Mobileforce

- General Resources

Table of Contents

ToggleThe Growing Disconnect in Industrial Operations

The industrial sector faces a critical challenge that’s costing companies millions in missed revenue opportunities. While organizations invest heavily in advanced manufacturing technologies and sophisticated sales processes, many still struggle with fundamental alignment issues between their sales and service operations that directly impact profitability and customer satisfaction. This challenge is particularly acute for industrial companies seeking field service management best practices and industrial service revenue optimization strategies.

Key Takeaways:

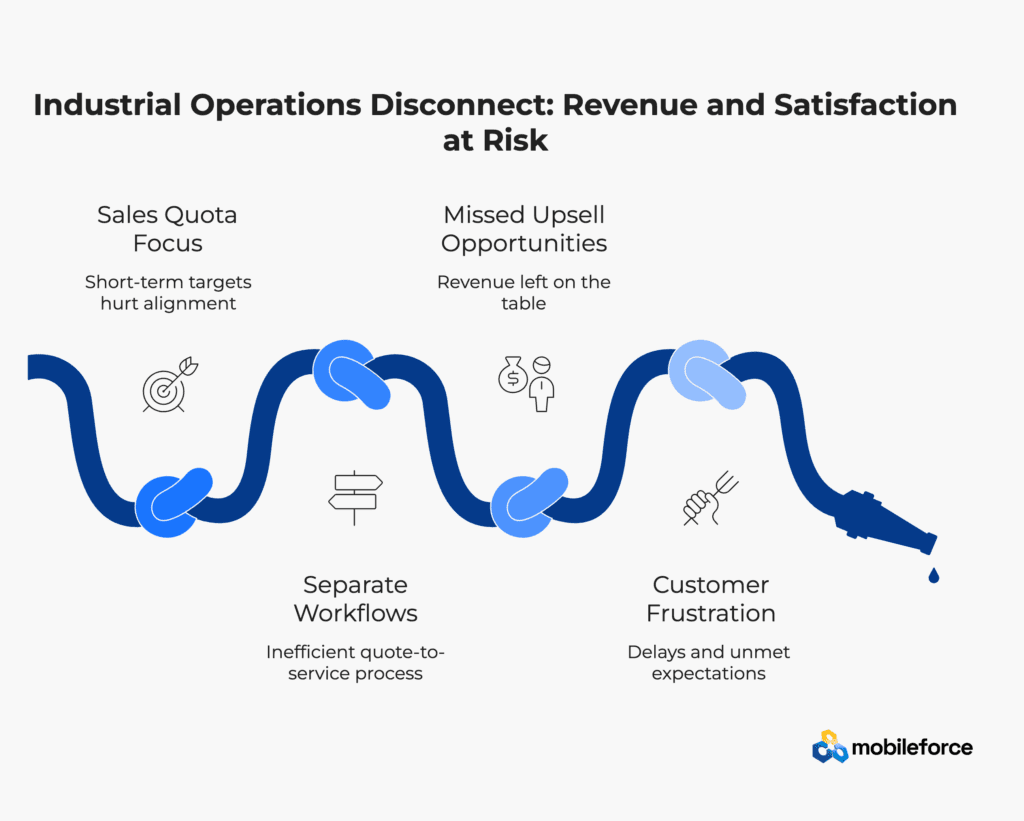

- Sales teams focus on pushing deals through quote-to-cash processes to meet quarterly targets

- Service teams manage installations, maintenance, and repairs through separate quote-to-service workflows

- This operational disconnect creates significant inefficiencies, missed service contract opportunities, and frustrated customers

- Industrial companies with aligned sales-service operations see 35% higher service revenue growth and improved customer retention rates

Field service management market size was valued at $4.68 billion in 2024 and is expected to grow at a compound annual growth rate (CAGR) of 16% between 2025 and 2034, highlighting the critical importance of optimizing service operations for sustainable growth. Yet despite this massive market opportunity, many industrial organizations continue to operate with fragmented systems that prevent effective collaboration between revenue-generating sales teams and service delivery operations.

💡 Key Insight: Manufacturing companies lead field service adoption with 22% market share, yet most fail to leverage service interactions for revenue expansion opportunities worth millions annually.

The consequences of this misalignment extend far beyond internal inefficiencies. When sales and service teams operate in isolation, companies experience installation delays that frustrate customers, miss critical opportunities for service contract upsells during field visits, and face higher customer churn rates due to unmet expectations and poor coordination between departments.

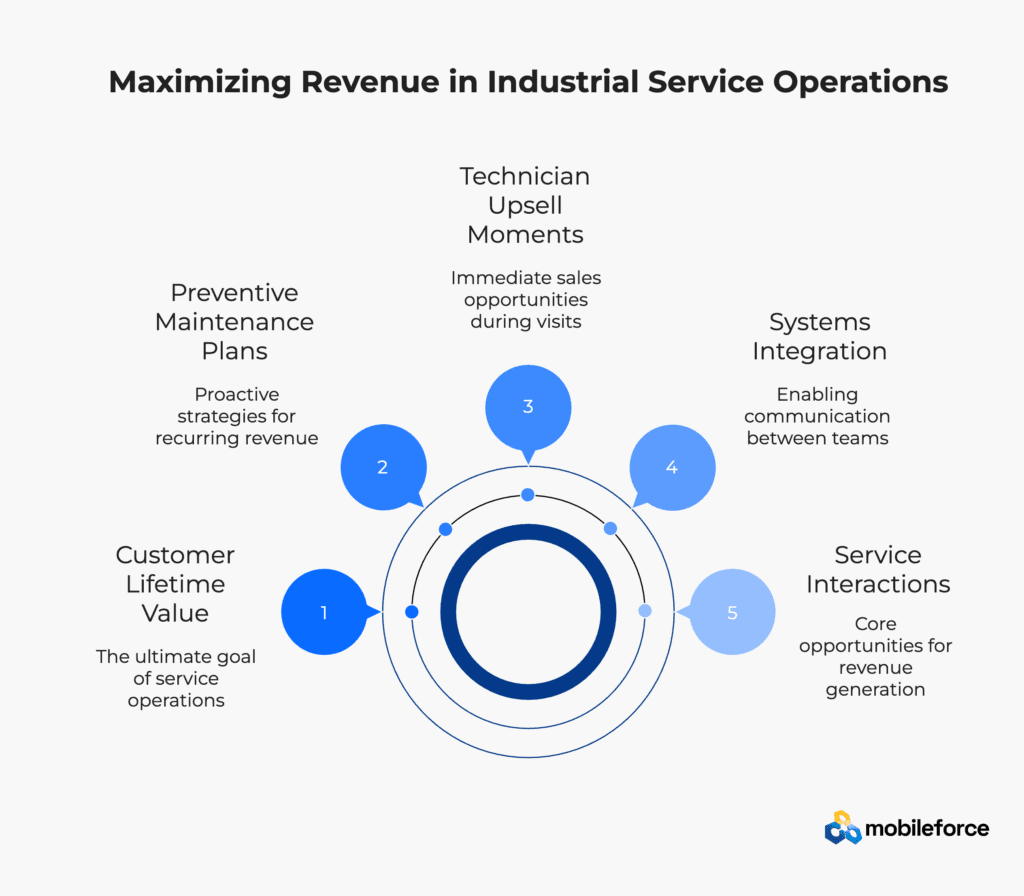

The Hidden Revenue Goldmine in Industrial Service Operations

Quick Stats: Research shows that selling to existing customers has a 60-70% probability of success compared to just 5-20% for new prospects, making service interactions prime revenue opportunities.

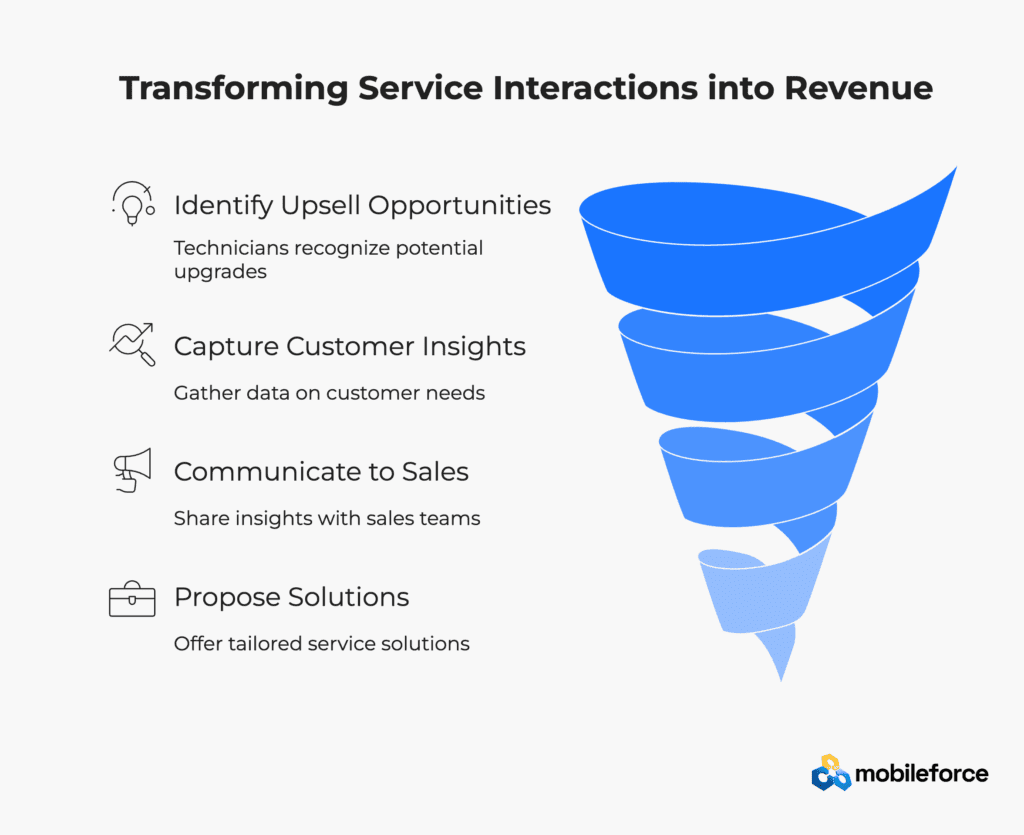

Technician Upsell Moments: The Untapped Revenue Stream

Field service visits represent some of the most valuable sales opportunities in industrial businesses, yet these moments are routinely wasted due to poor systems integration and lack of strategic alignment. When technicians perform maintenance, repairs, or installations, they gain intimate knowledge of equipment condition, usage patterns, and potential upgrade needs that could inform strategic revenue decisions. These interactions represent prime opportunities for warranty extensions, service contract upgrades, and equipment replacements.

However, without proper systems integration and communication protocols between sales and service teams, this valuable intelligence remains trapped within service silos. Technicians focus solely on completing immediate repair tasks rather than identifying broader revenue opportunities, missing chances to propose extended warranties, preventive maintenance programs, or equipment upgrades that could significantly increase customer lifetime value.

⚡ Action Item: Field technician interactions generate 4x more qualified upsell opportunities than traditional sales prospecting – but only when properly captured and communicated to sales teams.

Preventive Maintenance Plans: From Reactive to Revenue-Generating

Traditional industrial service models operate reactively, addressing equipment failures after they occur rather than implementing proactive strategies that could prevent downtime while generating recurring revenue. Forward-thinking industrial companies recognize that service interactions should function as strategic touchpoints for identifying commercial opportunities and building long-term customer relationships through preventive maintenance agreements.

Service teams often discover patterns in equipment failure, usage optimization opportunities, and upgrade needs during routine maintenance visits. Without established processes for capturing and acting on this intelligence, companies miss numerous opportunities to increase recurring revenue through comprehensive maintenance contracts while simultaneously improving customer operational efficiency.

The challenge intensifies when considering that industrial aftermarket services represent significant untapped revenue potential for original equipment manufacturers (OEMs), particularly in parts, repair, and maintenance services. Companies that fail to capitalize on these opportunities leave substantial recurring revenue on the table.

Reactive Versus Proactive Service Revenue Models

The shift from reactive problem-solving to proactive revenue generation requires fundamental changes in how industrial companies structure their service operations and incentive systems. Many service technicians lack the tools, training, and incentives necessary to identify and communicate expansion opportunities effectively, resulting in missed chances for service contract extensions, equipment upgrades, and additional service offerings.

Industrial service revenue optimization strategies must address this gap by providing field technicians with mobile access to customer history, sales data, and upsell opportunities. When service teams understand the broader customer relationship and have clear pathways for communicating opportunities to sales teams, every field visit becomes a potential revenue-generating interaction.

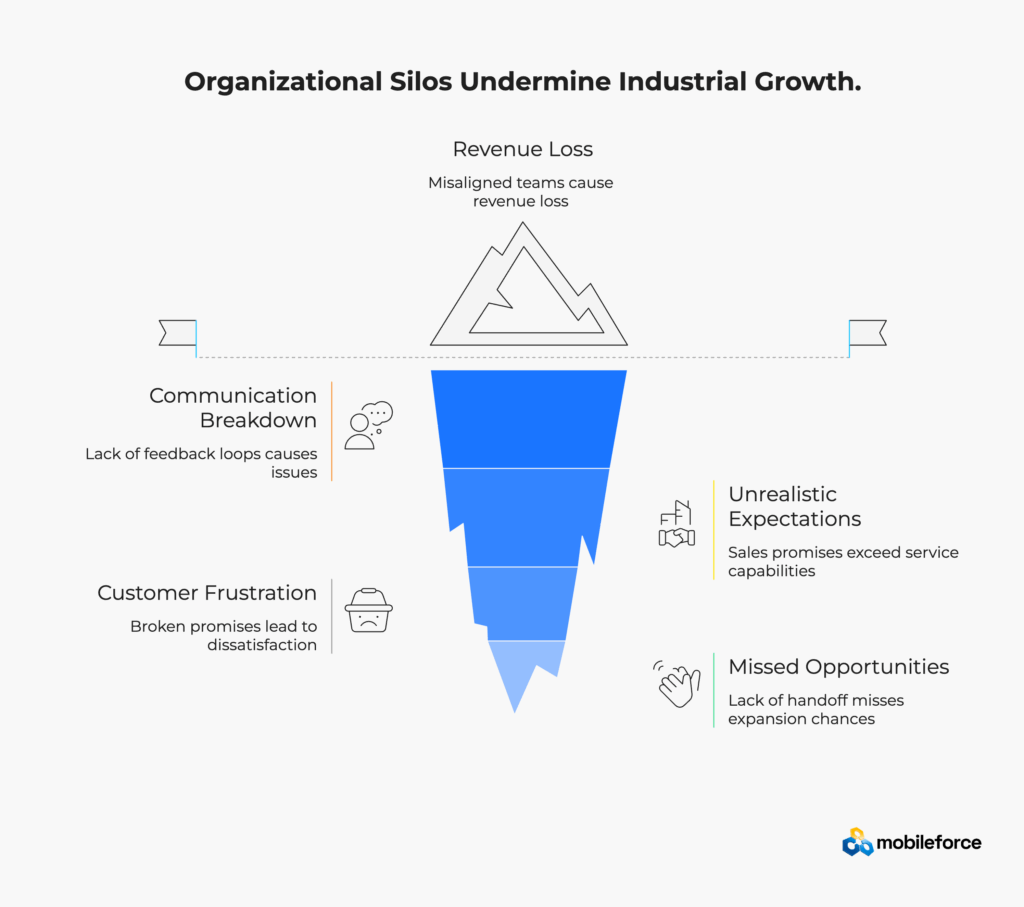

How Organizational Silos Undermine Industrial Growth

The Revenue Impact: Misaligned sales and service teams in industrial companies can cost organizations up to 40% of their potential service revenue growth, according to recent field service management research.

Business Efficiency Challenges in Industrial Operations

When sales and service teams operate without effective feedback loops, sales representatives often make commitments without fully understanding service delivery capabilities, installation requirements, or ongoing maintenance needs. For example, sales teams might promise accelerated installation timelines, specialized service arrangements, or custom equipment configurations without consulting with the service teams responsible for delivery.

This misalignment creates cascading problems throughout the organization. Service teams find themselves scrambling to meet unrealistic expectations with inadequate resources or insufficient technical specifications, potentially compromising service quality or requiring additional investments that weren’t budgeted. Meanwhile, customers experience frustration when promised deliverables don’t materialize as expected, leading to decreased satisfaction and increased risk of contract cancellations.

Customer Impact: The Cost of Poor Coordination

The customer experience suffers significantly when internal silos prevent seamless handoffs between sales and service teams in industrial environments. Poor coordination leads to equipment downtime, delayed installations, and unmet service expectations that directly impact customer operations and profitability. Research indicates that 74% of mobile workers report that customer expectations are higher than ever, making operational efficiency crucial for maintaining competitive advantage.

When customers experience extended downtime due to service delays or encounter technical issues that could have been prevented through better sales-service communication, their perception of the entire organization suffers. This negative experience impacts not only immediate satisfaction but also long-term contract renewal likelihood and expansion potential.

🎯 Success Pattern: Companies implementing integrated sales-service workflows see 45% reduction in customer downtime and 60% improvement in first-time fix rates.

Growth Impact Analysis: The Revenue Multiplication Effect

The growth implications of sales-service misalignment extend throughout the customer lifecycle in industrial businesses. Without established service-to-sales handoff processes, companies routinely miss opportunities to expand relationships through additional equipment sales, extended service contracts, and value-added services that could significantly increase per-customer revenue.

Furthermore, when service teams identify optimization opportunities, equipment upgrade needs, or expansion potential but lack efficient mechanisms for communicating this intelligence to sales teams, the entire organization suffers from reduced revenue optimization. The cumulative effect of these missed opportunities can substantially impact overall business growth trajectories, making field service management integration tools essential for scaling industrial operations.

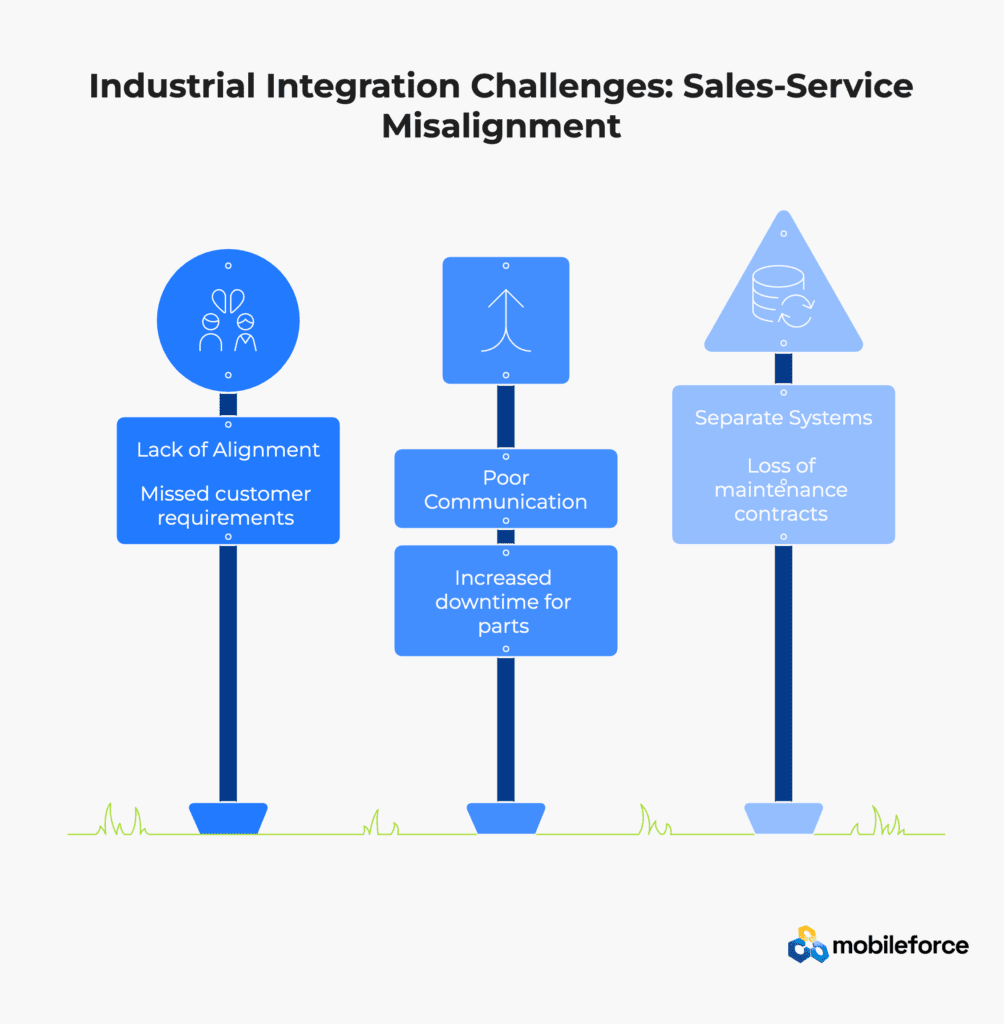

Real-World Industrial Integration Challenges

Case studies from actual industrial implementations demonstrate the critical importance of sales-service alignment across various sectors.

Mining Equipment Case Study: The Cost of Disconnected Operations

Consider a mining equipment manufacturer whose sales team successfully closes a deal for heavy machinery, promising comprehensive support and maintenance services. However, the service team wasn’t involved in pre-sales technical discussions and discovers during installation that the customer’s operating environment requires specialized parts inventory and customized maintenance schedules that weren’t originally planned.

The result is customer frustration due to extended downtime for parts procurement, increased service costs due to emergency logistics, and potential loss of lucrative long-term maintenance contracts. Had the sales and service teams been aligned through integrated systems and communication processes, they could have identified these requirements upfront, set appropriate expectations, and potentially upsold additional service packages to address the specialized needs.

📊 Reality Check: The average industrial company loses $3.2 million annually in missed service revenue due to poor sales-service alignment – equivalent to 200-300 maintenance contracts.

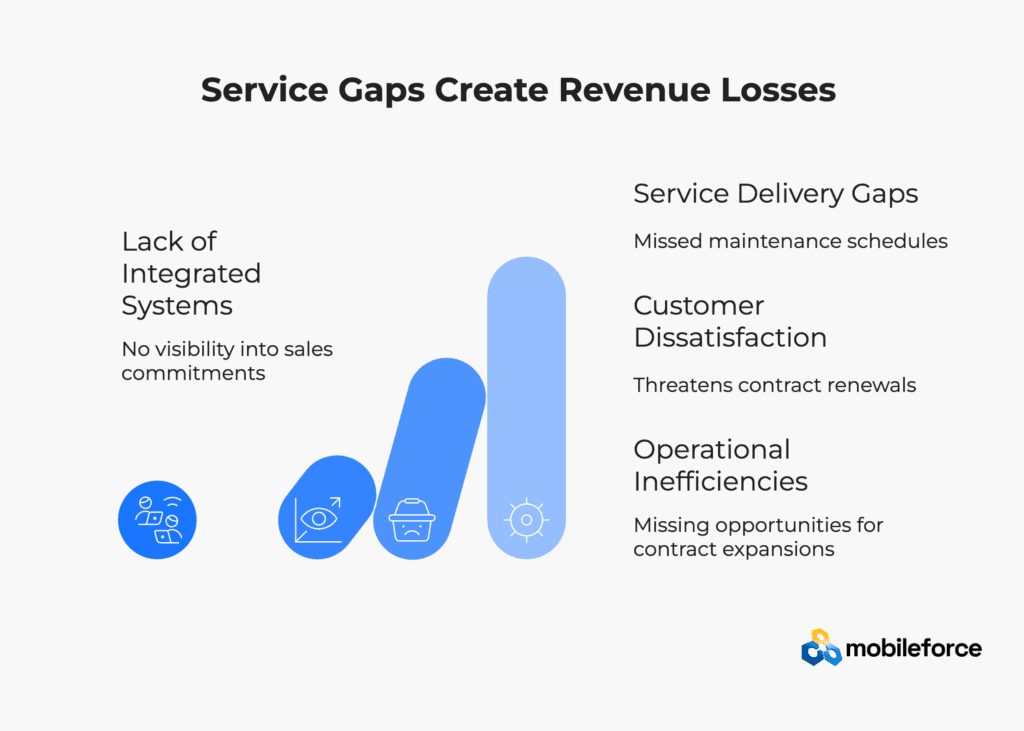

Fleet Management Scenario: Coordination Gaps Cost Contracts

A fleet management company offers comprehensive vehicle maintenance services but operates with separate sales and service systems. When sales teams close deals for fleet maintenance contracts, service teams often lack visibility into specific customer requirements, service level agreements, or specialized equipment needs outlined in the original proposals.

This disconnect leads to service delivery gaps, missed maintenance schedules, and customer dissatisfaction that threatens contract renewals. Without integrated systems that provide service teams with complete visibility into sales commitments and customer expectations, the company struggles to deliver on promises while missing opportunities for contract expansions and additional service offerings.

Energy & Utilities Example: Service Gaps Create Revenue Losses

An energy sector service provider’s sales team focuses on securing equipment installation and commissioning contracts, while service teams handle ongoing maintenance and emergency repairs. However, without systematic communication between departments, service teams miss opportunities to propose preventative maintenance programs during routine service calls, and sales teams lack insight into recurring service needs that could inform future proposals.

When equipment failures occur that could have been prevented through proactive maintenance programs, customers experience costly downtime while the service provider misses opportunities for recurring revenue contracts. The lack of integration between sales commitments and service delivery capabilities results in both operational inefficiencies and substantial revenue losses.

Manufacturing Equipment Installation Challenges

Manufacturing equipment provider’s installations frequently stall because service teams don’t receive complete technical specifications, customer site requirements, or specialized tool needs from sales teams during the handoff process. This disconnect leads to delayed installations, additional site visits, and frustrated customers who expected seamless equipment deployment.

These scenarios illustrate how organizational silos prevent industrial companies from maximizing service revenue potential while simultaneously limiting their ability to deliver optimal customer experiences that drive long-term loyalty and expansion opportunities.

Integration Solutions for Industrial Revenue Optimization

Transform your service operations with proven integration strategies that deliver measurable ROI and implement industrial service management best practices.

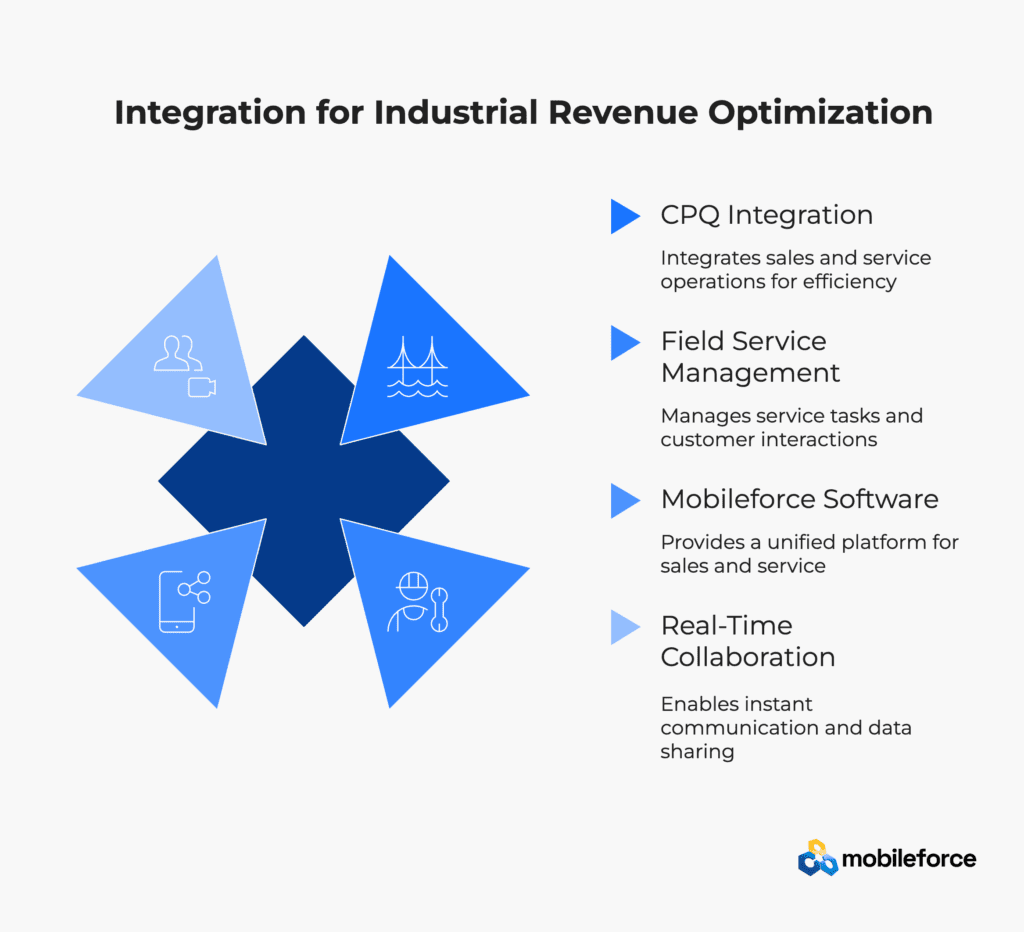

CPQ and Field Service Management Integration

Modern CPQ solutions can bridge the gap between sales and service operations by creating integrated workflows that sync equipment specifications, service requirements, and customer commitments with field service management systems. This integration enables service teams to access comprehensive customer intelligence when planning installations, scheduling maintenance, or identifying expansion opportunities during field visits.

Mobileforce Software’s integrated platform provides comprehensive quote-to-cash and quote-to-service capabilities that seamlessly connect sales commitments with field service delivery, ensuring that both teams have complete visibility into customer requirements, service commitments, and revenue opportunities. This approach exemplifies modern industrial service management best practices designed specifically for complex B2B environments.

When service data flows seamlessly into CPQ systems, sales representatives can create more accurate proposals based on actual service history, equipment performance data, and identified maintenance needs. This data-driven approach improves proposal accuracy and increases the likelihood of successful service contract expansions and equipment upgrades.

Ready to see how integrated CPQ can transform your industrial operations? Schedule a personalized demo to discover how Mobileforce Software’s platform can align your sales and service teams for maximum revenue impact. Our experts will show you real-world scenarios specific to your industry and operational requirements.

Real-Time Collaboration Frameworks for Industrial Teams

Effective sales-service alignment in industrial environments requires real-time collaboration capabilities that enable teams to share customer insights, coordinate field activities, and jointly identify growth opportunities. Direct CPQ-to-service connectivity transforms revenue identification by providing sales reps with live dashboards showing equipment performance and service trends for their accounts. When service data indicates churn risks or expansion opportunities, automated alerts route recommendations directly to the account owner with specific next steps.

🚀 Implementation Tip: Start with one integrated dashboard showing both sales commitments and service delivery status – this single view can improve cross-team collaboration by 65% and reduce customer issues by 40%.

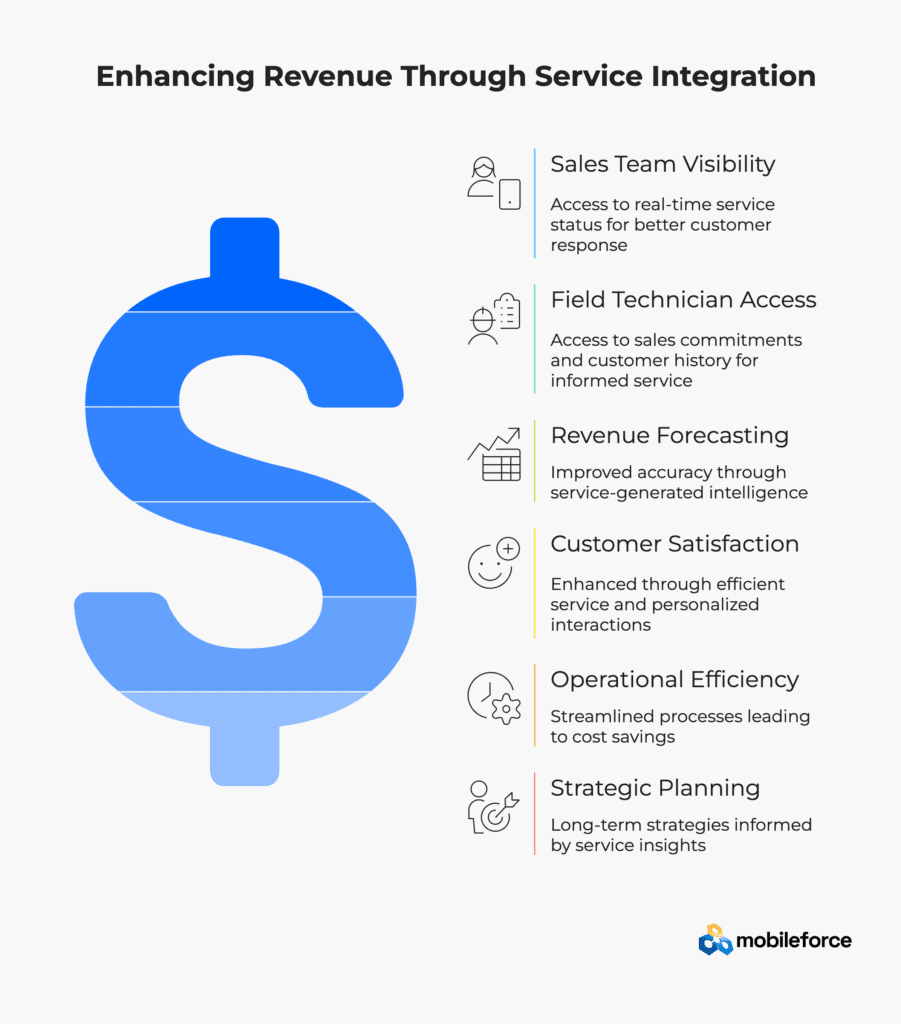

When sales teams can see real-time service delivery status and field technicians have access to sales commitments and customer history, both teams can respond more effectively to customer needs while identifying opportunities for service contract expansions, equipment upgrades, and additional value-added services. This visibility enables more strategic account management and improves the timing of revenue-generating activities.

Revenue Growth Through Service Integration

Companies that successfully integrate their sales and service operations typically experience improved forecasting accuracy, higher recurring service revenue, and reduced customer churn rates. Manufacturing companies represent the largest segment of the field service management market at 22% market share, yet many still operate with disconnected systems that prevent optimal revenue capture from service interactions.

Integrated systems enable more accurate revenue forecasting by incorporating service-generated intelligence about equipment health, maintenance needs, and expansion potential. This comprehensive view of customer relationships improves both short-term service scheduling and long-term strategic planning, making it an essential component of modern industrial revenue optimization strategies.

Companies with effective field service automation typically see improved metrics across all aspects of their business, from service efficiency to customer lifetime value optimization. The investment in integration technology pays dividends through improved operational efficiency, enhanced customer satisfaction, and accelerated service revenue growth.

Real-Time Revenue Intelligence from Service Operations

Any CPQ platform directly connected with service operations – whether homegrown usage tracking systems, third-party field service management tools, or integrated maintenance platforms – significantly amplifies a company’s ability to identify and act on revenue opportunities at the rep level:

- Churn Risk Detection: Service operations data automatically flags accounts showing declining engagement, increased support requests, or delayed maintenance schedules, alerting reps to intervention opportunities before contracts are at risk

- Usage-Based Upsell Triggers: Equipment utilization data and service patterns automatically generate expansion recommendations when customers exceed optimal usage thresholds or require additional capacity

- Cross-Sell Intelligence: Service technician reports and maintenance data reveal opportunities for complementary products, extended warranties, or upgraded service tiers that directly benefit customer operations

⚡ Critical Advantage: This direct integration means revenue opportunities and churn risks are identified and routed to the right rep within minutes of service interactions, rather than being lost in departmental handoff delays that plague traditional industrial sales processes.

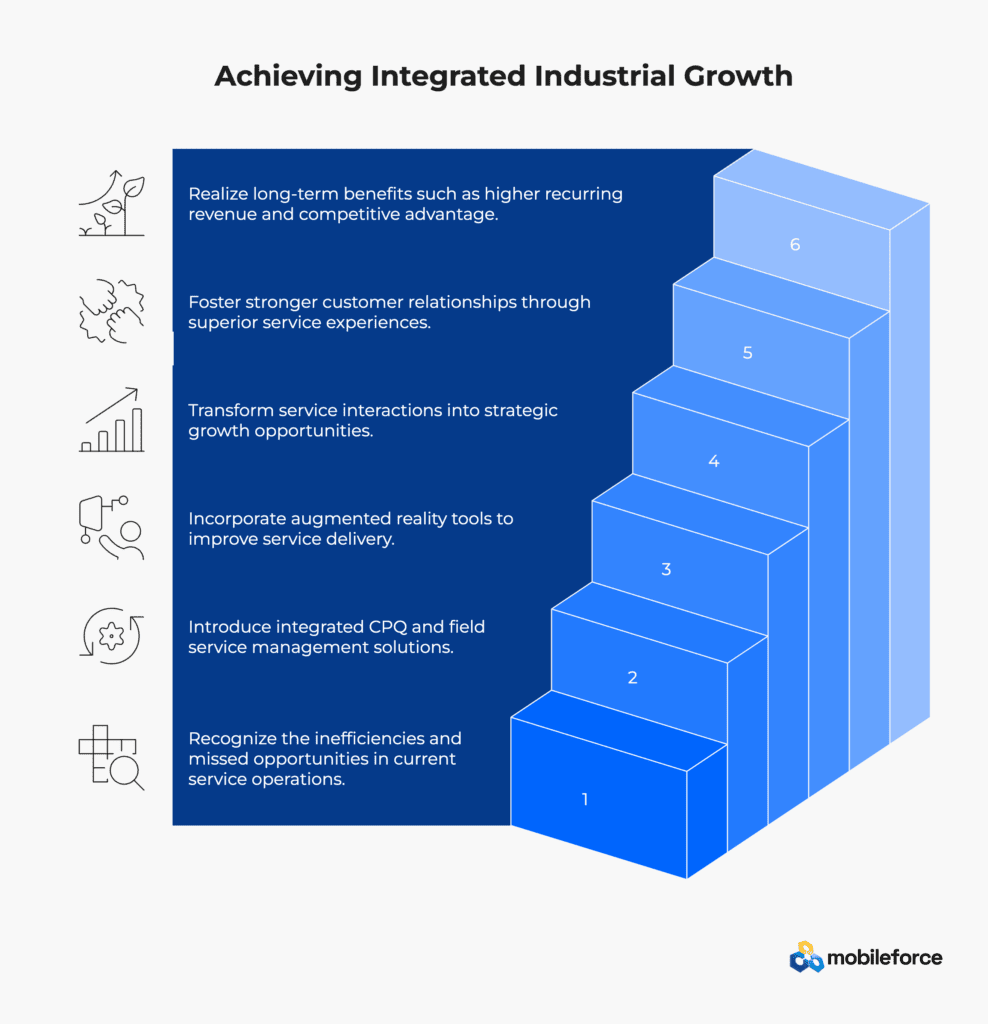

Building a Unified Industrial Growth Engine

The Cost of Inaction in Industrial Service Operations

Industrial businesses that fail to address sales-service alignment issues continue bleeding revenue through preventable service inefficiencies and missed expansion opportunities. The field service management market is projected to reach $11.78 billion by 2030, growing at a CAGR of 13.3%, suggesting that companies investing in integrated operations will capture disproportionate market share.

The cumulative impact of missed opportunities compounds over time in industrial environments where service contracts often represent 40-60% of total customer lifetime value. Each failed service upsell, delayed maintenance contract, or churned customer represents not only immediate revenue loss but also reduced long-term profitability and diminished competitive positioning.

The Future of Integrated Industrial Operations

Forward-thinking industrial companies are implementing integrated CPQ and field service management solutions that transform service interactions into strategic growth opportunities. By 2025, 50% of field service deployments will incorporate augmented reality tools to enhance technician capabilities and improve service delivery efficiency.

The future belongs to organizations that can effectively combine operational excellence with revenue optimization. Companies that invest in integration solutions position themselves to capture more value from existing customer relationships while delivering superior service experiences that drive long-term loyalty and expansion opportunities.

Want to explore how your organization can achieve these results? Book a strategic consultation with our industrial operations specialists. We’ll analyze your current sales-service alignment and provide a customized roadmap for integration success.

Long-Term Benefits: From Cost Center to Revenue Driver

Successfully aligned sales and service operations deliver multiple long-term benefits including higher recurring revenue, improved equipment uptime for customers, and stronger customer relationships. Companies with integrated operations transform service from a necessary cost center into a strategic revenue driver that contributes significantly to overall business growth.

The transformation requires commitment to breaking down traditional departmental boundaries and implementing systems that enable seamless collaboration between sales and service teams. Organizations that successfully make this transition create sustainable competitive advantages that become increasingly difficult for competitors to replicate.

Take Action: Transform Your Industrial Operations Today

Ready to transform service into your primary growth driver? Contact Mobileforce Software to learn how our integrated platform can align your sales and service teams for maximum revenue impact in industrial environments.

Frequently Asked Questions

What is the main cause of sales-service misalignment in industrial companies?

The primary cause is the lack of integrated systems and communication processes between sales and service teams in industrial environments. When teams use separate tools for quote-to-cash and quote-to-service workflows without shared visibility into customer commitments and service requirements, misalignment becomes inevitable. Studies show that 65% of industrial companies struggle with disconnected sales and service operations.

How can CPQ integration help improve industrial service revenue?

CPQ integration provides service teams with comprehensive visibility into sales commitments, customer requirements, and service history, enabling more effective field service delivery and proactive identification of revenue opportunities. Industrial companies using integrated CPQ-FSM systems report 35% higher service revenue growth compared to those with disconnected operations. When field technicians have access to complete customer data, they can identify upsell opportunities for maintenance contracts, warranty extensions, and equipment upgrades during service visits.

What metrics should industrial companies track to measure sales-service alignment?

Key metrics include service contract attachment rates, recurring service revenue growth, first-time fix rates, customer satisfaction scores, and the percentage of service-generated leads that convert to additional sales. Additional industrial-specific metrics include equipment uptime improvements, preventive maintenance contract growth, and average service revenue per customer. These metrics provide insights into how effectively teams collaborate to drive both operational efficiency and revenue growth.

How long does it typically take to see results from sales-service integration in industrial settings?

Most industrial companies begin seeing initial improvements in service delivery coordination and customer satisfaction within 90-120 days of implementation. However, measurable impacts on service revenue metrics typically become evident after 6-9 months as integrated processes mature and teams adapt to new workflows. Industrial environments often require longer implementation timelines due to complex equipment requirements and customer service level agreements.

What are the most common obstacles to implementing sales-service integration in industrial companies?

Common obstacles include resistance to process changes from field technicians (cited by 50% of implementations), complex legacy system integration requirements, lack of executive sponsorship across departments, and inadequate training on new integrated workflows. Industrial companies also face unique challenges such as managing service commitments across multiple customer sites and coordinating specialized equipment requirements. Success requires strong change management, comprehensive technician training, and commitment from leadership across both sales and service organizations.