Mobileforce

- General Resources

Table of Contents

ToggleYour sales team just spent two weeks crafting the perfect proposal for your biggest prospect of the quarter. Product configurations are spot-on, pricing looks competitive, and the presentation is polished. Then reality hits—contract negotiations stall, fulfillment gets confused by missing details, and invoicing becomes a nightmare because half the quote data got lost in translation between systems. Sound familiar?

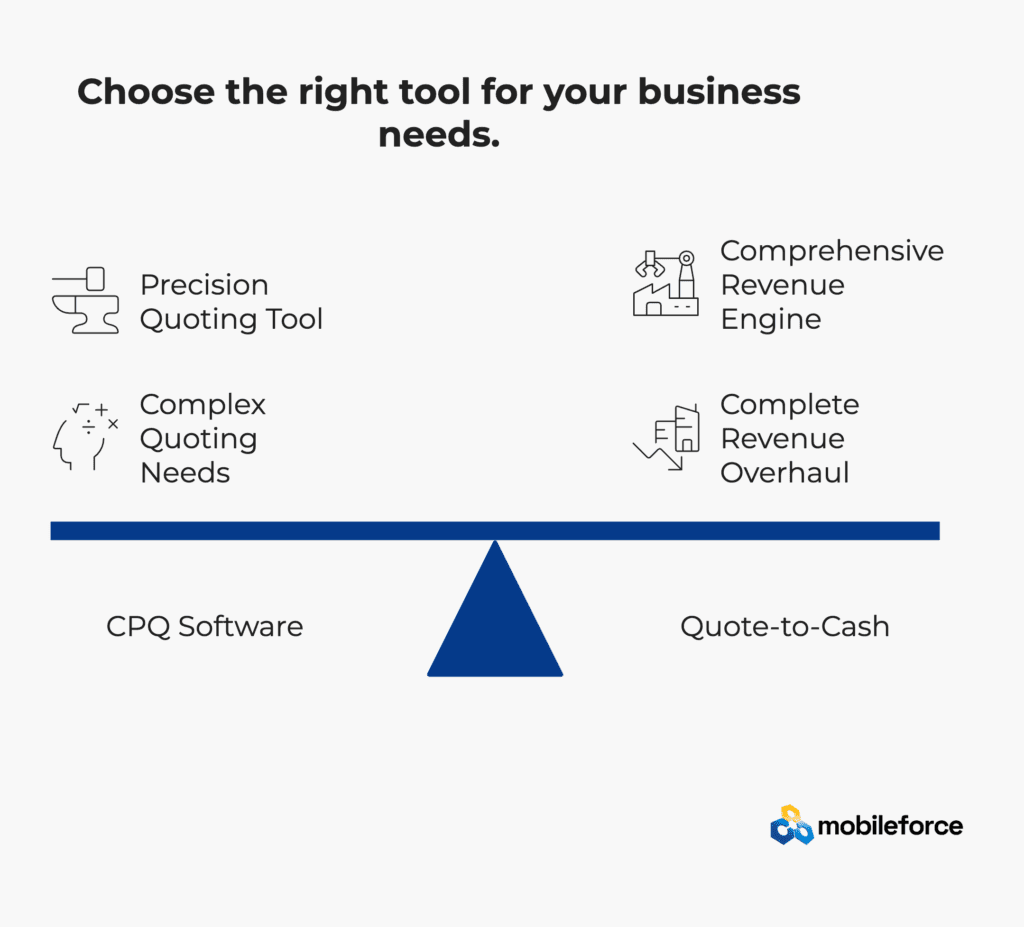

This scenario plays out daily in companies wrestling with the CPQ software versus Quote-to-Cash dilemma. It’s not just about choosing between tools—it’s about deciding whether to solve one piece of the puzzle really well or tackle the entire revenue mess at once.

CPQ software does exactly what it says on the tin: configure products, calculate prices, generate quotes. It’s focused, specialized, and incredibly good at turning complex product catalogs into professional proposals. Think of it as the Swiss Army knife for sales teams drowning in configuration complexity.

Quote-to-Cash takes a different approach entirely. It’s the entire toolshed—quote generation, contract management, order fulfillment, billing, revenue recognition, and everything in between. When it works, it’s beautiful. When it doesn’t, it’s expensive.

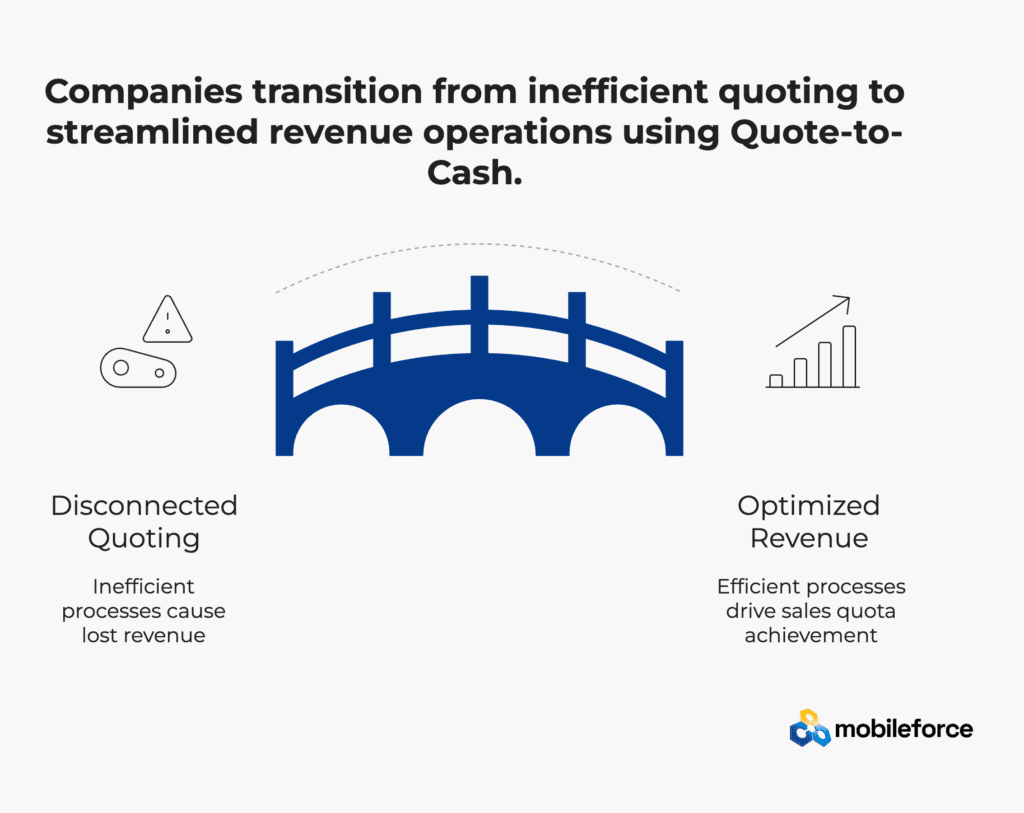

Here’s the data that should grab your attention: companies with optimized quoting processes achieve 105% of their sales quotas compared to just 82% for those still wrestling with manual, disconnected systems. That’s not just a performance gap—it’s the difference between thriving and surviving in today’s marketplace.

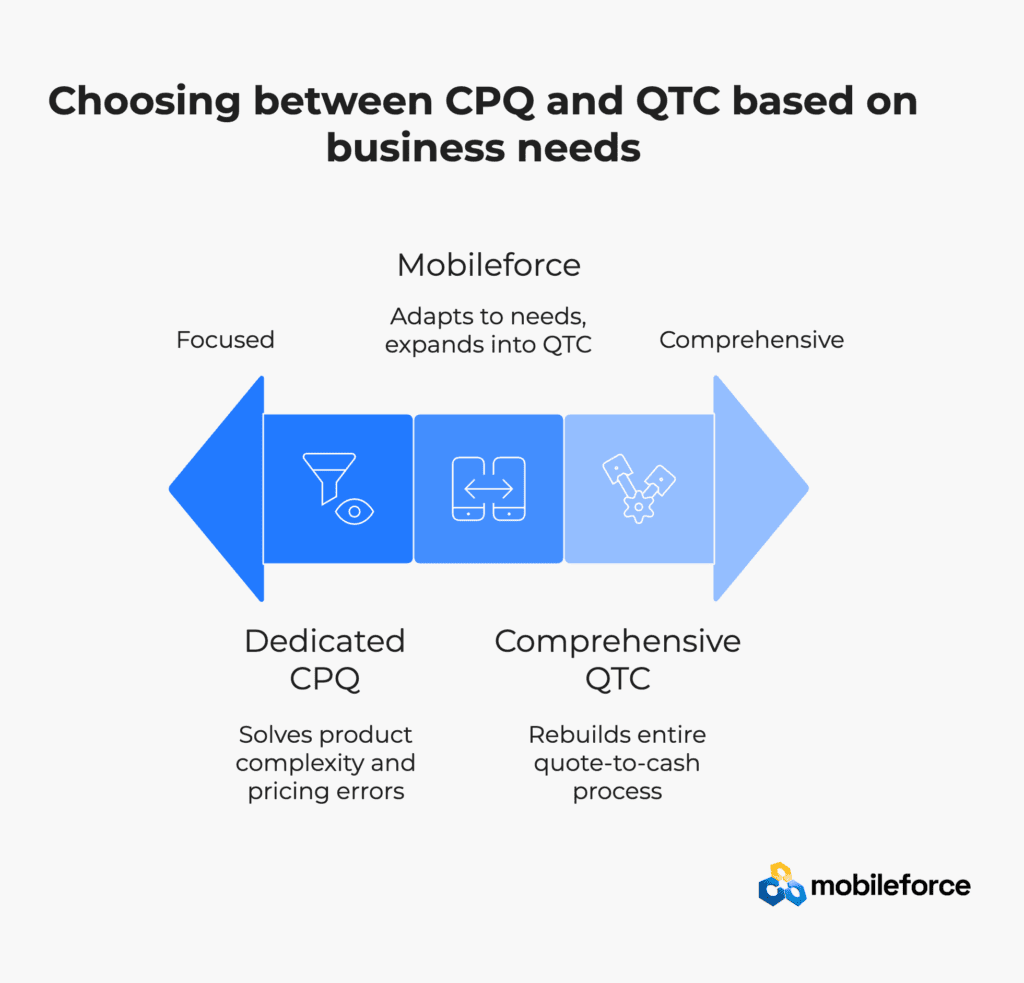

The question isn’t whether you need better processes. The question is how much of your revenue operations you’re ready to fix at once. If you’re primarily battling product complexity and pricing errors, a dedicated CPQ solution might be your fastest path to sanity. But if your entire quote-to-cash process feels like pushing rope uphill, you need something more comprehensive.

For organizations seeking the sweet spot between capability and implementation speed, Mobileforce offers a CPQ platform that doesn’t force you to choose between power and practicality. But more on that as we dig into what really matters for your specific situation.

🚀 Ready to see which approach fits your business? Get your personalized demo today →

What is CPQ Software?

Nothing kills deal momentum quite like a sales rep fumbling through product catalogs while a prospect waits on the other end of the line. CPQ software (Configure, Price, Quote) exists to eliminate exactly this kind of painful awkwardness from your sales process.

Definition and core purpose

CPQ software is the specialized tool that handles the three most error-prone parts of selling: figuring out what the customer actually needs, calculating what it should cost, and creating a professional quote that doesn’t embarrass your brand.

Think of traditional quoting as manual surgery with a butter knife. CPQ software gives you precision instruments. Instead of sales reps copying and pasting product specs into Word documents, cross-referencing pricing sheets, and hoping they didn’t miss any compatibility rules, CPQ handles the heavy lifting automatically.

The core problems CPQ solves are painfully familiar to anyone who’s managed a sales team:

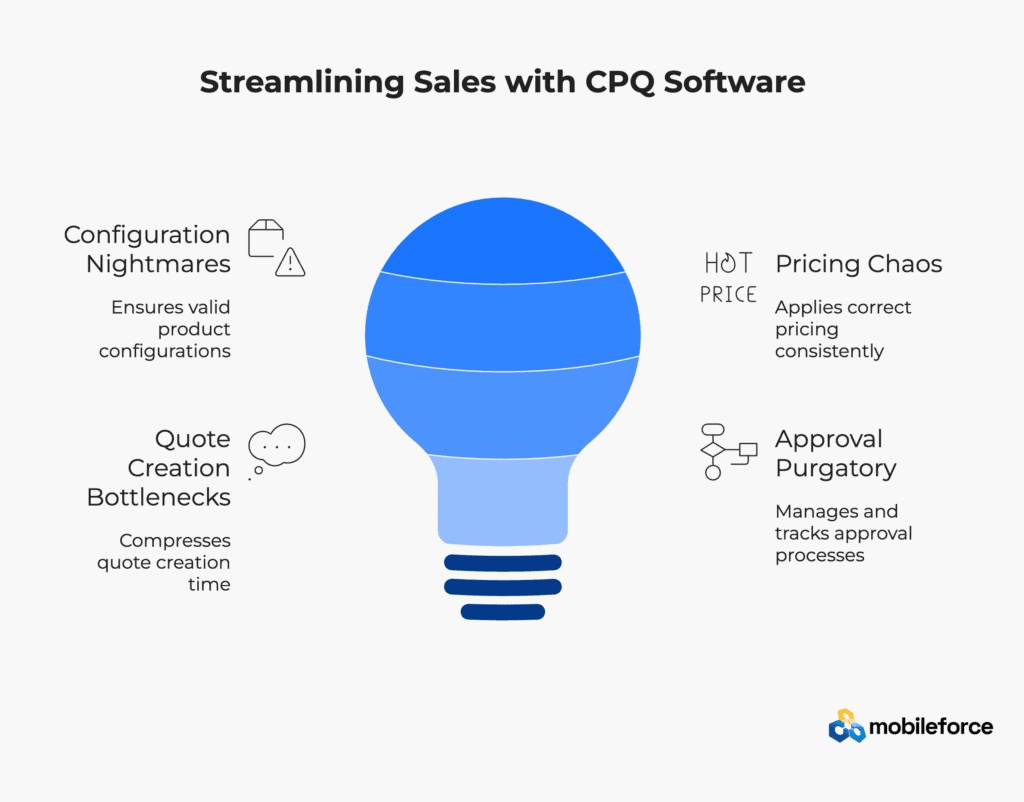

Configuration nightmares: When you have thousands of product combinations and rules, human brains simply can’t keep track. CPQ ensures only valid configurations make it into quotes.

Pricing chaos: Discounts, promotions, volume tiers, customer-specific pricing—it’s a recipe for costly mistakes. CPQ applies the right pricing every time.

Quote creation bottlenecks: Turning product selections into professional proposals shouldn’t take days. CPQ compresses this from hours to minutes.

Approval purgatory: Special pricing requests disappear into email chains where they die slow deaths. CPQ routes approvals intelligently and tracks progress.

Companies that get this right see dramatic improvements: 8x faster quote production, 70% decrease in approval times, and 20% higher lead-to-close rates. But here’s what the numbers don’t capture—the relief of sales teams finally freed from administrative quicksand.

How CPQ fits into the sales process

CPQ sits at the crucial handoff point between relationship building and order fulfillment. Your CRM captures the opportunity. Your ERP fulfills the order. CPQ bridges that gap where deals either accelerate or die.

The workflow typically unfolds like this:

Configuration guidance: Sales reps answer customer requirement questions, and CPQ suggests appropriate products while preventing incompatible combinations. No more “I’ll get back to you” moments during demos.

Dynamic pricing: The system calculates accurate pricing based on customer relationship, purchase history, volume thresholds, and current promotions. Regional pricing variations and currency conversions happen automatically.

Professional quote generation: Within minutes, prospects receive branded proposals that look like they came from a Fortune 500 company, regardless of your actual size.

Seamless handoff: Approved quotes flow directly to fulfillment and billing systems without manual re-entry or translation errors.

For field sales teams, modern CPQ platforms work offline, allowing reps to create and modify quotes during customer meetings, even in areas with poor connectivity. The difference in customer experience is night and day.

Common features of top CPQ software

The best CPQ solutions share several must-have capabilities:

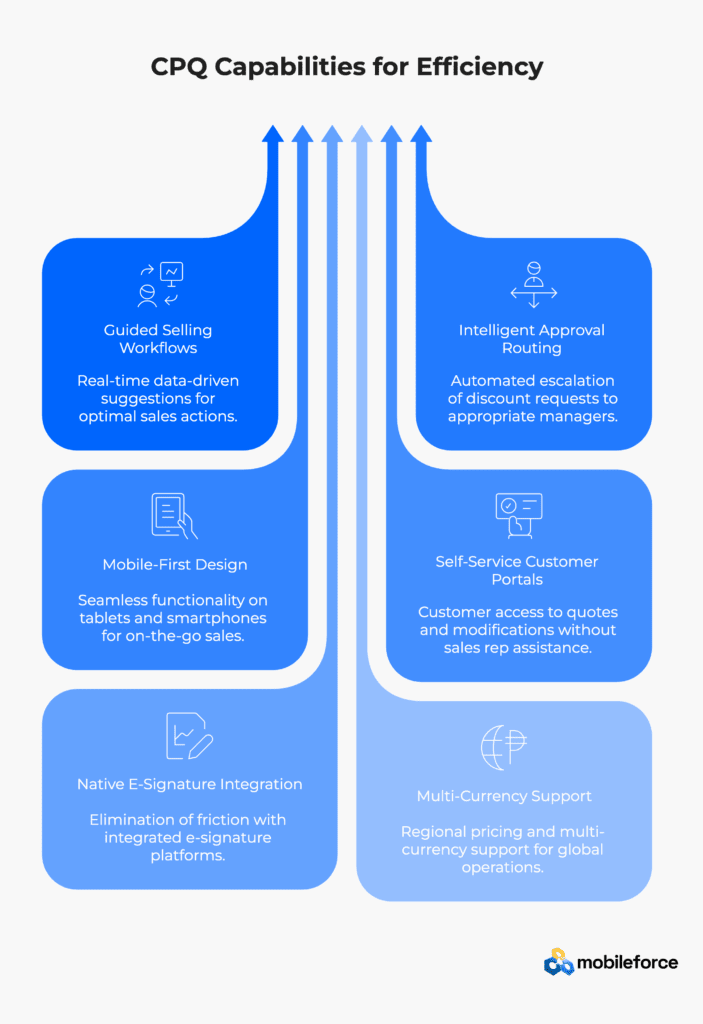

Guided selling workflows that pull real-time data from your CRM and suggest next best actions based on customer context.

Intelligent approval routing that automatically escalates discount requests to appropriate managers based on deal size, margin impact, and risk factors.

Mobile-first design that works seamlessly on tablets and smartphones, because deals don’t wait for reps to get back to their desks.

Self-service customer portals where prospects can review quotes, request modifications, and even accept terms without waiting for sales rep availability.

Native e-signature integration with DocuSign, Adobe Sign, and other platforms to eliminate the final friction point between quote and closed deal.

Multi-currency support and regional pricing capabilities for businesses operating across multiple markets.

Comprehensive audit trails that track every quote modification, approval, and customer interaction for compliance and revenue protection.

No-code customization that lets business users modify product catalogs, pricing rules, and approval workflows without involving IT teams.

Mobileforce CPQ exemplifies these capabilities through its no-code platform that reduces quote generation time by up to 80%. Its persona-driven design creates seamless collaboration across sales, finance, and customer teams—particularly valuable for manufacturing, distribution, and subscription businesses dealing with complex configuration scenarios.

💡 See how CPQ could transform your quoting process. Schedule your demo →

What is Quote-to-Cash (QTC)?

Most organizations operate with a patchwork of disconnected systems that make quote-to-cash feel like a relay race where half the runners drop the baton. Sales generates quotes in one system, contracts get managed in another, orders flow through a third platform, and billing happens in yet another tool. Data flows between these systems like water through a sieve—slowly, inconsistently, and with significant leakage along the way.

Quote-to-Cash (QTC) represents the ambitious attempt to fix this chaos by connecting every step from initial quote creation through final payment collection into one seamless workflow. It’s the difference between hoping your revenue process works and knowing it works.

The Complete Revenue Journey

While CPQ handles the front-end complexity of quoting, QTC encompasses the entire revenue lifecycle that actually gets you paid. Think of CPQ as the engine that starts the car, and QTC as the complete transportation system that gets you to your destination.

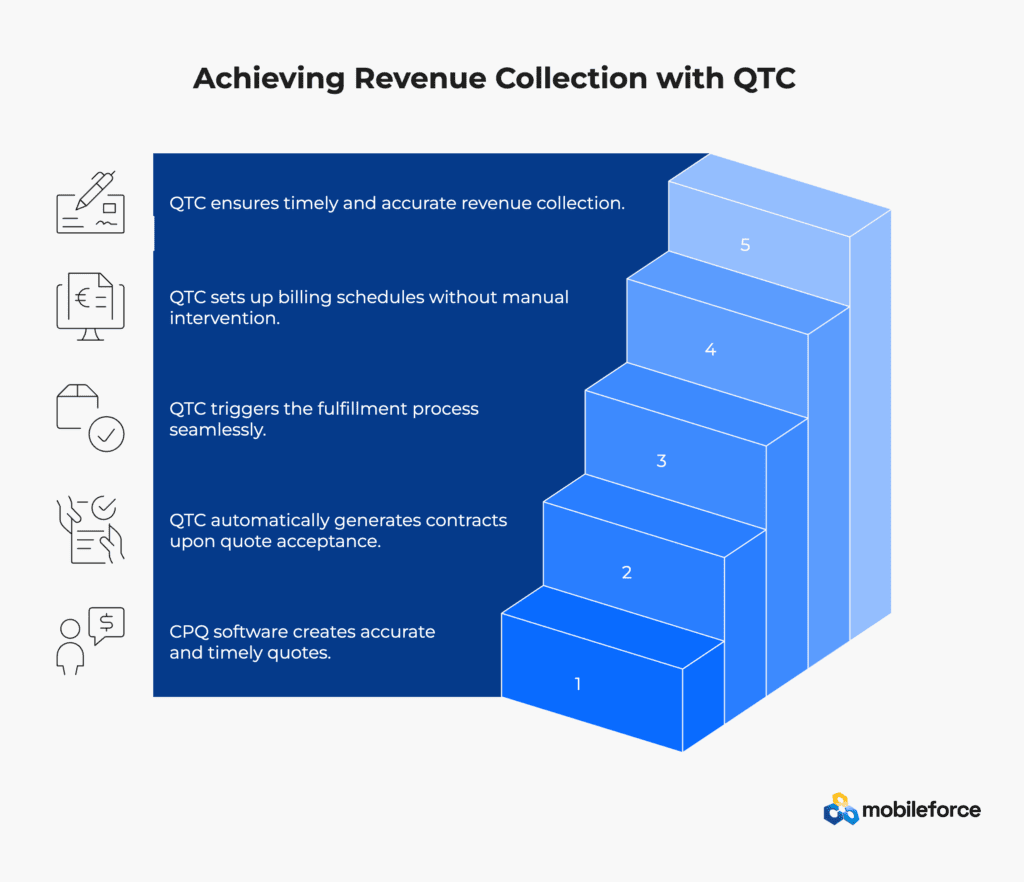

The process typically flows like this: quote creation and approval, contract generation and negotiation, order processing and fulfillment, invoicing and payment collection, and revenue recognition. Each step connects to the next without manual handoffs or data re-entry that creates delays and errors.

Companies implementing optimized QTC systems report impressive results:

70% decrease in approval times

20% increase in lead-to-close rates

60% reduction in overall sales cycle length

But here’s what those statistics don’t capture: the relief of finally having visibility into where deals stand instead of constantly chasing updates across multiple systems.

Where QTC Goes Beyond CPQ

CPQ gets you to the finish line of quote generation. QTC takes you through the entire marathon of revenue collection.

The real magic happens in the automation between steps. Customer accepts a quote? The system automatically generates contracts, routes them for signatures, triggers order fulfillment, and sets up billing schedules. No manual intervention. No data gets lost in translation. No deals fall through the cracks because someone forgot to follow up.

QTC also addresses the compliance nightmare that keeps finance teams awake at night. Audit trails become automatic. Pricing consistency gets enforced across regions and channels. Revenue recognition follows accounting standards without manual calculations that invite errors.

The Moving Parts That Matter

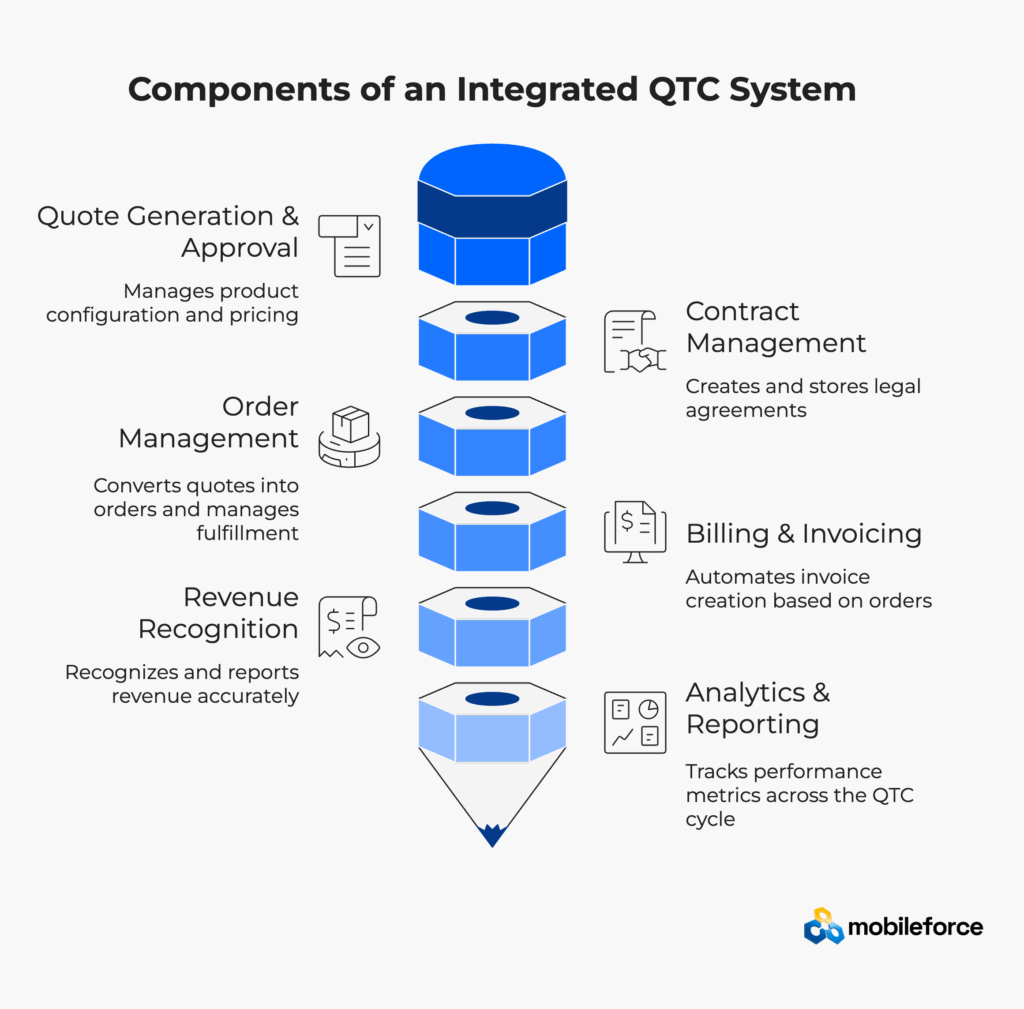

A proper QTC system connects several critical components:

Quote Generation & Approval Workflows – The CPQ foundation that handles product configuration, pricing calculation, and approval routing

Contract Management – Tools for creating, negotiating, and storing legal agreements with electronic signature capabilities

Order Management – Systems that convert approved quotes into orders and manage fulfillment without dropping details

Billing & Invoicing – Automated processes for creating accurate invoices based on orders and contracts

Revenue Recognition – Tools for properly recognizing and reporting revenue according to accounting standards

Analytics & Reporting – Dashboards that track performance metrics across the entire quote-to-cash cycle

The challenge isn’t finding systems that handle these individual pieces—it’s finding a platform that connects them without creating new integration headaches.

Mobileforce approaches this challenge through its seamless quote-to-cash-to-service platform. The no-code architecture means businesses can rapidly configure and adapt processes without extensive coding or lengthy implementations. The platform breaks down information silos by integrating with CRM, ERP, and contract systems to maintain data consistency throughout the entire customer lifecycle.

For organizations tired of managing revenue operations through disconnected systems, Mobileforce provides an integrated QTC solution that connects previously fragmented processes into one cohesive system that actually works.

CPQ vs Quote-to-Cash: What’s the Difference?

The choice between CPQ and Quote-to-Cash isn’t about picking the “better” solution—it’s about understanding which problem you’re actually trying to solve. Most organizations get seduced by feature lists and vendor promises without asking the fundamental question: are you fixing a quoting problem or a revenue operations problem?

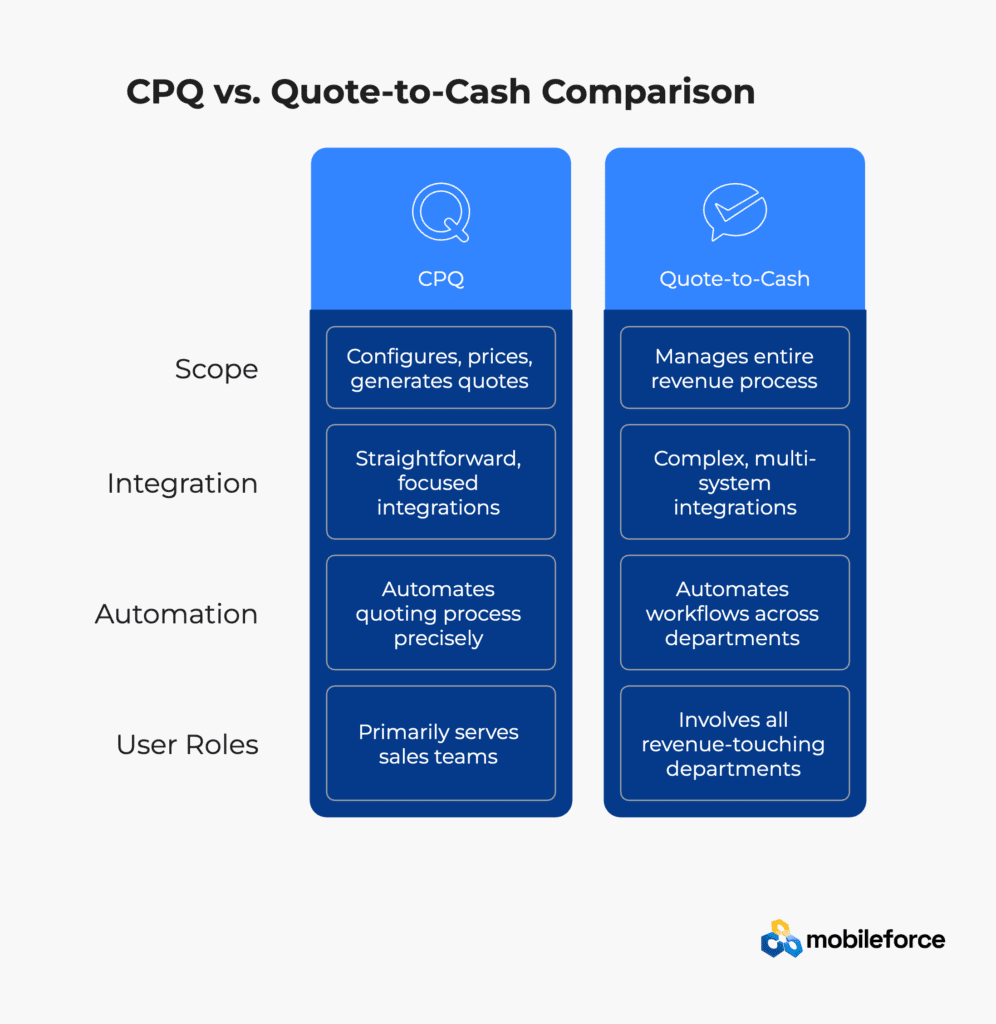

Scope and functionality

CPQ software does three things exceptionally well:

Configures complex products without breaking compatibility rules

Calculates accurate prices with proper discounts and approvals

Generates professional quotes that don’t embarrass your brand

That’s it. CPQ is a specialist—the orthopedic surgeon of sales tools. It diagnoses configuration complexity, operates with precision, and sends you home with a professional-looking quote.

Quote-to-Cash has different ambitions entirely. It wants to own your entire revenue process from first contact to final payment. Contract management, order fulfillment, billing, revenue recognition—the whole enchilada. When QTC works, it’s like having a personal assistant who handles everything. When it doesn’t, it’s like having a personal assistant who’s also trying to be your accountant, lawyer, and operations manager.

Here’s where it gets interesting: CPQ lives comfortably inside QTC systems, but QTC can’t exist without some form of quoting capability. Think of CPQ as the engine and QTC as the entire vehicle. You can upgrade the engine without buying a new car, but you can’t drive an engine to work.

Integration and automation levels

CPQ integrations tend to be straightforward—pull customer data from your CRM, grab pricing from your ERP, maybe sync with your product catalog. Clean, focused, manageable.

QTC integrations are where things get complicated fast. You’re connecting CRM, CPQ, contract management, order systems, billing platforms, accounting software, and customer service tools. Each integration point becomes a potential failure point. Data flows like a river through multiple dams—sometimes smoothly, sometimes creating expensive floods.

The automation story follows the same pattern. CPQ automates the quoting process with surgical precision. QTC automates entire workflows across departments, which sounds amazing until you realize that one broken integration can bring down your entire revenue operation.

Smart organizations approach this challenge incrementally. Start with CPQ to solve immediate quoting pain, then expand automation gradually as processes mature and teams adapt.

User roles and touchpoints

CPQ primarily serves sales teams with some spillover into sales operations and finance. The user base is contained, focused, and relatively easy to train.

QTC systems involve everyone who touches revenue—sales, legal, operations, finance, customer success, and sometimes even IT. More stakeholders mean more opinions, more change management, and more ways for implementations to go sideways.

This isn’t necessarily bad, but it requires honest assessment of your organization’s readiness for cross-departmental process change. Some companies thrive on this coordination. Others struggle to get sales and marketing aligned on lead definitions.

The Strategic Reality

Mobileforce addresses this dilemma through flexible architecture that doesn’t force you to choose between focused CPQ capabilities and broader QTC ambitions. Start with core quoting functionality that delivers immediate ROI, then expand into contract management, order processing, and billing automation as your organization evolves.

The platform’s no-code approach means you’re not locked into rigid workflows or expensive customizations. You can adapt the system to match your actual business processes rather than forcing your team to adapt to someone else’s idea of how revenue operations should work.

💡 See how Mobileforce adapts to your specific needs. Book your demo today →

Benefits of CPQ Software and QTC Systems

Nothing speaks louder than cold, hard results. Companies that optimize their quoting processes don’t just work faster—they win more deals, make more money, and drive their competitors crazy trying to keep up.

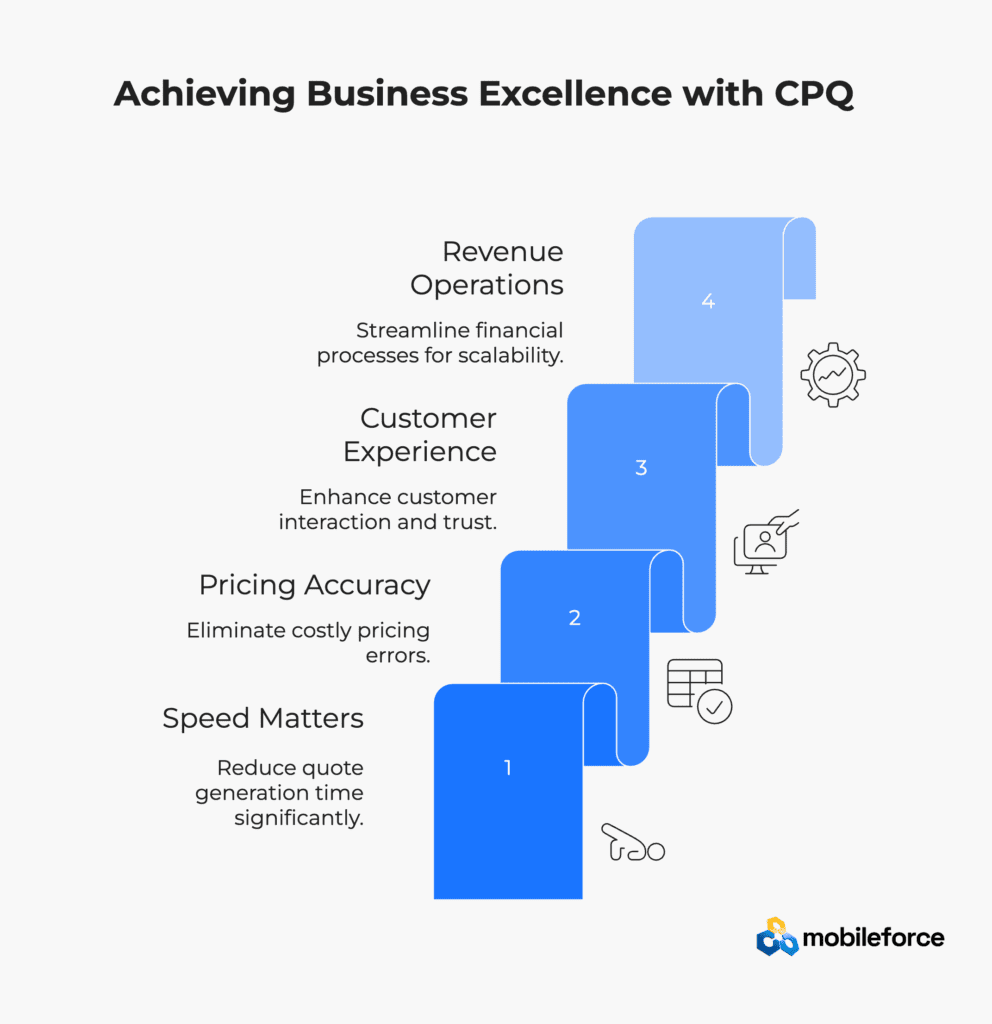

Speed That Actually Matters

Manual quoting processes are where deals go to die. Sales reps spend days hunting down product specifications, double-checking discount calculations, and formatting proposals that look like they were assembled by a committee of caffeinated interns.

Modern CPQ solutions cut through this administrative quicksand. Quote generation time drops by up to 80%. What used to take three days now happens in thirty minutes. Field sales teams can create complex configurations while sitting in their prospect’s conference room, turning “let me get back to you” into “when can we start?”

The approval bottleneck that strangles so many deals? Gone. Automated routing based on deal size and discount thresholds means your best deals don’t languish in someone’s inbox while competitors move faster.

Pricing Accuracy That Protects Your Margins

Here’s a sobering reality: manual pricing errors cost the average B2B company 2-5% of annual revenue. One misplaced decimal point, one forgotten discount tier, one outdated price list—and suddenly your “profitable” deal is bleeding money.

CPQ systems eliminate these expensive mistakes through intelligent validation. Consistent pricing across regions and channels. Proper application of volume discounts and promotions. Adherence to customer-specific pricing agreements. Automated compliance with regulatory requirements.

The result? Pricing confidence that lets your sales team focus on value instead of constantly second-guessing their numbers.

Customer Experience That Closes Deals

Your prospects expect Amazon-level speed and professionalism. When they request a quote, they’re not interested in your internal process challenges or approval delays. They want accurate information, delivered quickly, in a format that helps them make decisions.

Self-service portals let customers review proposals and make simple modifications without playing phone tag with sales reps. Real-time collaboration features enable joint engagement throughout the quotation process. Professional presentation builds trust from the first interaction.

The competitive advantage here is simple: while your competitors are still formatting PDFs and hunting down approvals, you’re already discussing implementation timelines.

Revenue Operations That Scale

The finance team benefits extend far beyond faster invoicing. QTC systems automatically translate accepted quotes into orders, contracts, and invoices without manual re-entry that introduces errors. Revenue recognition becomes manageable through automated tracking of contract terms and billing cycles.

For subscription businesses especially, this automation isn’t just convenient—it’s essential for maintaining accurate financial reporting as you scale.

Real-World Impact: A manufacturing equipment distributor reduced quote generation time from 3 days to 2 hours while increasing quote accuracy by 89%. Their field sales team can now create complex equipment configurations at customer sites, even in areas with poor cellular coverage. The result? 40% shorter sales cycles and 25% higher win rates.

Mobileforce delivers these benefits through its no-code platform that connects quoting with downstream processes, reducing implementation time while maintaining the flexibility to adapt to your unique business requirements.

📊 Calculate your potential ROI and see these benefits in action. Schedule your demo today →

When to Choose CPQ or QTC

The choice between CPQ software and Quote-to-Cash isn’t about following industry trends—it’s about matching your solution to your specific business reality. Some organizations need a precision instrument for complex quoting. Others need to rebuild their entire revenue engine. The difference matters more than you might think.

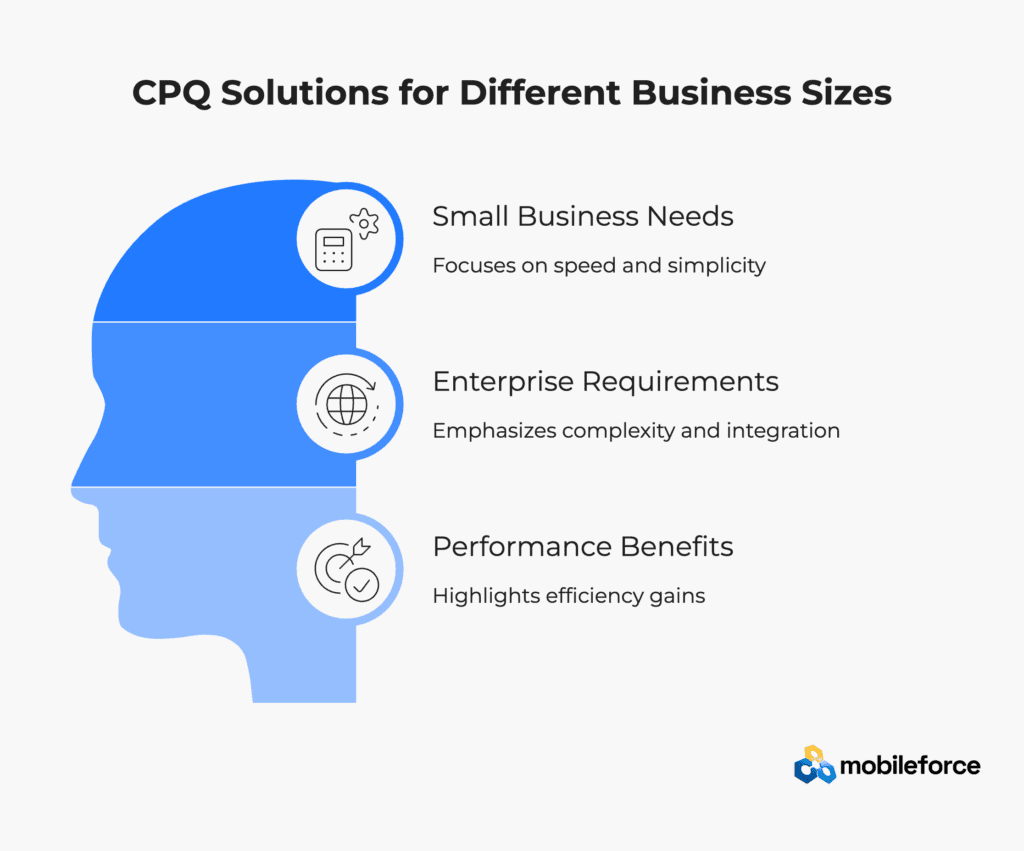

Small Business vs Enterprise: Different Problems, Different Solutions

Small businesses typically face one primary challenge: getting quotes out faster without breaking the bank or requiring a computer science degree to operate. If you’re running a lean operation where every minute counts, standalone CPQ software makes sense when you need:

Quick setup that measures in weeks, not quarters. No-code configuration that lets your sales ops person make changes without calling IT. Simple interfaces that new hires can master in days, not months.

Enterprise organizations operate in a different universe entirely. Complex approval hierarchies where a single discount request might need three different signatures. Multi-currency support for global operations. Integration requirements that would make a systems architect weep. When you’re managing enterprise complexity, sophisticated CPQ functionality becomes essential—not optional.

The performance gap speaks for itself. Companies with properly implemented CPQ solutions achieve 8x faster quote production and 70% decreases in approval times. At enterprise scale, those improvements translate into millions in additional revenue.

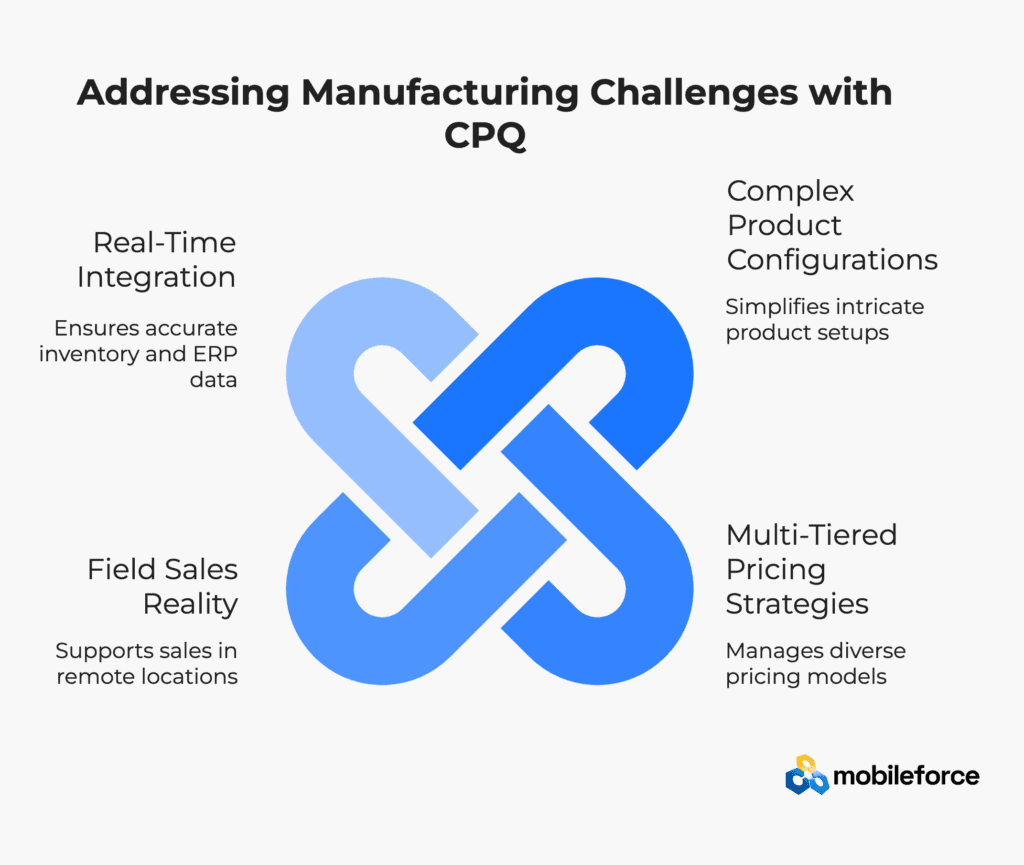

Manufacturing: Where CPQ Complexity Meets Reality

Manufacturing companies live in configuration hell. Thousands of possible product combinations. Pricing that changes based on materials, volume, and customer relationships. Field sales teams working in locations where WiFi is a luxury, not a given.

Manufacturing CPQ software addresses these pain points directly:

Complex product configurations that would overwhelm manual processes. Your sales rep shouldn’t need an engineering degree to quote a custom solution.

Multi-tiered pricing strategies that adapt to distributors, regions, and volume commitments. The system should handle the complexity, not your sales team.

Field sales reality where reps work in remote manufacturing sites with spotty connectivity. Offline capability isn’t a nice-to-have—it’s mission-critical.

Real-time integration with inventory and ERP systems prevents the nightmare of promising something you can’t deliver.

QTC: When You Need to Fix Everything

Sometimes the problem isn’t just quoting—it’s the entire revenue process. Quote-to-Cash makes sense when you’re dealing with:

Subscription businesses where the real work begins after the quote is signed. Recurring billing, usage tracking, renewal management—these aren’t CPQ problems, they’re business model problems.

Complex revenue recognition requirements that keep your finance team up at night. Companies subject to strict financial regulations can’t afford manual processes that create compliance risks.

Digital transformation initiatives that span multiple departments. When you’re trying to eliminate information silos and create unified customer views, piecemeal solutions create more problems than they solve.

Making the Right Choice for Your Business

Here’s what most vendors won’t tell you: the “best” solution is the one that solves your specific problems without creating new ones. If you’re primarily battling product complexity and pricing errors, a dedicated CPQ solution gets you there faster and cheaper. If your entire quote-to-cash process needs rebuilding, a comprehensive approach makes more sense.

Mobileforce bridges this gap through its adaptable platform that grows with your needs. Start with core CPQ functionality and expand into broader QTC processes as your requirements evolve. The no-code architecture means you can address immediate quoting challenges while maintaining a clear path toward comprehensive revenue management—without the traditional trade-offs between capability and implementation speed.

🎯 Not sure which approach fits your business? Get a personalized assessment today →

The Bottom Line: Stop Overthinking, Start Implementing

The CPQ versus Quote-to-Cash decision isn’t as complicated as most vendors make it seem. You know your pain points. You understand your priorities. The question isn’t whether you need better quoting processes—it’s how quickly you can get them implemented and working for your team.

If your primary headache is product complexity and pricing errors, CPQ software offers the fastest path to relief. You’ll see immediate improvements in quote accuracy and speed without the overhead of a massive system overhaul.

If your entire revenue operation feels like herding cats, Quote-to-Cash provides the comprehensive approach needed to connect all those disconnected pieces. Yes, it’s more complex. Yes, it takes longer. But it solves the bigger problem.

Here’s what shouldn’t factor into your decision: vendor marketing promises, feature checklists that read like technical manuals, or implementation timelines that stretch into next year. What should matter is getting your sales team back to selling instead of wrestling with spreadsheets and approval bottlenecks.

The dirty secret about both CPQ and QTC implementations? Most fail because companies choose based on what they think they need rather than what actually works for their specific situation. Small businesses get talked into enterprise solutions they’ll never fully utilize. Enterprises get sold lightweight tools that crumble under real-world complexity.

Mobileforce cuts through this noise with a platform that adapts to your actual requirements rather than forcing you to adapt to theirs. Start with core CPQ functionality if that’s what you need today. Expand into broader Quote-to-Cash capabilities when your business demands it. The architecture supports both approaches without the typical rip-and-replace drama.

Your competitors aren’t waiting for the perfect solution. They’re implementing better processes today and gaining ground while you’re still evaluating options. The cost of inaction compounds daily—every manual quote, every pricing error, every lost deal because your process couldn’t keep up with the buyer’s timeline.

🎯 Stop debating and start seeing results. Book your Mobileforce demo today →

Key Takeaways

Understanding the difference between CPQ software and Quote-to-Cash systems is crucial for optimizing your sales process and revenue operations.

• CPQ focuses on quoting efficiency – Streamlines product configuration, pricing accuracy, and quote generation, reducing quote creation time by up to 80%

• QTC covers the complete revenue journey – Extends beyond quoting to include contract management, order fulfillment, billing, and revenue recognition across departments

• Choose CPQ for focused sales challenges – Best for businesses primarily struggling with complex configurations, pricing errors, and slow quote generation

• Choose QTC for comprehensive revenue operations – Ideal for subscription businesses, companies with complex revenue recognition needs, or organizations eliminating cross-departmental silos

• Implementation success drives measurable results – Companies with optimized quoting processes achieve 105% of sales quotas versus 82% for manual systems

The key is matching your solution to your specific business challenges while considering future growth needs. Whether you start with CPQ and expand to QTC or implement a comprehensive system from the beginning, the right choice will transform your customer engagement and accelerate revenue growth.

FAQs

Q1. What’s the main difference between CPQ software and Quote-to-Cash systems? CPQ software focuses specifically on automating the quoting process, including product configuration, pricing, and quote generation. Quote-to-Cash systems, on the other hand, cover the entire revenue journey from initial quote to payment collection, including contract management, order fulfillment, and billing.

Q2. How does CPQ software benefit small businesses versus enterprises? Small businesses benefit from standalone CPQ software for faster quote generation without the complexity of a full QTC implementation. Enterprises often require more sophisticated CPQ functionality to handle complex approval hierarchies, multi-currency support, and integration with existing systems.

Q3. When should a company consider implementing a Quote-to-Cash system? A Quote-to-Cash system is particularly beneficial for subscription-based businesses, companies with complex revenue recognition requirements, and organizations undergoing digital transformation across multiple departments. It helps eliminate information silos and create unified customer views.

Q4. What are the key benefits of implementing CPQ or QTC solutions? Both CPQ and QTC solutions offer benefits such as faster quote generation and approvals, improved pricing accuracy and compliance, enhanced customer experience, and streamlined revenue recognition. Companies with optimized quoting processes achieve significantly higher sales quota attainment.

Q5. How do CPQ and QTC solutions impact different departments within an organization? CPQ primarily serves sales teams, with some touchpoints extending to sales managers, product managers, and finance teams. QTC systems have a broader impact, involving sales, legal, operations, finance, and customer success departments, creating unified visibility into customer relationships across the organization.