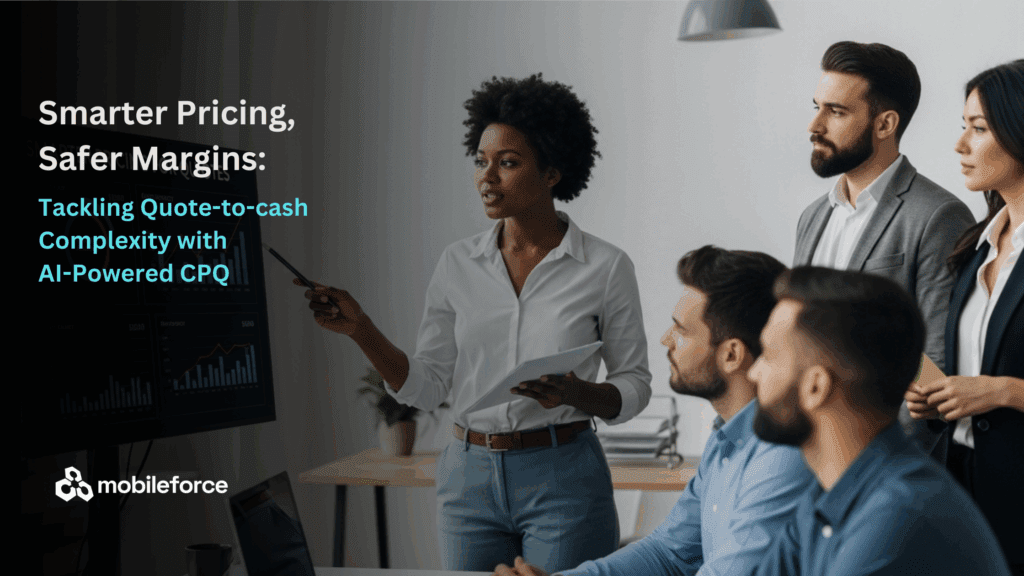

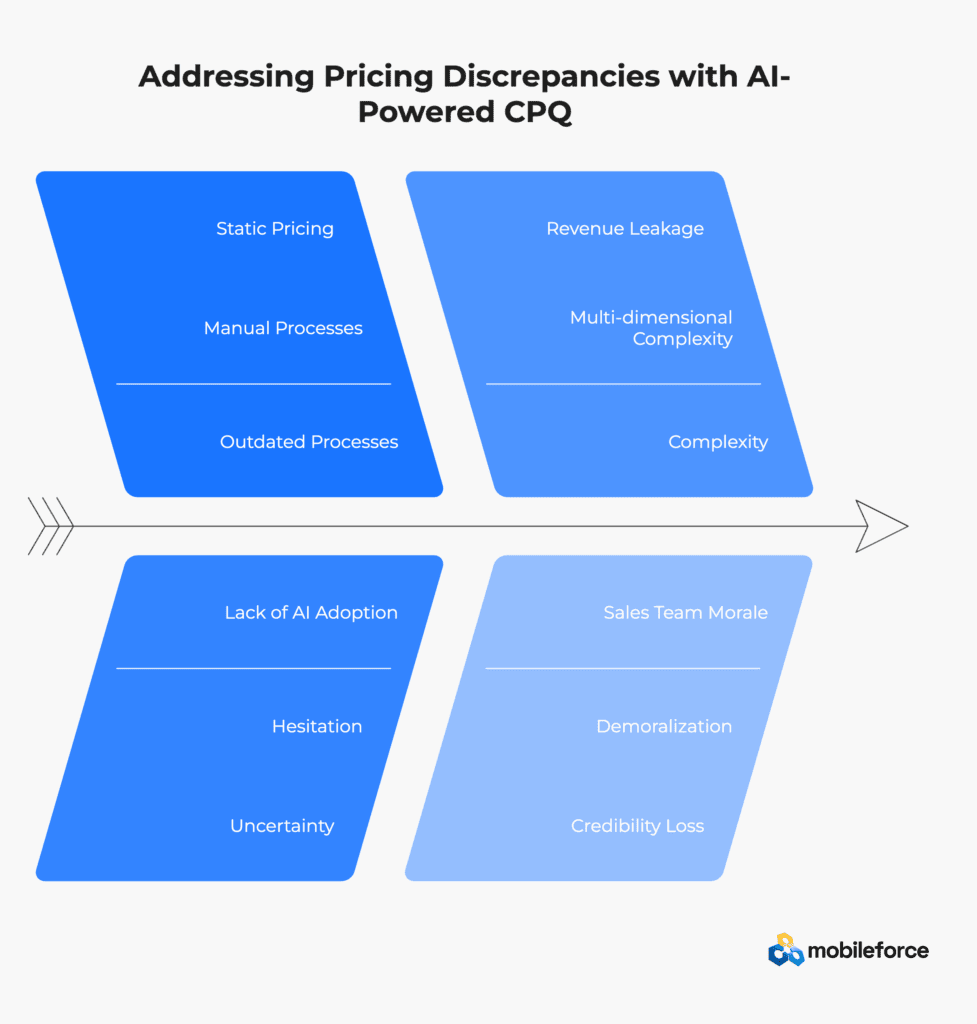

Your sales team just closed a major deal, but three weeks later, finance discovers the quote was off by 15%. The customer’s furious about the pricing discrepancy. Your margins took a hit you can’t afford. Your rep is demoralized, and your credibility is shot. Sound familiar?

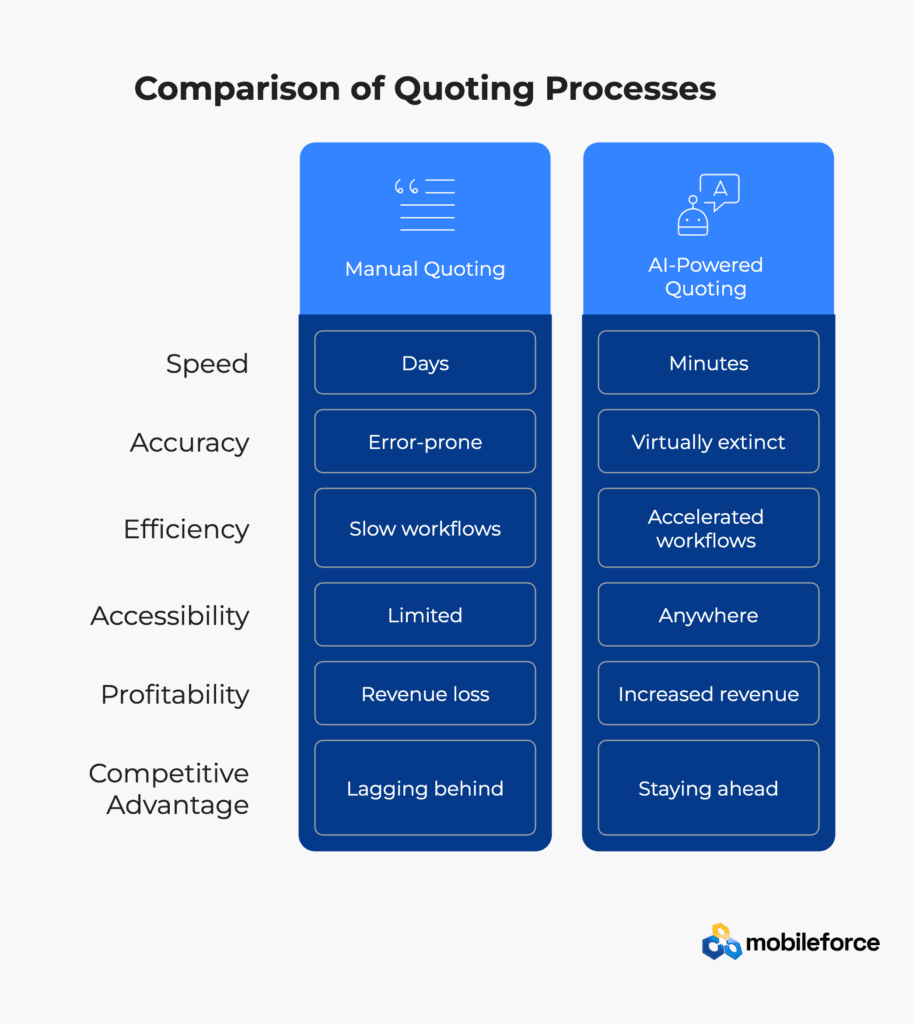

This scenario plays out daily in companies still managing complex pricing through spreadsheets, outdated catalogs, and manual processes. Meanwhile, organizations using AI-powered CPQ software report quote generation time reductions of 75% and deal closure rates that jump by an average of 23%. The gap between those struggling with antiquated quoting methods and those embracing intelligent solutions is widening fast.

Traditional CPQ systems were built for a simpler world—one where product catalogs were smaller, pricing was more static, and buyers had patience for lengthy sales cycles. That world doesn’t exist anymore. Today’s intelligent CPQ software must handle multi-dimensional complexity while preventing the revenue leakage that’s quietly bleeding your business dry.

The business case for AI-powered quoting tools has never been stronger. McKinsey estimates AI can bring a potential $13 trillion to the manufacturing sector by 2030, while Accenture predicts a 40% productivity boost by 2035 in industries that adopt AI. It’s no surprise that 83% of companies already say it’s a top priority in their business plans.

Yet adoption hesitation persists. A recent survey revealed that while 59% of manufacturers showed excitement for new tools that can streamline their processes, 20% remain very cautious about the future. This tension between opportunity and uncertainty creates the perfect moment to explore how AI-powered CPQ solutions can protect margins, reduce errors, and deliver ROI typically within weeks.

The question isn’t whether you can afford to upgrade your quoting process—it’s whether you can afford not to.

🚀 Ready to stop the revenue leak? Get your personalized Mobileforce demo today →

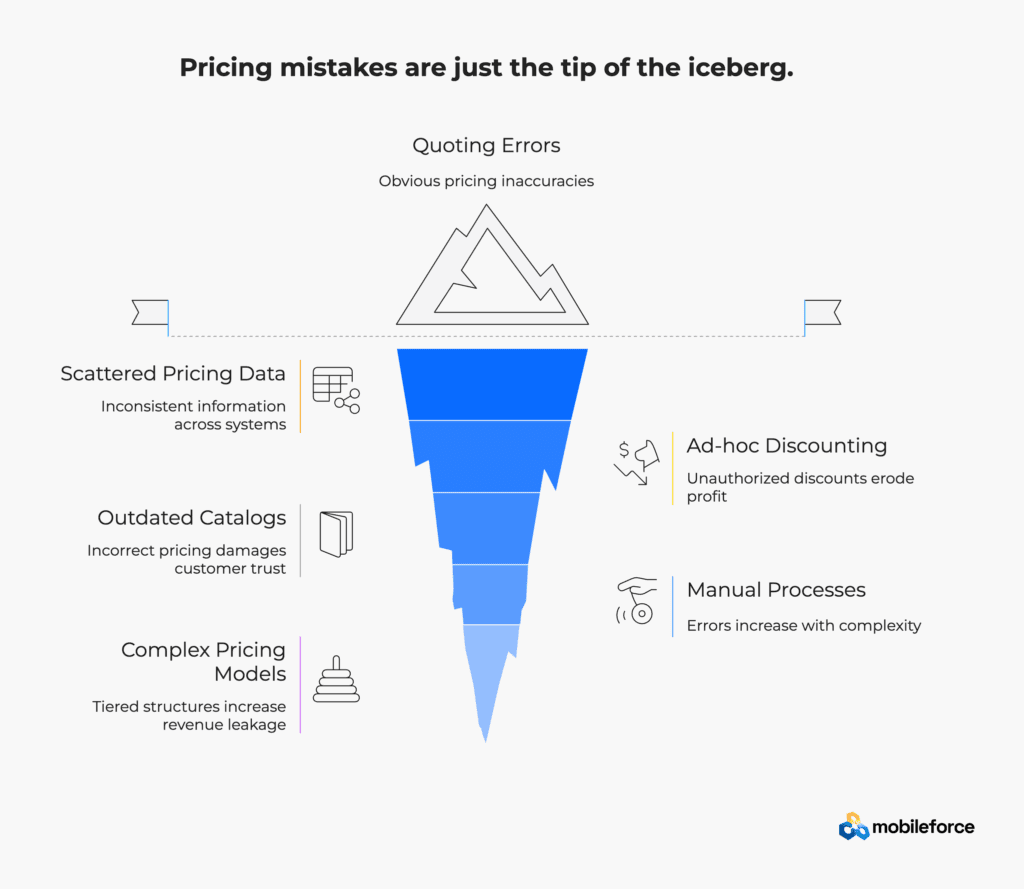

The Hidden Cost of Quoting Errors

Nothing kills profit margins quite like pricing mistakes hiding in plain sight. Behind every misquoted price lies a cascade of costly consequences that most businesses don’t discover until the damage is done. When your pricing data lives scattered across multiple spreadsheets, outdated catalogs, and disconnected systems, errors become inevitable.

The Anatomy of Pricing Chaos

Scattered pricing information creates a perfect storm for quoting errors. Sales teams operating across different regions with inconsistent product catalogs face a nightmare scenario: some locations show excessive inventory while others face shortages of the same item. This disconnection doesn’t just create operational headaches—it drives customers straight to your competitors when they can’t get consistent information.

Ad-hoc discounting remains one of the most insidious sources of margin erosion. Sales representatives offer unauthorized discounts or continue applying one-time quarter-end discounts indefinitely, and revenue silently drips away. When pricing data exists across multiple platforms without centralization, maintaining consistency becomes nearly impossible, creating a breeding ground for errors.

Outdated catalogs compound these issues by presenting incorrect pricing or unavailable products to customers. The result? Customer confusion, damaged trust, and quotes that don’t match final pricing. It’s a credibility killer that competitors exploit ruthlessly.

The Staggering Cost of Getting It Wrong

The financial impact of quoting errors is staggering. Consider this stark example: a business selling $50,000 worth of software in a month might discover that $5,000 wasn’t properly invoiced, $2,500 was under billed, and $4,000 remains unpaid due to invoice disputes. That’s $11,500—or 23% of expected revenue—completely lost.

Most organizations don’t realize how much profit they sacrifice through inconsistent pricing practices. Only 8% of companies reach an ‘integrated’ level of pricing maturity, but those who do gain between 3-12 margin points. Here’s what really matters: a mere 1% improvement in pricing can translate to 2-4 margin points and deliver a 10x impact on EBITDA.

When Complexity Meets Chaos

As pricing models grow more sophisticated—involving tiered structures, usage-based billing, or custom configurations—errors don’t just increase linearly; they multiply exponentially. Manual or semi-automated quoting processes become increasingly prone to mistakes as complexity rises.

For SaaS companies with recurring billing models, the complexity opens even more opportunities for revenue leakage. Each minor error, like omitting a usage-based fee, might seem small initially but accumulates significantly over time. Every pricing mistake carries a compounding effect—not only do you lose immediate revenue, but the error often persists through subsequent billing cycles, multiplying the damage.

When complex pricing models meet scattered data and manual processes, the result is a perfect storm for revenue leakage that intelligent CPQ systems are specifically designed to prevent. The question isn’t whether you’re losing money to quoting errors—it’s how much you’re losing and how quickly you can stop the bleeding.

🚀 Ready to stop the revenue leak? Get your personalized Mobileforce demo today →

What Makes Pricing “Complex”

Pricing complexity isn’t just about having lots of products—it’s about the intricate relationships between those products, the customers who buy them, and the business rules that govern how they’re sold together.

Think of modern pricing structures as elaborate machinery rather than simple price lists. Every gear, lever, and connection point creates potential for things to go wrong. The complexity behind today’s pricing models directly impacts how accurately your team can quote—and ultimately, your bottom line.

Understanding these complexity factors helps explain why traditional quoting methods often fall short. More importantly, it reveals why intelligent CPQ solutions have become essential for protecting margins and maintaining competitive advantage.

The reality is stark: what looks like a straightforward pricing decision on the surface often involves dozens of interdependent variables that manual processes simply cannot handle reliably.

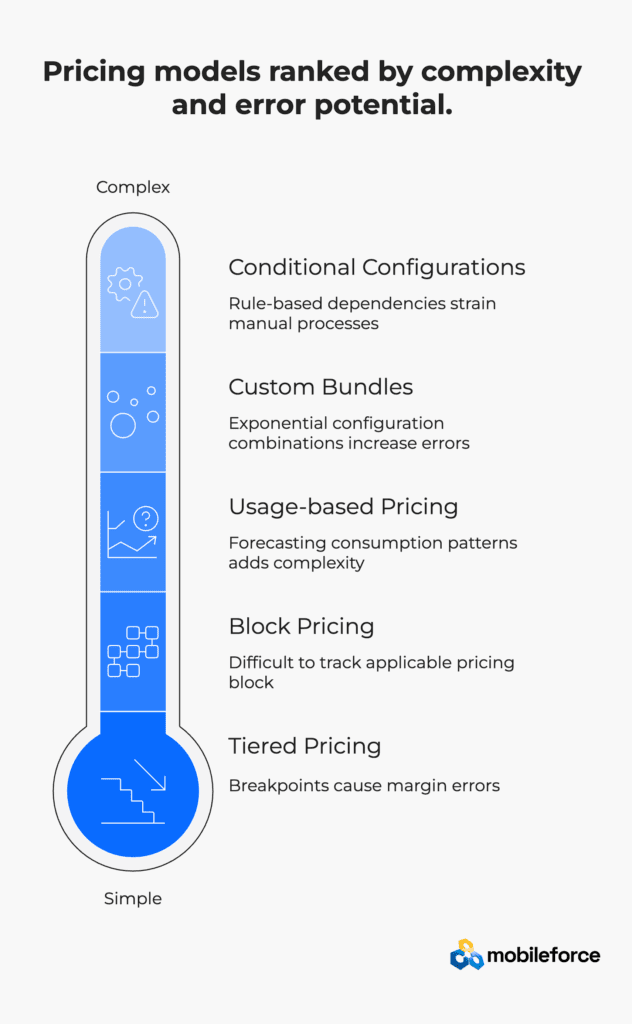

Tiered pricing models turn simple math into migraine-inducing calculations. Picture this: a customer needs 150 users, and you’re charging $10 per user for the first 100, then $8 for the next 100. Sounds straightforward until your sales rep quotes $1,500 instead of the correct $1,400. Without intelligent CPQ software, these tier breakpoints become landmines waiting to explode your margins.

Block pricing creates its own special brand of chaos. You’re selling predetermined quantities at fixed prices, which means tracking exactly which pricing block applies to every customer scenario. Try doing that manually across hundreds of products and thousands of customers. Good luck with that.

Usage-based pricing adds another layer of complexity that would make a mathematician weep. Your sales team needs to forecast consumption patterns, explain variable costs to skeptical buyers, and somehow estimate future usage while keeping margins intact. This pricing model demands sophisticated tools that can handle the guesswork without sacrificing profitability.

Custom product bundles are where things get truly interesting. When customers can mix-and-match components or services, the potential configuration combinations grow exponentially. Each configuration might trigger specific pricing rules, volume discounts, or compatibility requirements. Miss one dependency, and your quote becomes a expensive mistake.

Conditional configurations represent the final boss of pricing complexity. These interdependent products follow rules like “if product A is selected, then product B must also be included” or “if feature X is chosen, feature Y becomes unavailable.” Manual quoting processes buckle under these rule-based dependencies faster than you can say “pricing exception.

Here’s what makes this complexity particularly painful: every additional variable multiplies the chances for error. It’s not just about getting the math right—it’s about remembering every rule, exception, and dependency while your prospect waits on the phone.

Manual processes weren’t designed for this level of complexity.

Here’s the brutal reality: no human can reliably juggle hundreds of interdependent pricing conditions while maintaining speed and accuracy. Sales reps become amateur mathematicians, cross-referencing multiple spreadsheets while customers wait. Version control becomes a nightmare as pricing sheets multiply across teams, regions, and product lines.

The math is simple, but the execution is anything but. Each additional pricing variable compounds the potential for error. A 5% volume discount here, a regional adjustment there, plus a seasonal promotion that should have expired last quarter—suddenly your quote is off by thousands of dollars.

Without intelligent CPQ systems, complex configurations require multiple review cycles just to catch basic errors. Legal reviews pricing. Finance double-checks calculations. Product teams verify configurations. Each handoff introduces delays and new opportunities for mistakes.

The result? Quote generation stretches from minutes to days. Customers grow impatient. Competitors move faster. Your sales team spends more time wrestling with spreadsheets than actually selling.

This isn’t about lazy sales teams or inadequate training. It’s about asking humans to perform tasks that exceed human cognitive capacity. Even the most detail-oriented sales engineer can’t maintain perfect accuracy when managing dozens of pricing variables simultaneously.

The bottlenecks are predictable, the errors are inevitable, and the customer experience suffers. That’s precisely why intelligent CPQ systems exist—to handle the complexity that manual processes simply cannot.

🚀 Ready to stop the revenue leak? Get your personalized Mobileforce demo today →

How Intelligent CPQ Solves the Problem

Here’s where the magic happens. The right CPQ technology doesn’t just patch problems—it eliminates them entirely. While your competitors wrestle with spreadsheet gymnastics and manual calculations, intelligent CPQ creates a foundation for pricing accuracy and margin protection that actually works.

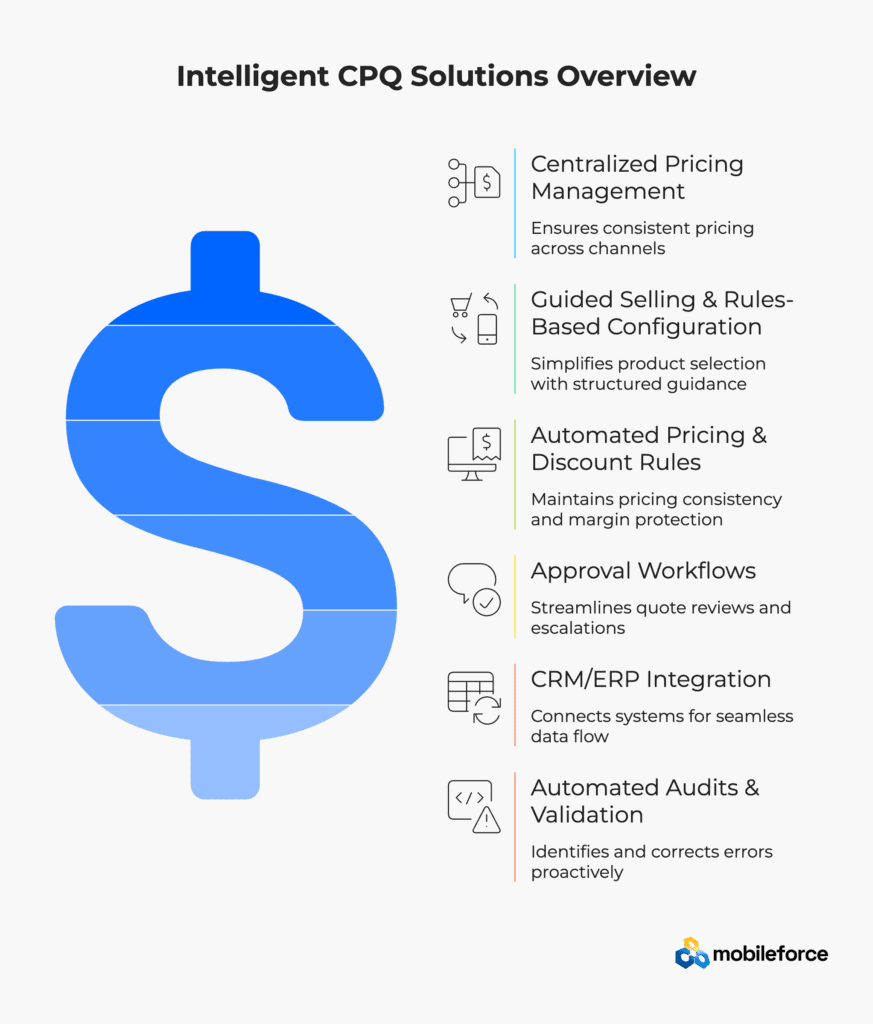

Centralized Pricing Management – One Source of Truth, Zero Chaos

Remember those scattered spreadsheets and inconsistent catalogs we discussed? Centralized pricing strategy provides a cohesive approach driven by a core pricing team fluent in analytics and AI platforms. This unified framework eliminates the chaos of disconnected spreadsheets and manual processes that spawn errors. Companies with centralized pricing strategies can more easily navigate market disruptions while increasing profits and protecting price perception. A centralized pricing engine delivers instant visibility and real-time pricing across all sales channels, creating a single source of pricing truth regardless of where and how customers purchase.

No more hunting through outdated files or wondering if your pricing is current. Everything lives in one place, updated in real-time, accessible to everyone who needs it.

Guided Selling & Rules-Based Configuration – Idiot-Proof Product Selection

Guided selling provides a structured approach through complex product configurations with step-by-step guidance. Salesforce CPQ, for instance, incorporates rules-based logic to enforce constraints, validations, and dependencies during configuration. This ensures sales representatives can only select valid options, minimizing errors and ensuring compliance with business rules. Conditional logic guides users through an optimized path toward their desired configuration while preventing incompatible combinations.

Think of it as having guardrails on a mountain highway. Your sales team can’t accidentally drive off the cliff of incompatible product combinations or pricing mistakes.

Automated Pricing & Discount Rules – Margin Protection on Autopilot

Intelligent CPQ applies predefined rules that determine how product prices are calculated and discounts are applied. These automation guardrails maintain pricing consistency across all quotes while enabling dynamic strategies based on factors like order size, customer type, or specific product combinations. Price rules in CPQ systems enforce standardized pricing regardless of which sales rep creates the quote, thereby building customer trust and minimizing disputes.

Your star performer and your newest hire generate quotes with identical accuracy. No more rogue discounting or accidentally giving away margin.

Approval Workflows for Custom/High-Risk Quotes – Smart Escalation That Actually Works

CPQ approval workflows define specific states, actions, and transitions for quote reviews. Multi-level approvals can be configured based on predefined thresholds, directing high-risk quotes through appropriate review channels. Approval workflows can be condition-based, triggering only when specific criteria are met—such as margin falling below a certain percentage value. Automated email notifications keep stakeholders informed throughout the approval process, ensuring timely responses to approval requests.

No more deals disappearing into email chains. The system knows when to escalate and ensures nothing falls through the cracks.

Seamless CRM/ERP Integration – Data That Actually Talks to Itself

CPQ-ERP integration provides a centralized platform for capturing customer order details and managing product information. This connectivity eliminates duplicate data entry while providing real-time visibility into inventory levels for better decision-making. Integrated systems streamline the entire order fulfillment process from quote creation to invoicing, accelerating quote-to-cash cycles by eliminating manual processes.

Finally, your systems work together instead of against each other. Customer data flows seamlessly, inventory levels update automatically, and everyone works from the same playbook.

Automated Audits & Validation – Catch Problems Before They Become Disasters

Automated auditing isn’t just about catching billing mistakes—it’s a strategic function that provides confidence in shipping data and clarity needed to optimize spend. Intelligent auditing dynamically interprets data, detects patterns, and adapts to specific business requirements. By applying custom rules, automated validation consistently identifies inaccuracies and areas for improvement without relying on IT or manual checks.

The system acts like a vigilant accountant, constantly scanning for anomalies and catching errors before they reach customers.

🚀 Ready to stop the revenue leak? Get your personalized Mobileforce demo today →

Mobileforce Value Proposition

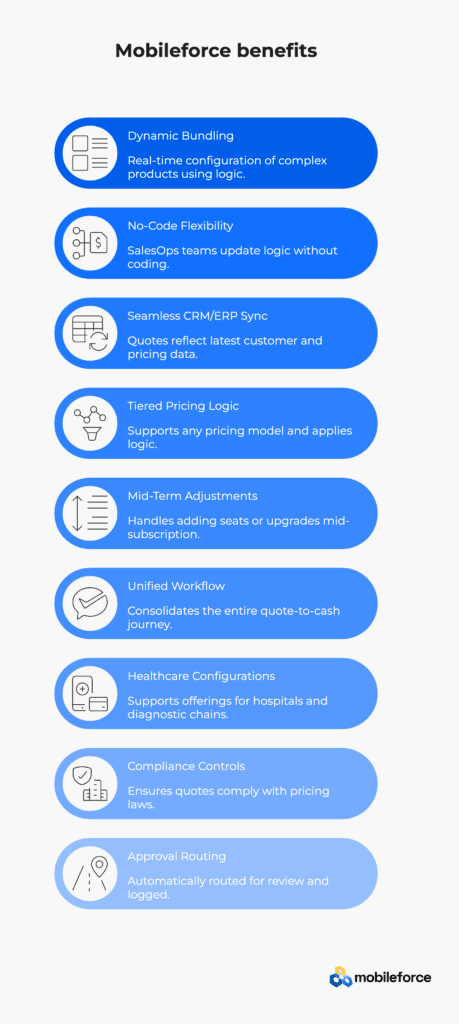

Here’s where most CPQ vendors make their pitch with feature laundry lists and buzzword bingo. We’ll skip that nonsense and talk about what actually matters for your business.

Mobileforce takes a different approach to the quoting chaos that’s been driving your team crazy. Instead of forcing you to adapt to their rigid system, they built a platform that adapts to how your sales team actually works. The result? Real solutions to real problems, not theoretical improvements that look good in demos but fall apart in practice.

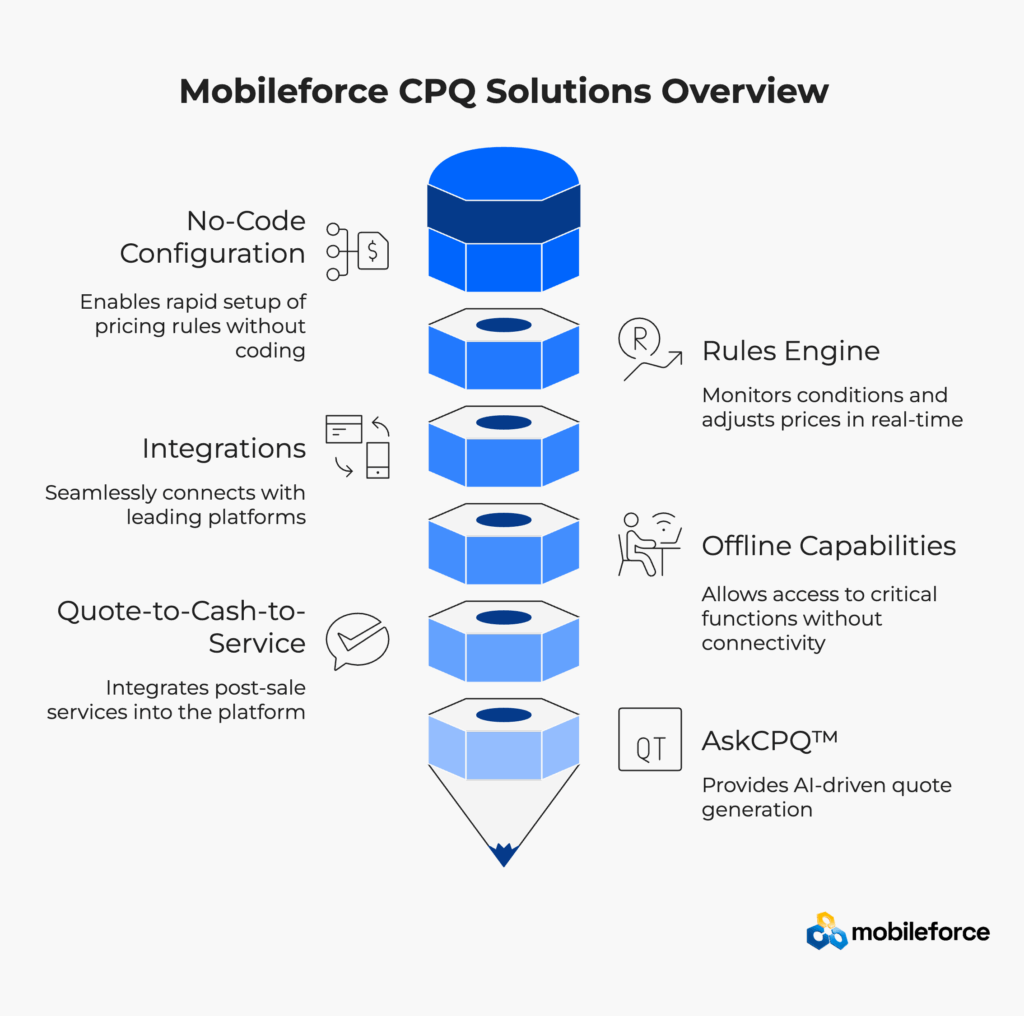

No-Code Configuration That Actually Works

Your RevOps team doesn’t need a computer science degree to set up complex pricing rules. Mobileforce enables business administrators to rapidly configure pricing hierarchies, approval workflows, and discount structures without writing a single line of code. When your competitors change their pricing strategy, you can respond the same day instead of waiting weeks for IT resources.

Rules Engine That Thinks Like Your Finance Team

The platform’s sophisticated rules engine continuously monitors conditions and makes real-time price adjustments based on predefined parameters. This isn’t just automation—it’s intelligent automation that understands your business logic and protects your margins automatically. No more surprise discounts that your finance team discovers three months later.

Integrations That Don’t Require a PhD

Mobileforce creates seamless connections with leading platforms including Salesforce, HubSpot, Zendesk, MS Dynamics, and Creatio. These aren’t the typical “integration” nightmares that require six months of custom development. They work out of the box, ensuring your pricing accurately reflects current inventory levels and costs while maintaining appropriate discount governance.

Offline Capabilities That Actually Matter

Perhaps most distinctively, Mobileforce operates with an offline-first design philosophy. Representatives can access all critical functionality even in areas with no connectivity—a feature competitors typically lack. Product configurations, pricing calculations, and proposal generation work flawlessly offline, with intelligent synchronization once connection returns.

Think about it: how many deals have you lost because your field rep couldn’t generate a quote at a customer site with spotty WiFi? Mobileforce solves that problem.

Quote-to-Cash-to-Service Integration

Mobileforce coined the phrase “Quote-to-Cash-to-Service” to describe their approach. This expanded concept includes critical post-sale field service capabilities like scheduling appointments, dispatching technicians, and tracking job progress. Your entire customer lifecycle operates from a single platform instead of juggling multiple disconnected systems.

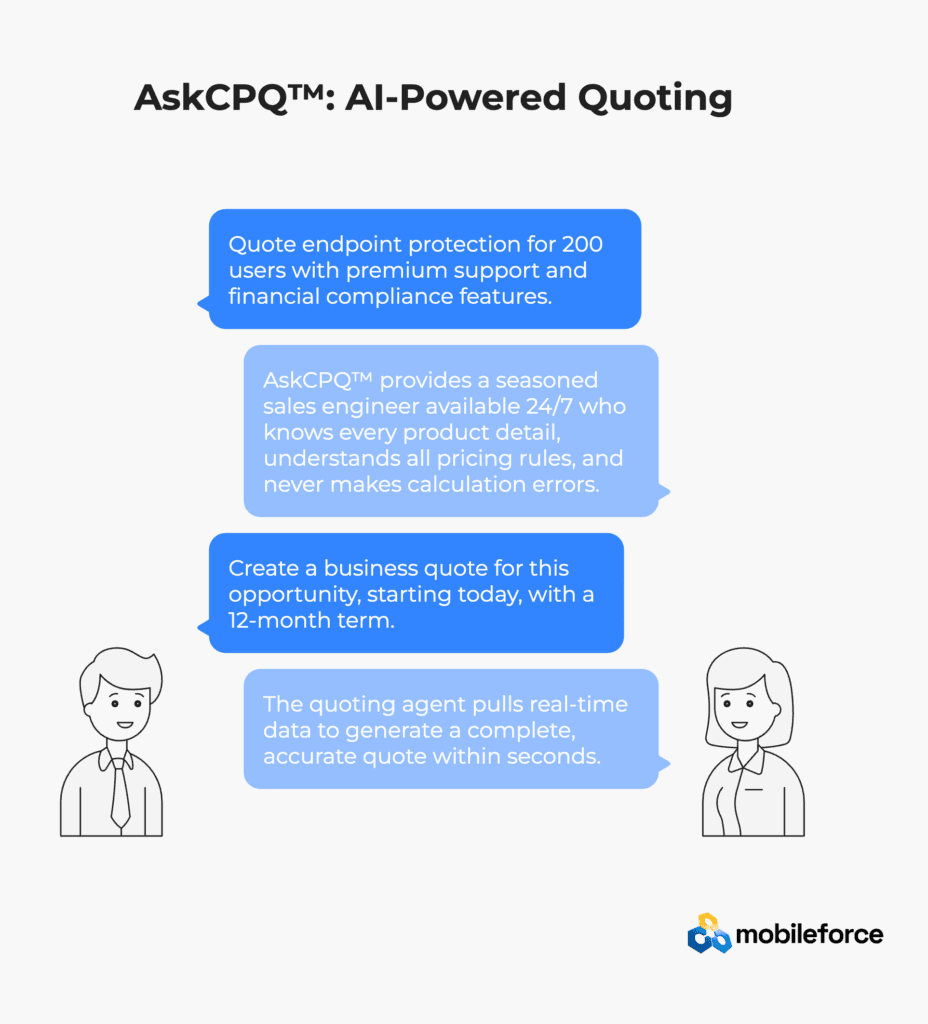

AskCPQ™: Your AI Sales Engineer

The AskCPQ™ feature functions like having a seasoned sales engineer available 24/7. Sales reps can simply type natural language requests like “Quote endpoint protection for 200 users” and receive fully compliant, configured quotes within minutes. No more hunting through product catalogs or playing phone tag with technical specialists.

Results That Matter

One manufacturing equipment distributor reduced quote generation time from 3 days to 2 hours while increasing accuracy by 89%. Field sales teams typically report 25-35% higher productivity, generating more quotes per day. These aren’t marketing claims—they’re measurable improvements that impact your bottom line immediately.

The platform doesn’t just solve today’s problems; it positions your team to handle whatever complexity tomorrow brings. Because in the world of enterprise sales, complexity isn’t decreasing—it’s accelerating.

🚀 Ready to stop the revenue leak? Get your personalized Mobileforce demo today →

Advanced CPQ Features in Action

Nothing beats seeing intelligent CPQ capabilities tackle real-world pricing challenges head-on. When sophisticated AI meets complex quoting scenarios, the results speak louder than any feature demonstration ever could.

AI-driven pricing engines: predictive analytics dynamically optimize margin and minimize leakage.

Here’s where AI pricing engines really flex their muscles. These systems analyze thousands of data points simultaneously—industry trends, company size, purchasing history, seasonal patterns—to recommend optimal product configurations that human sales reps would never consider.

Consider this pharmaceutical company that saw a 34% increase in average deal size after their AI CPQ began suggesting compliance-related add-ons that sales reps typically overlooked. The AI noticed patterns human eyes missed—certain types of customers consistently needed specific regulatory components, but reps forgot to include them in quotes.

These engines adjust pricing in real-time based on dozens of variables. Market demand shifting? Prices adapt accordingly. Competitor launching a new product? The AI factors it in immediately. This intelligent approach isn’t about maximizing every transaction—it’s about optimizing lifetime customer value while maintaining competitive positioning.

Predictive analytics harness historical and current data to forecast future activities and behaviors. Once integrated with existing systems, they offer two significant advantages: enhanced sales efficiency and improved billing management. Through machine learning algorithms that identify successful pricing patterns, your team can offer competitive yet profitable pricing options.

AskCPQ™ in action: using natural prompts like magic.

Picture this: your sales rep is on a call with a prospect who needs endpoint protection for 200 users, premium support, and compliance features for a financial services environment. Instead of hunting through product catalogs and running mental calculations, they simply type: “Quote endpoint protection for 200 users with premium support and financial compliance features.”

That’s essentially what AskCPQ™ provides. Imagine having a seasoned sales engineer available 24/7 who knows every product detail, understands all pricing rules, and never makes calculation errors.

With AskCPQ™, account executives can handle 80% of quotes independently by asking natural language questions. The AI understands industry compliance requirements, suggests appropriate service levels, includes necessary add-ons, and explains its recommendations—all within minutes.

Reps can open a chat window and enter simple prompts like “Create a business quote for this opportunity, starting today, with a 12-month term.” Within seconds, the quoting agent pulls real-time data to generate a complete, accurate quote. This approach has reduced clicks by 87% for some organizations, turning hours into minutes.

The magic happens behind the scenes. While the rep types their request, the AI is checking inventory levels, applying discount rules, verifying compliance requirements, and routing approvals if needed. What used to require multiple systems and several team members now happens in one seamless interaction.

🚀 Ready to stop the revenue leak? Get your personalized Mobileforce demo today →

Results That Actually Matter to Your Bottom Line

Here’s what gets us excited about intelligent CPQ: the numbers don’t lie. When companies stop managing quotes through spreadsheets and embrace AI-powered solutions, the performance improvements aren’t incremental—they’re substantial.

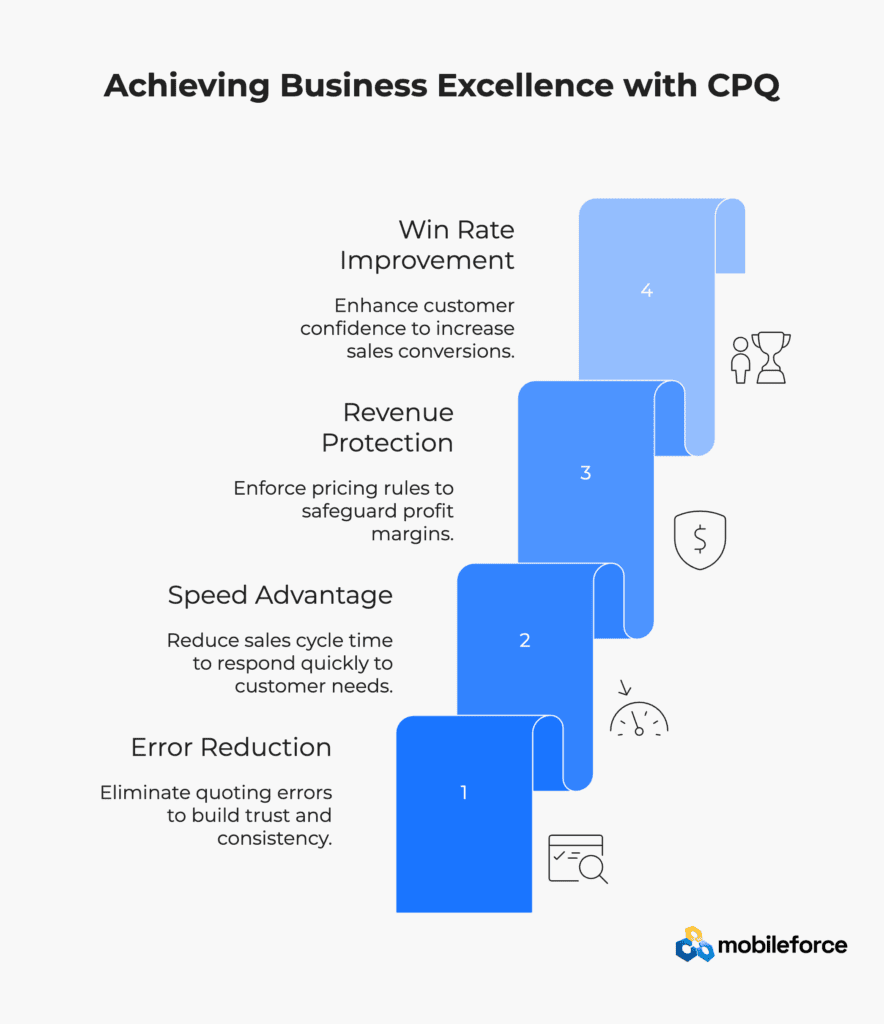

Error Reduction: From Chaos to Consistency

Nothing destroys credibility faster than sending a customer three different prices for the same product. Automated validation eliminates this nightmare scenario entirely. Organizations using CPQ systems report reducing quoting errors by up to 30%, leading to a 20% year-over-year improvement in customer satisfaction.

The math is simple: automated calculations virtually eliminate human error in complex pricing scenarios. When every quote draws from a single, verified source, your pricing becomes consistent regardless of which rep creates it. This accuracy builds client trust and significantly reduces the disputes that typically delay payments.

Speed: The Competitive Advantage You Can Measure

Your prospect just called asking for an urgent quote. Your competitor using manual processes needs three days. You need thirty minutes. Who wins?

Companies report an average 28% reduction in overall sales cycle time after implementing automated quoting solutions. But the real magic happens when you integrate order management into a unified platform—suddenly you have real-time visibility into order status, enabling proactive issue resolution.

This streamlined approach allows sales representatives to deliver accurate information to clients quickly. That matters because studies consistently show sales generally go to vendors who respond first. Speed isn’t just convenience—it’s competitive advantage.

Revenue Protection: Stopping the Silent Leak

Ad-hoc discounting is like a slow puncture in your profit margins. By enforcing standardized pricing rules, CPQ systems protect margins automatically. Companies with centralized pricing strategies navigate market disruptions more effectively while maintaining profitability.

The benefits extend beyond pricing consistency. Proper CPQ implementation accelerates invoice generation and payment collection, improving business liquidity. The result is better cash flow management and more accurate forecasting—benefits that compound over time.

Win Rates: Where Professionalism Meets Performance

Perhaps most importantly, CPQ implementation directly impacts win rates. Forrester reports that intentional quoting processes create detailed sales histories that drive future success. Organizations that establish clear pricing guardrails see higher conversion rates.

When clients receive error-free, professionally formatted quotes quickly, their confidence in your organization increases—translating to faster approvals and higher close rates. It’s not just about the quote itself; it’s about the impression of competence and reliability you create.

The Strategic Investment That Pays for Itself

The ROI metrics demonstrate that CPQ isn’t merely an operational improvement but a strategic investment with measurable returns across the entire customer lifecycle. Companies that embrace intelligent quoting don’t just work faster—they win more, protect margins better, and build stronger customer relationships.

The question isn’t whether CPQ delivers value. It’s whether you can afford to keep losing deals to competitors who quote faster and more accurately than you do.

🚀 Ready to stop the revenue leak? Get your personalized Mobileforce demo today →

Getting It Right: Your CPQ Implementation Roadmap

Here’s the truth about CPQ implementations: the technology is only as good as the strategy behind it. You can have the most sophisticated AI-powered quoting system in the world, but if you skip the groundwork, you’ll end up with an expensive digital paperweight that frustrates your team and confuses your customers.

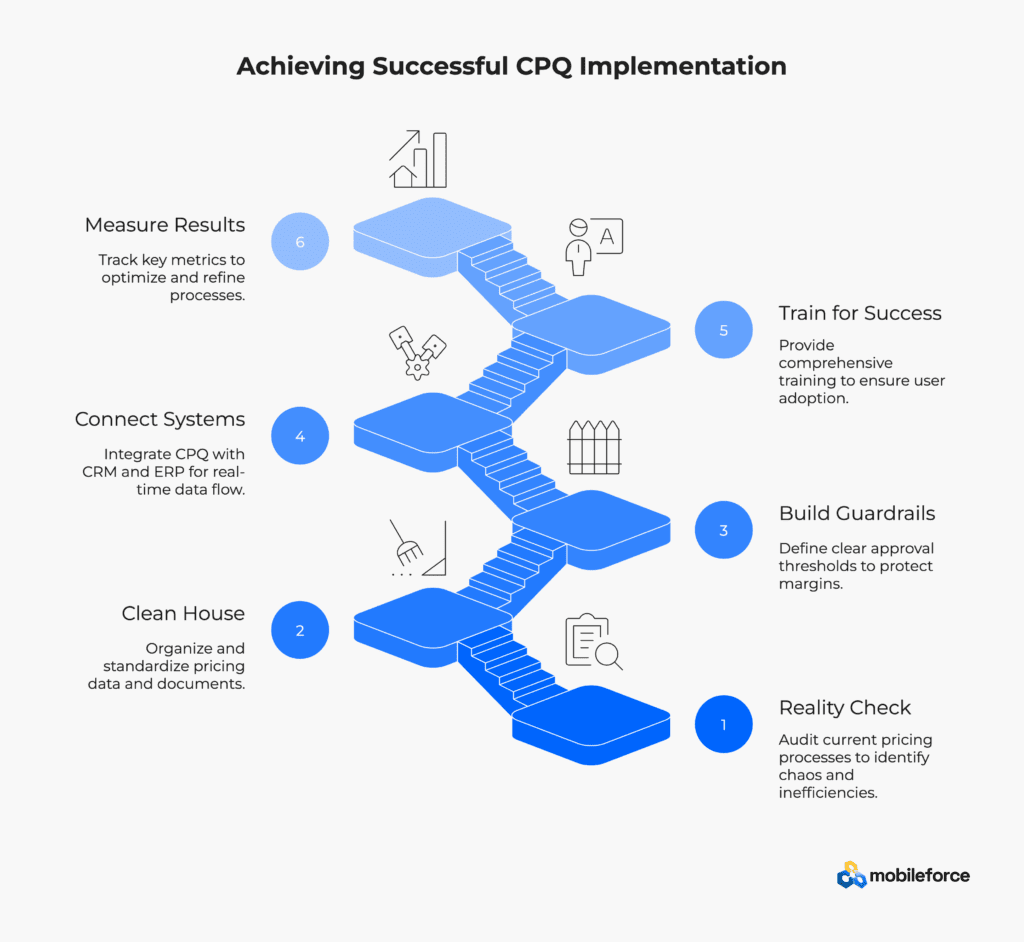

Start with a Reality Check

Before you touch any software, audit your current pricing chaos. Yes, chaos—because let’s be honest, that’s what most pricing processes look like. Map out how quotes actually get created today, not how they’re supposed to get created according to your process documentation.

Talk to your sales reps. Ask them about the workarounds they’ve invented, the spreadsheets they’ve hidden, and the pricing rules they ignore because they’re too complicated to follow. Look for the telltale signs: outdated catalogs gathering digital dust, conflicting discount policies that nobody can explain, and approval processes that send deals into bureaucratic black holes.

This isn’t about finding blame—it’s about finding the truth. One manufacturing company discovered they had 47 different pricing spreadsheets scattered across their sales team, each with slightly different product codes and pricing rules. No wonder their quotes were inconsistent.

Clean House Before You Move In

Data migration sounds boring, but it’s make-or-break time. Garbage in, garbage out applies here more than anywhere else. Before you import anything into your new CPQ system, clean and organize your pricing documents, product catalogs, and discount structures.

Create a single source of truth for your product information. Document every product-specific discount so your reps can actually find and use them. Establish standard quote templates that look professional and consistent—your customers notice when quotes look like they were cobbled together by different companies.

Build Smart Guardrails, Not Roadblocks

Your pricing rules should protect margins while enabling deals, not creating bureaucratic nightmares. Define clear approval thresholds: What discount levels trigger manager approval? What deal sizes require executive sign-off? What product combinations need special review?

The goal isn’t to control everything—it’s to control the right things. One tech company streamlined their approval process by automating routine discount approvals under 15% while flagging anything above 25% for immediate manager review. Deals moved faster, margins stayed protected, and managers could focus on the deals that actually needed their attention.

Connect the Dots

Your CPQ system needs to talk to your CRM and ERP systems in real-time. Not daily batch updates, not weekly synchronizations—real-time. When a sales rep creates a quote, it should reflect current inventory levels, up-to-date pricing, and accurate customer information.

Run pilot tests with a small group before rolling out company-wide. Let your most patient (and most vocal) sales reps test the system with real deals. They’ll find the edge cases and workflow gaps that your implementation team missed.

Train for Success, Not Compliance

Here’s where most implementations fail: treating training like a checkbox instead of a success factor. Your sales team needs to understand not just how to use the system, but why it makes their lives easier.

For platforms with conversational AI like AskCPQ™, spend extra time on effective prompting techniques. Train your reps to ask specific questions like “Create a quarterly subscription quote for 150 users with premium support” instead of vague requests that confuse the AI.

Address resistance head-on by showing, not telling. Demonstrate how the new system turns a three-day quoting process into a thirty-minute task. Let your early adopters share their success stories with the broader team.

Measure What Matters

Track the metrics that actually indicate success: quote-to-close ratios, average deal size, sales cycle length, and—most importantly—sales rep satisfaction. If your team isn’t using the system enthusiastically, something’s wrong.

Set up regular review meetings to analyze performance and identify improvement opportunities. This isn’t a “set it and forget it” technology—it’s a business process that requires ongoing attention and optimization.

The companies that get the best results from CPQ implementation treat it as a business transformation, not a technology upgrade. They invest in change management, celebrate early wins, and continuously refine their processes based on real-world feedback.

Your CPQ system should feel like a natural extension of how your sales team already works, not a foreign system they have to learn to tolerate.

🚀 Ready to stop the revenue leak? Get your personalized Mobileforce demo today →

Real-World Use Cases: How Mobileforce Solves Complex Quoting Challenges

Manufacturing: Turning Product Complexity into Sales Velocity

Manufacturers often juggle massive product catalogs, intricate configurations, and interdependent SKUs. Manual quoting in this environment is slow, error-prone, and expensive.

How Mobileforce Helps:

-

Dynamic Bundling & Auto-Validation: Mobileforce enables real-time configuration of complex products using logic-based rules. As reps build quotes, the system ensures every selection is compatible and optimized for margin.

-

No-Code Flexibility for Ops: SalesOps teams can create and update bundling logic, pricing tiers, and product dependencies without writing a single line of code.

-

Seamless CRM/ERP Sync: With deep integrations into Salesforce, Microsoft Dynamics, Creatio, and more, quotes always reflect the latest customer, product, and pricing data.

Impact:

Manufacturing clients using Mobileforce report up to 80% reduction in quoting errors, and save days of backend effort every time the product catalog updates.

SaaS & Subscriptions: Stopping Revenue Slippage Before It Starts

SaaS businesses thrive on flexible pricing models—but that flexibility often leads to inconsistent quotes, manual re-approvals, and missed upsells.

How Mobileforce Helps:

-

Tiered & Usage-Based Pricing Logic: Mobileforce supports any pricing model—per-user, per-feature, consumption-based—and applies the correct logic instantly.

-

Mid-Term Adjustments Without Friction: Adding seats, features, or upgrades mid-subscription doesn’t require contract overhauls—Mobileforce handles it all with pre-approved rules.

-

Unified Workflow: From quote to e-signature to payment, Mobileforce consolidates the entire quote-to-cash journey.

Impact:

SaaS clients see faster expansion revenue, fewer contract delays, and in some cases, conversion rate lifts of 20–30% thanks to simplified quoting and faster approval cycles.

Healthcare & Healthtech: Configured Care Meets Compliance-Ready Quoting

Quoting in healthcare is uniquely high-stakes. Between regulatory rules, insurance constraints, and care-specific pricing models, the risk of quoting errors is not just financial—it’s reputational.

How Mobileforce Helps:

-

Healthcare-Specific Configurations: Mobileforce supports per-procedure, per-license, bundled, or tiered offerings for hospitals, clinics, and diagnostic chains.

-

Built-In Compliance Controls: Guardrails ensure all quotes comply with regional pricing laws, public tender terms, and insurance reimbursement limits.

-

Approval Routing with Audit Trails: Complex quotes involving multiple locations or provider networks are automatically routed for review and logged for audit readiness.

Impact:

A healthtech client cut quote turnaround time from days to under 45 minutes, driving 20–30% higher conversion rates. At the same time, they reduced compliance errors and improved operational trust across their provider network.

🚀 Ready to stop the revenue leak? Get your personalized Mobileforce demo today →

Taking Control of Your Pricing Future

Look, we’ve covered a lot of ground here. You’ve seen the spreadsheet nightmare that’s bleeding your margins dry. You’ve watched manual processes turn profitable deals into costly mistakes. You’ve witnessed the complexity explosion that’s making traditional quoting methods about as effective as a chocolate teapot.

The data doesn’t lie. Organizations stuck in the stone age of manual quoting are hemorrhaging revenue—sometimes 9% or more—while their competitors race ahead with AI-powered solutions that actually work. It’s like watching a horse and buggy compete against a Tesla.

But here’s what really matters: this isn’t just about upgrading your technology stack. It’s about fundamentally changing how your sales team operates. When your reps can generate accurate quotes in minutes instead of days, when pricing errors become virtually extinct, when approval workflows actually accelerate deals instead of killing them—that’s when you stop playing defense and start playing offense.

Mobileforce gets this. Their no-code approach means your team controls the system, not the other way around. AskCPQ turns complex configuration nightmares into simple conversations. And when your field reps can quote anywhere—even in the middle of nowhere—you’re not just solving connectivity problems, you’re unleashing productivity that your competitors can’t match.

The companies making this transition aren’t just protecting their margins. They’re creating competitive moats that get deeper with every accurate quote, every faster response, every delighted customer who didn’t have to wait three days for pricing that’s actually correct.

Here’s the uncomfortable truth: while you’re debating whether to upgrade your quoting process, your competitors are already implementing solutions that make them faster, more accurate, and more profitable. Your prospects aren’t getting more patient. Your pricing isn’t getting simpler. Your margins aren’t getting safer.

The window for competitive advantage is closing. The question isn’t whether you can afford to implement AI-powered CPQ—it’s whether you can afford to keep bleeding revenue while everyone else moves forward.

Your move.

🚀 Ready to stop the revenue leak? Get your personalized Mobileforce demo today →

Key Takeaways

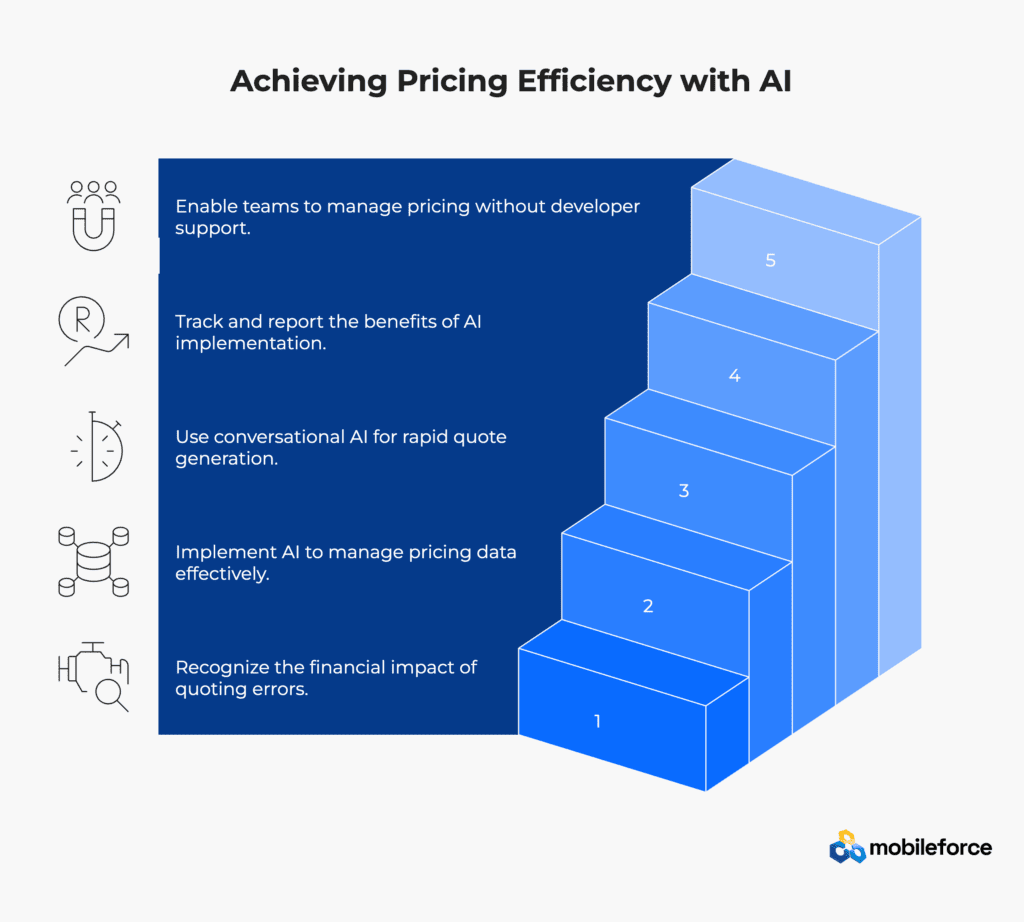

Complex pricing structures and manual quoting processes are silently draining revenue from businesses, but AI-powered CPQ solutions offer a proven path to protect margins and accelerate sales cycles.

• Quoting errors cost businesses 9%+ in revenue leakage – scattered pricing data, outdated catalogs, and manual processes create costly mistakes that compound with complexity.

• AI-powered CPQ centralizes pricing management – eliminates inconsistent catalogs, enforces margin guardrails, and prevents misconfiguration through automated rules and validation.

• Conversational AI transforms quoting speed – natural language prompts like “Quote endpoint protection for 200 users” generate compliant quotes in minutes instead of hours.

• Implementation delivers measurable ROI quickly – companies report 75% faster quote generation, 23% higher deal closure rates, and 30% fewer quoting errors within weeks.

• No-code configuration empowers business teams – RevOps teams can build workflows and pricing rules without developer support, enabling rapid response to market changes.

The transition from manual to intelligent CPQ isn’t just an operational upgrade—it’s a strategic investment that protects revenue while giving sales teams the tools to close deals faster and more accurately.

🚀 Ready to stop the revenue leak? Get your personalized Mobileforce demo today →

FAQs

Q1. What is AI-powered CPQ and how does it work? AI-powered CPQ systems use artificial intelligence to analyze past deals, customer behavior, and product performance to recommend optimal quotes. They guide sales representatives through complex configurations and pricing logic, providing real-time suggestions that balance customer needs with business priorities.

Q2. How does AI-powered CPQ help reduce quoting errors? AI-powered CPQ systems centralize pricing management, enforce margin guardrails, and use automated rules and validation to prevent misconfiguration. This approach can reduce quoting errors by up to 30%, leading to improved customer satisfaction and protected revenue.

Q3. What are the key benefits of implementing an AI-powered CPQ solution? Implementing an AI-powered CPQ solution can lead to 75% faster quote generation, 23% higher deal closure rates, and 30% fewer quoting errors. It also enables more accurate pricing, protects margins, and accelerates the quote-to-cash cycle.

Q4. How does conversational AI transform the quoting process? Conversational AI in CPQ systems, like Mobileforce’s AskCPQ, allows sales representatives to generate complex quotes using natural language prompts. This can reduce quote creation time from hours to minutes, while ensuring compliance with pricing rules and business logic.

Q5. What should businesses consider when implementing an AI-powered CPQ system? When implementing an AI-powered CPQ system, businesses should conduct a full pricing process audit, centralize pricing data, define clear pricing rules and approval gates, integrate with existing CRM/ERP systems, provide comprehensive training for teams, and continuously monitor performance metrics for ongoing refinement.