dig deeper than surface-level features. Examine whether potential solutions offer contract visibility for revenue protection, global scalability for revenue assurance, and simplified management.

Here’s what separates smart buyers from everyone else: they evaluate customer support reliability, training resources, and implementation costs before they fall in love with features. The right RLM software should deliver increased revenue over customer lifetime, reduced revenue leakage, fewer invoice errors, higher contract renewal rates, and lower administrative costs.

Notice what’s missing from most evaluation processes? Testing the software with your actual data, your real processes, and your specific edge cases. Demos with perfect sample data tell you nothing about how the platform handles your messy reality.

The companies that get RLM selection right don’t just evaluate software—they evaluate partnerships. Because when your revenue engine breaks down, you need more than a help desk ticket system.

🚀 Ready to stop leaving revenue on the table? Get your personalized RLM assessment today →

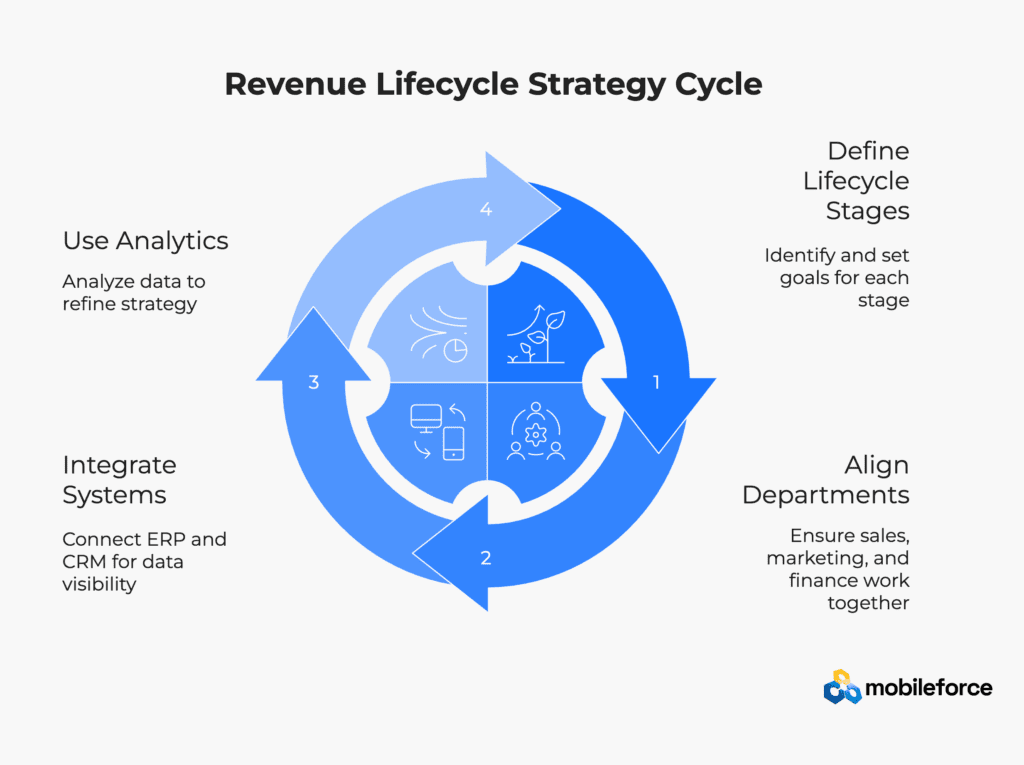

Building a Revenue Lifecycle Strategy

Most revenue lifecycle strategies fail before they even start. Not because the concept is flawed, but because organizations treat strategy building like assembling IKEA furniture—they skip the instructions and wonder why nothing fits together properly.

Here’s the truth about building an RLM strategy: It’s not about the technology you choose or the processes you map. It’s about getting everyone in your organization rowing in the same direction instead of paddling in circles.

Defining lifecycle stages and goals

You can’t manage what you don’t measure, and you can’t measure what you haven’t defined. Most effective RLM strategies recognize four primary stages: awareness, engagement, purchase, and loyalty. Sounds simple, right? It’s not.

Each stage needs specific goals, objectives, and tactics that actually make sense for your business. Take the awareness stage—your goal might be “increase brand recognition among target audience” with concrete objectives like “improve website traffic by 10% within six months”. Notice the specificity? That’s intentional.

The key is identifying KPIs that matter. Revenue growth rate, customer retention rate, average deal size—these metrics tell you whether your strategy is working or just making you feel busy. Track the right numbers, and you’ll know exactly where your revenue engine is humming versus where it’s grinding to a halt.

Aligning sales, marketing, and finance

This is where most RLM initiatives go to die. Everyone talks about alignment, but few organizations actually achieve it. Why? Because alignment isn’t about getting everyone to agree in meetings—it’s about getting everyone to work toward the same outcomes.

Start by obtaining buy-in from all stakeholders involved in the project, including sales teams, financial departments, and leadership. Then establish cross-functional teams to oversee implementation, schedule regular meetings to ensure alignment, use collaborative tools to enhance communication, and define roles and responsibilities clearly.

The magic happens when marketing and sales teams work efficiently toward common revenue growth goals. Meanwhile, finance and sales alignment becomes critical for order management and billing processes to prevent revenue leakage. Without this coordination, you’re essentially running three different businesses under one roof.

Integrating with ERP and CRM systems

A successful RLM strategy requires deep integration with Enterprise Resource Planning (ERP) systems to ensure financial accuracy, compliance, and end-to-end visibility. This integration connects CPQ, CRM, contract lifecycle management, and billing tools with finance and operations.

But here’s what most consultants won’t tell you: consolidating systems isn’t always necessary. Employing Master Data Management (MDM) platforms can help aggregate, match, and link customer records to provide a holistic view without merging all systems. Organizations with substantial investments in multiple ERP and CRM systems can adopt RLM while preserving existing system investments.

The goal isn’t perfect integration—it’s functional integration. Your systems need to talk to each other, not necessarily live in the same house.

Using analytics to refine the strategy

Data without action is just expensive decoration. Set up processes for data collection and analysis, identifying which systems to use and assigning responsibility for analysis. The real value comes from implementing AI and machine learning for predictive analytics that can anticipate customer needs and adjust pricing strategies.

This data-driven approach helps identify trends, uncover new opportunities, and maintain competitive advantage. But remember—analytics enable you to continuously iterate and improve your RLM strategy based on real-time insights. The companies that win aren’t the ones with the most data; they’re the ones who act on the right data fastest.

Your revenue lifecycle strategy isn’t a document that sits in a drawer. It’s a living, breathing framework that evolves with your business. Build it right, and it becomes your competitive advantage. Build it wrong, and it becomes another expensive experiment that didn’t quite work out.

🚀 Ready to stop leaving revenue on the table? Get your personalized RLM assessment today →

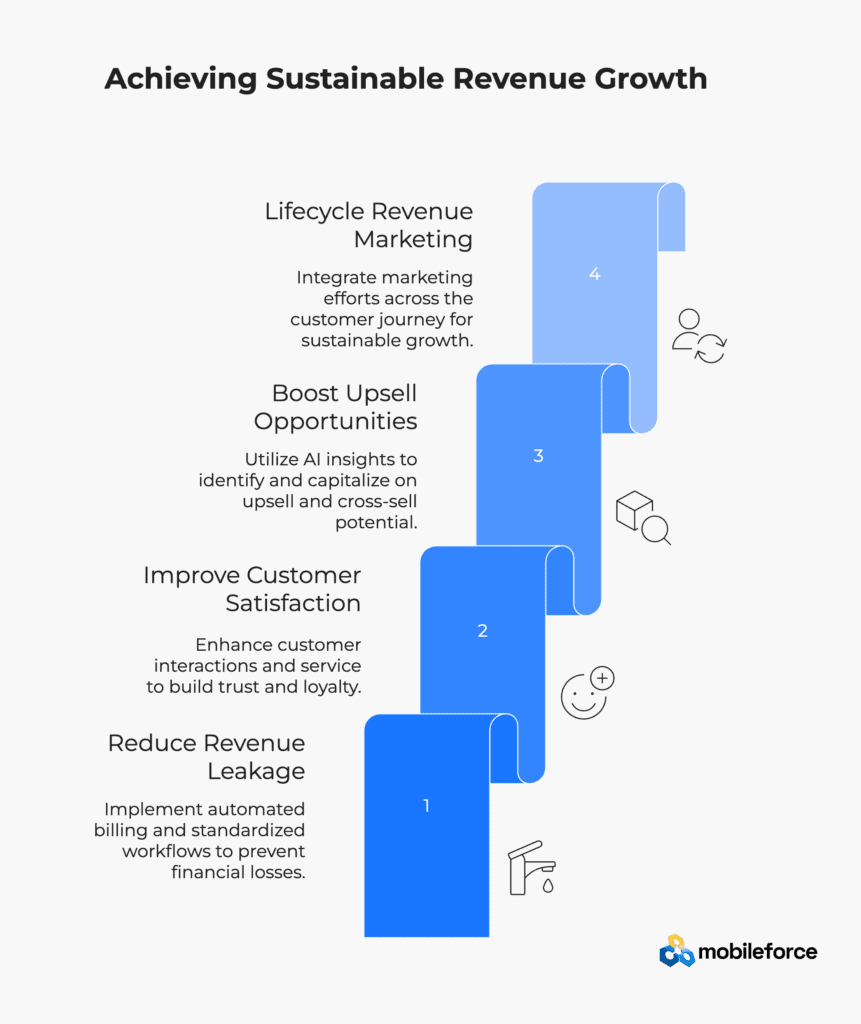

Maximizing ROI with RLM Solutions

324.5% return on investment. That’s not a typo—it’s what organizations actually achieve when they implement RLM solutions correctly.

But here’s what that number doesn’t tell you: the real value isn’t just in the percentage. It’s in finally plugging the revenue holes that have been bleeding your profits dry for years.

Reducing Revenue Leakage

Revenue leakage sounds like accounting jargon, but it’s actually quite simple. Money you’ve earned just… disappears. A renewal slips through the cracks. A price increase gets forgotten. A discount gets approved without proper oversight. Death by a thousand cuts.

RLM solutions don’t just patch these holes—they eliminate the conditions that create them. Automated billing cycles catch what manual processes miss. Standardized workflows prevent the “that’s how we’ve always done it” exceptions that cost you money. Consistent tracking means nothing falls through the cracks anymore.

The numbers paint a clear picture. Organizations report 40% reduction in operational costs while simultaneously capturing more revenue. These systems identify missed renewals and price escalations before they become problems, then implement approval workflows that prevent rogue discounting. Contract visibility and streamlined renewal processes ensure businesses can accurately fulfill orders and intelligently renew agreements.

Improving Customer Satisfaction

Here’s something most people miss about RLM: it’s not just about internal efficiency. Your customers notice the difference too.

When your systems work seamlessly, customers get personalized interactions instead of generic responses. They receive consistent service instead of departmental confusion. These systems analyze behavioral data and segmentation information to actually anticipate customer needs—imagine that.

The ripple effect is measurable. Customers become 5.1 times more likely to recommend organizations after positive experiences and 3.3 times more likely to trust brands following positive interactions. But here’s the kicker: they become 2.6 times more likely to purchase more after favorable experiences. Better customer experience directly translates to more revenue.

Boosting Upsell and Cross-Sell Opportunities

Most businesses are sitting on goldmines they don’t even know exist. Your existing customer base contains untapped revenue potential that traditional approaches completely miss.

RLM platforms use AI-powered insights to identify promising upsell and cross-sell opportunities based on actual purchase history and preferences. More importantly, they enable tailored expansion offers customized to meet evolving customer needs. This isn’t spray-and-pray marketing—it’s surgical precision.

A healthcare solutions provider implementing RLM reported significant sales volume increases by guiding representatives through personalized cross-sell recommendations. Their reps weren’t working harder—they were working smarter.

Using Lifecycle Revenue Marketing for Growth

Lifecycle revenue marketing takes RLM principles and extends them across your entire customer journey. This approach breaks through departmental silos, extends audience engagement, and connects marketing programs to all revenue opportunities.

The benefits include interlocking siloed marketing capabilities, providing broader audience visibility, and allowing marketing programs to flex for different lifecycle objectives. When implemented properly, this strategy transforms how organizations manage sustainable revenue growth throughout the customer lifecycle.

The end result? Revenue that compounds instead of competing with itself.

🚀 Ready to stop leaving revenue on the table? Get your personalized RLM assessment today →

How Mobileforce Adds Value to RLM

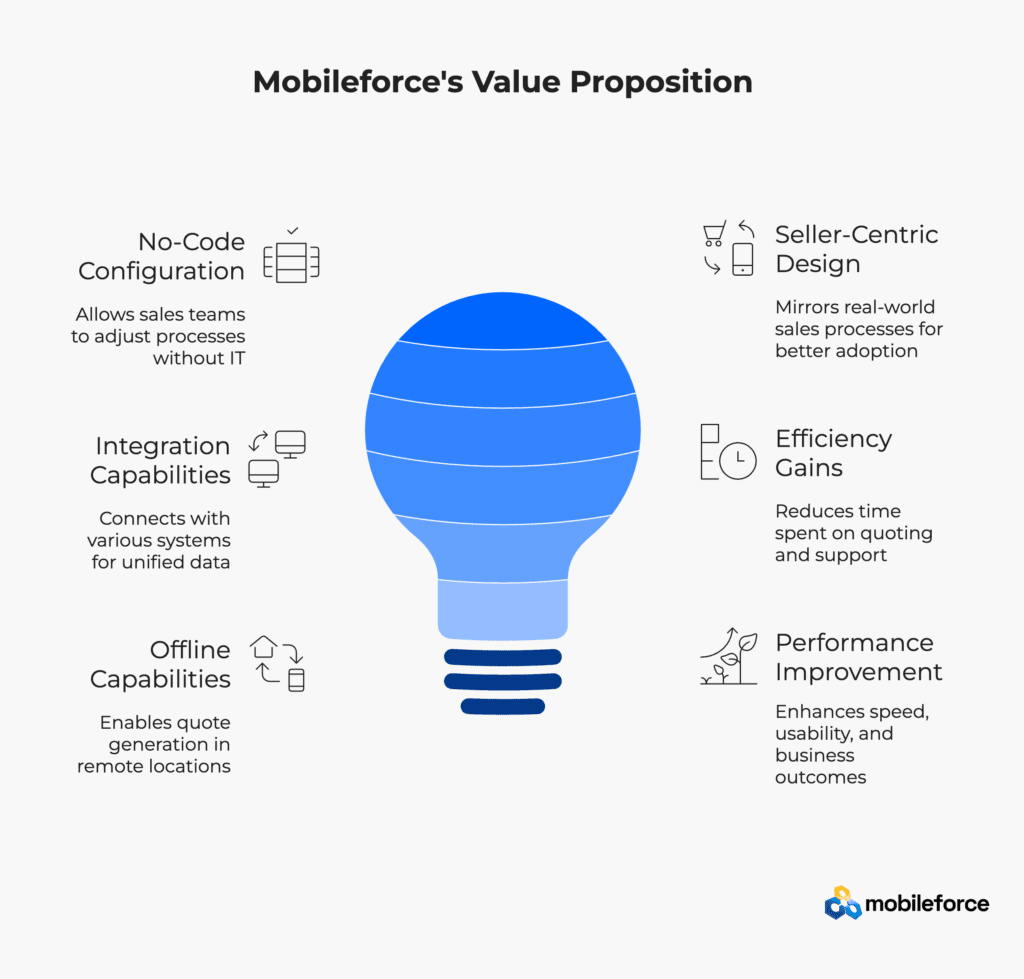

Here’s what separates Mobileforce from the pack of RLM solutions flooding the market: they actually understand how sales teams work in the real world.

While most RLM platforms force you to adapt your sales process to their rigid workflows, Mobileforce flips the script. They’ve built what they call the leading enterprise no-code RLM platform—and the “no-code” part isn’t just marketing speak. Sales ops teams can configure rules, approvals, workflows, and quote templates without calling IT every time market conditions shift. When your biggest competitor drops their pricing by 15% on a Tuesday afternoon, you can adjust your response that same day, not next quarter.

The platform’s seller-centric design philosophy shows up in unexpected places. Instead of building another system that salespeople have to learn, Mobileforce mirrors how they actually sell. The result? Adoption rates that don’t require threats from management and sales processes that actually accelerate instead of creating bottlenecks.

What makes this particularly powerful is the integration story. Mobileforce doesn’t just connect with your CRM and ERP systems—it creates a unified platform that talks to proprietary and legacy applications too. Your quotes stay accurate because they’re pulling real-time data from inventory and policy systems, not last month’s exported spreadsheet.

The efficiency gains are measurable. Sales reps spend 25% less time on quoting, which means more time actually selling. Revenue operations teams report getting back about 25% of their time by reducing ad hoc support requests—finally shifting from constant firefighting to strategic initiatives.

For mid-to-large companies dealing with complex CPQ scenarios, Mobileforce offers something most competitors can’t: true offline capabilities. Your field sales team can generate quotes in remote locations without internet connectivity. No more “I’ll get back to you with pricing” conversations that kill deal momentum.

The bottom line? Mobileforce customers report 140% better performance across speed, usability, and business outcomes compared to traditional CPQ systems. That’s not incremental improvement—that’s the difference between a revenue process that works with your business versus one that works against it.

🚀 Ready to stop leaving revenue on the table? Get your personalized RLM assessment today →

The Revenue Reality Check: Why RLM Isn’t Optional Anymore

Economic turbulence isn’t slowing down anytime soon. Supply chain disruptions, inflation spikes, and political instability create perfect storms for revenue pressure. While you can’t control global economics, you absolutely can control how efficiently your business captures and retains revenue.

Here’s the sobering truth: 97% of executives across the UK and US feel pressured to maximize revenue, yet 46% lack confidence in their organization’s ability to identify and capture all revenue opportunities. That’s not a minor gap—it’s a chasm that separates thriving businesses from struggling ones.

The companies winning right now aren’t the ones with the biggest budgets or the flashiest products. They’re the ones who’ve stopped leaving money on the table. Every renewal that slips through the cracks, every pricing error that erodes margins, every manual process that delays deals—these aren’t minor inefficiencies anymore. They’re competitive disadvantages that compound over time.

Revenue lifecycle management solutions aren’t just upgraded CPQ tools with fancier interfaces. They’re strategic weapons that attack revenue leakage at its source while building sustainable growth engines. Organizations implementing these solutions report measurable wins: slashed operational costs, eliminated revenue leakage, and dramatically improved customer satisfaction.

But here’s where most companies stumble: they try to go it alone. RLM implementation requires specialized expertise—the kind that comes from partners who’ve seen every possible pitfall and know how to avoid them. Companies like Pierce Washington have built their reputation on successful implementations for manufacturing, high-tech, and life-sciences businesses. CloudMasonry brings deep experience with Salesforce revenue lifecycle management solutions, customizing platforms to fit unique business requirements rather than forcing businesses to fit the software.

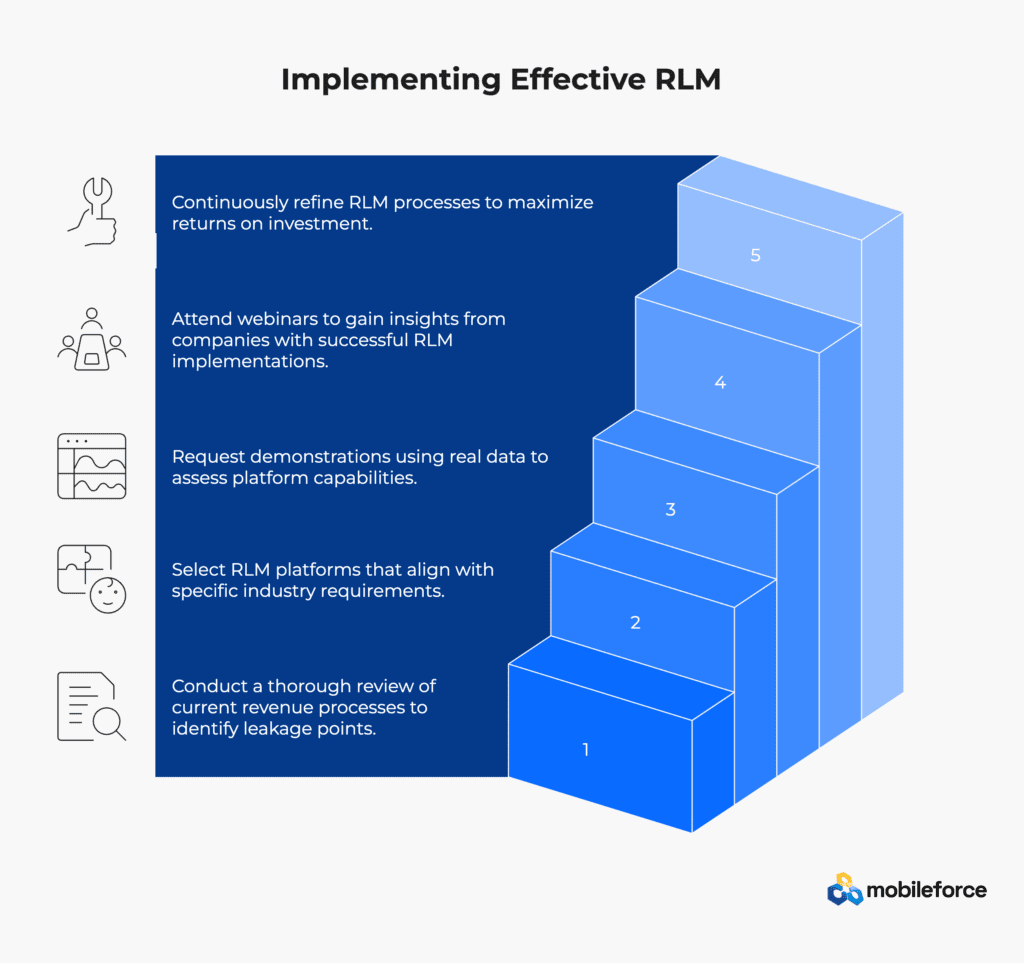

Your RLM Action Plan:

Start with brutal honesty. Audit your current revenue processes and identify where money disappears. Don’t sugar-coat the findings—accurate diagnosis leads to effective treatment.

Match solutions to reality. Explore RLM platforms that actually fit your industry requirements instead of settling for generic solutions that require workarounds.

See before you buy. Request demonstrations using your actual data and use cases. Generic demos hide real-world limitations.

Learn from others. Attend specialized RLM webinars where you’ll hear from companies who’ve already solved the problems you’re facing.

The implementation is just the beginning. Revenue lifecycle management requires ongoing optimization to maximize returns on your investment. Think of it as tuning a high-performance engine—regular adjustments keep it running at peak efficiency.

The question isn’t whether you’ll implement RLM eventually. Market pressure makes it inevitable. The question is whether you’ll implement it before your competitors do, or after they’ve already gained the advantage.

🚀 Ready to stop leaving revenue on the table? Get your personalized RLM assessment today →

Key Takeaways

Revenue Lifecycle Management represents a fundamental shift from traditional siloed approaches to unified revenue optimization across the entire customer journey.

• RLM goes beyond CPQ – While CPQ handles quoting, RLM manages the complete revenue process from lead generation through renewal and expansion opportunities.

• Integration drives results – Companies with fully integrated RLM systems are 2.5 times more confident in capturing revenue opportunities and report 324.5% ROI.

• Five critical stages require optimization – Lead qualification, proposal/quoting, contract execution, fulfillment/billing, and renewal/expansion each need strategic attention.

• AI and automation prevent revenue leakage – Modern RLM platforms use AI-powered analytics and automated workflows to reduce operational costs by 40% and eliminate missed opportunities.

• Cross-functional alignment is essential – Success requires breaking down silos between sales, marketing, and finance teams to create seamless customer experiences.

The shift toward RLM isn’t just about technology—it’s about creating a customer-centric growth strategy that maximizes lifetime value while reducing operational complexity. With 97% of executives feeling pressure to maximize revenue yet 46% lacking confidence in their capture abilities, implementing a comprehensive RLM strategy has become critical for sustainable business growth.

FAQs

Q1. What is Revenue Lifecycle Management (RLM) and how does it differ from traditional approaches?

Revenue Lifecycle Management is a comprehensive approach that manages all revenue-generating activities throughout the customer journey. Unlike traditional siloed methods, RLM integrates marketing, sales, finance, and operations into a streamlined process, covering everything from lead generation to customer retention and upsell opportunities.

Q2. Why is Revenue Lifecycle Management gaining momentum in businesses?

RLM is gaining traction due to the shift from siloed to unified revenue processes, the role of digital transformation, and the growth of SaaS and subscription models. Companies with integrated RLM tools are 2.5 times more likely to capture all revenue opportunities, addressing challenges like operational complexity and revenue leakage.

Q3. How does Revenue Lifecycle Management differ from Configure, Price, Quote (CPQ) solutions?

While CPQ focuses specifically on streamlining the configuration, pricing, and quoting processes during the sales cycle, RLM encompasses the entire customer journey. RLM provides end-to-end visibility and management across all revenue-generating activities, extending beyond quoting to include contract management, order fulfillment, billing automation, and renewal orchestration.

Q4. What are the key features to look for in RLM software?

Essential features in RLM software include quote-to-cash automation, contract lifecycle management, AI-powered pricing and analytics, seamless integration with CRM and ERP systems, and revenue recognition compliance. These capabilities help streamline processes, enhance decision-making, and ensure regulatory compliance.

Q5. How can businesses maximize ROI with RLM solutions?

Businesses can maximize ROI with RLM solutions by reducing revenue leakage, improving customer satisfaction, boosting upsell and cross-sell opportunities, and implementing lifecycle revenue marketing for growth. Effective RLM implementation can lead to significant reductions in operational costs, increased sales volume, and improved customer retention rates.