- Home

- Glossary Term

- Custom Price Per Customer

Introduction

Custom Price Per Customer (CPP) is a method that adjusts product or service prices based on individual client needs. Rather than using a fixed, one-size-fits-all approach, CPP tailors costs according to each customer’s unique factors, allowing businesses to better align pricing with the value offered. This guide outlines the concept, benefits, practical examples, and implementation considerations of CPP in a straightforward manner.

What is Custom Price Per Customer?

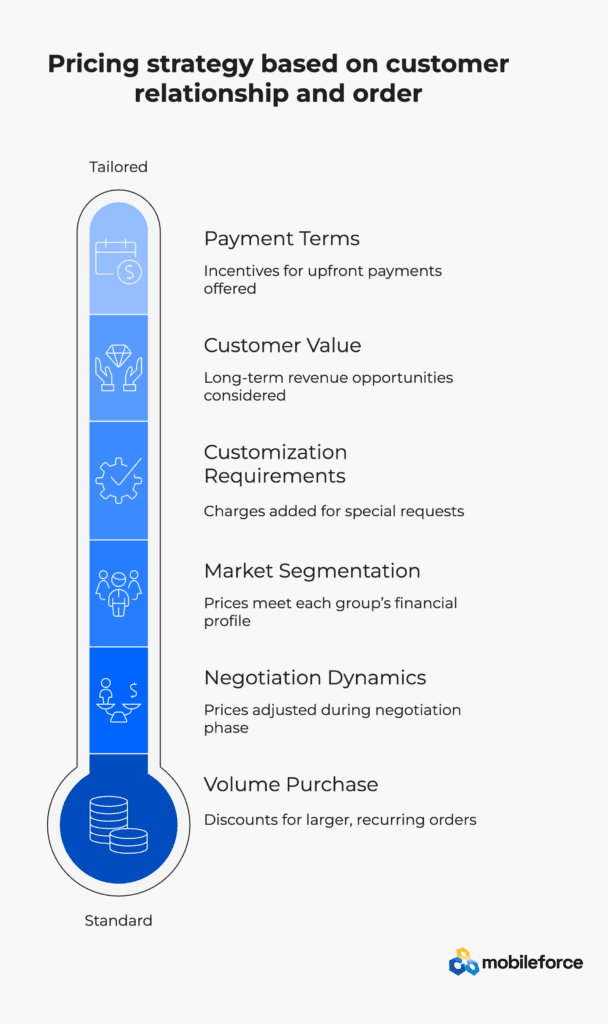

Custom Price Per Customer involves setting prices based on several factors, allowing the pricing to reflect the distinct characteristics and requirements of each customer. In practice, this means that:

- Customer Value is assessed by analyzing:

- The potential long-term revenue from a customer.

- Purchase frequency and opportunities for upsell or cross-sell.

- Volume of Purchase is considered, where:

- Larger orders or recurring subscriptions often qualify for discounts.

- Economies of scale are recognized and factored into the pricing.

- Negotiation Dynamics come into play:

- Prices may be adjusted during the negotiation phase, reflecting competitive market conditions and customer commitment.

- Customization Requirements are integrated by:

- Adding charges for special requests or unique product features that require additional resources.

- Market Segmentation is used to:

- Differentiate pricing for various customer groups—such as startups, mid-sized companies, or large enterprises—ensuring that prices meet each group’s financial profile.

- Payment Terms are incorporated, providing:

- Incentives for upfront payments or longer-term contracts, which can help with cash flow management.

Together, these factors ensure that the pricing model is flexible and aligned with both the customer’s needs and the company’s strategic objectives.

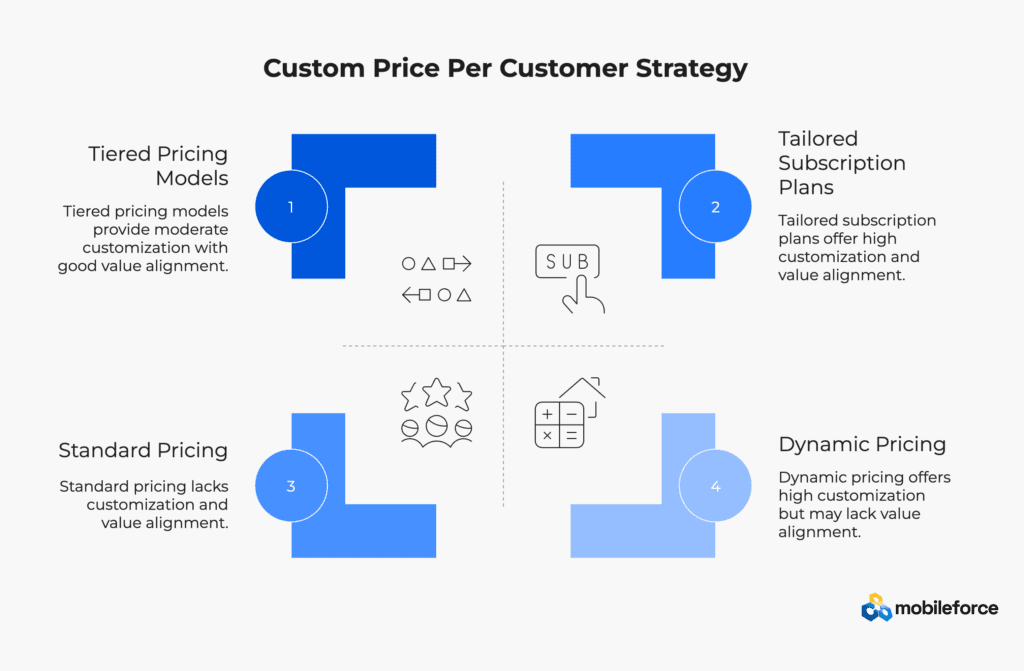

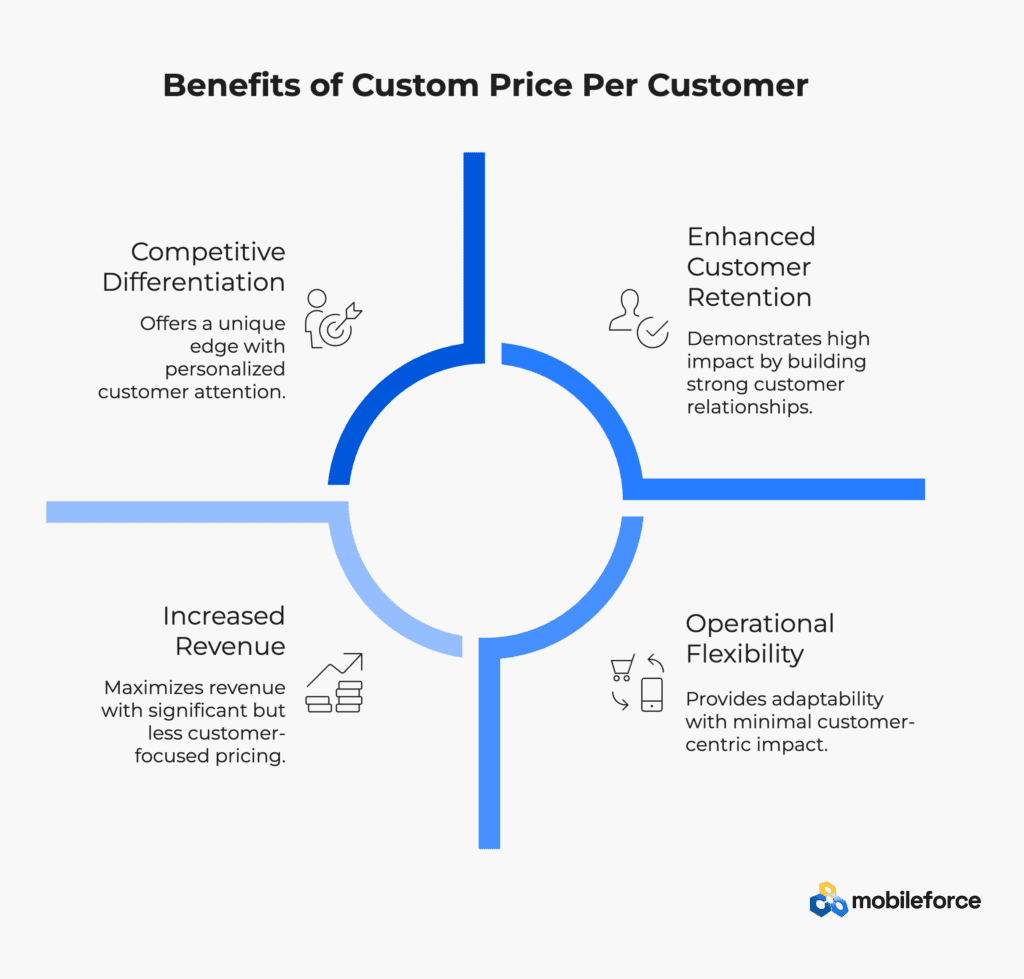

Why Use Custom Price Per Customer?

There are several clear advantages to implementing CPP:

- Increased Revenue

- By charging prices that more accurately capture the value offered, businesses can potentially increase revenue per sale.

- Improved Profitability

- Pricing based on individual customer profiles can help maintain higher margins, ensuring profitability even when offering discounts for volume or loyalty.

- Enhanced Customer Retention

- Custom pricing strengthens customer relationships by demonstrating that the business understands and caters to specific needs, which builds trust and loyalty.

- Competitive Differentiation

- A tailored pricing approach can be a distinguishing factor in competitive markets, attracting customers who value personalized attention.

- Operational Flexibility

- Adjusting prices in response to market conditions or evolving customer requirements makes the business more agile and adaptable.

In summary, CPP not only presents a new way to approach pricing but also helps maintain a competitive edge by ensuring that each deal is optimized for both the customer and the company.

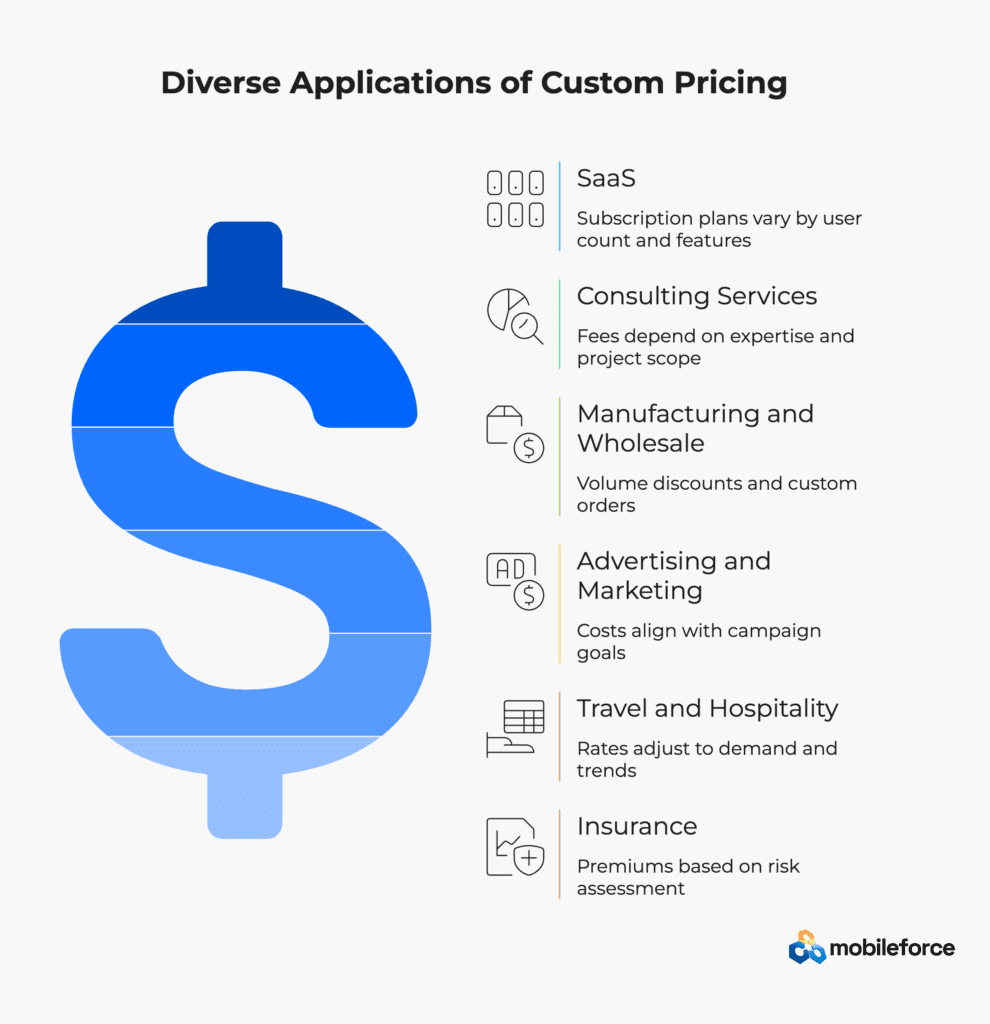

Real-World Examples of Custom Price Per Customer

Custom Price Per Customer is widely used across several industries:

- Software-as-a-Service (SaaS)

- Subscription plans vary according to the number of users, features required, storage, and support levels. For instance, a small startup may choose a basic package, while an enterprise requires premium services.

- Consulting Services

- Fees differ based on the consultant’s expertise, the scope of the project, and the client’s specific needs. This ensures that complex projects are matched with pricing that reflects the intensive support provided.

- Manufacturing and Wholesale

- Volume discounts are typical, along with negotiated prices for orders that involve custom packaging or production adjustments.

- Advertising and Marketing

- Campaign costs, such as those based on cost per thousand impressions (CPM) or cost per click (CPC), are negotiated to align with campaign goals and target audience size.

- Travel and Hospitality

- Rates are adjusted dynamically based on factors like demand, seasonal peaks, and booking trends, ensuring optimal occupancy and maximized revenue.

- Insurance

- Premiums are calculated based on tailored risk assessments and coverage options, resulting in policies that are optimized for each customer’s profile.

These examples demonstrate how CPP can be effectively tailored to different sectors, ensuring that each customer pays a price that reflects their specific situation.

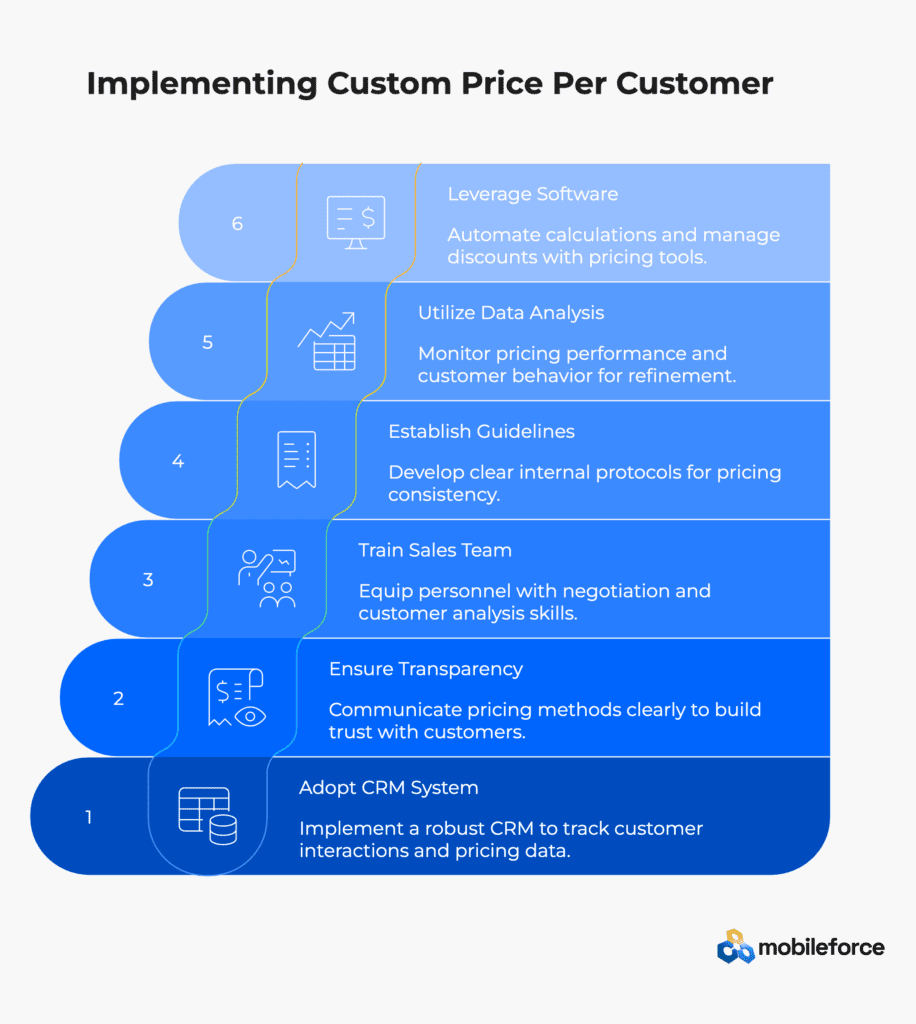

Implementing Custom Price Per Customer: Key Considerations

To effectively adopt CPP, a business should consider several key points:

- Adopt a Robust CRM System

- Maintain detailed records of customer interactions, pricing negotiations, and historical data. A sophisticated CRM helps track these variables to support informed pricing decisions.

- Ensure Transparency in Pricing

- Clearly communicate how individual prices are determined. Transparency builds trust and reduces potential misunderstandings with customers.

- Train Your Sales Team

- Equip personnel with skills in negotiation and customer analysis. Well-trained teams can better articulate the value of tailored pricing and manage complex negotiations.

- Establish Defined Pricing Guidelines

- Develop clear internal protocols to standardize the approach while allowing for necessary flexibility. This ensures consistency and prevents pricing from deviating too far from strategic goals.

- Utilize Data Analysis

- Regularly monitor pricing performance and customer behavior. Continuous data analysis helps refine the pricing strategy over time.

- Leverage Pricing Software Tools

- Employ technology to automate calculations and manage discounts, streamlining the CPP process and reducing errors.

A thoughtful implementation strategy that combines modern tools with best practices in customer communication can make CPP an effective and profitable pricing model.

Conclusion

Custom Price Per Customer is a versatile pricing model designed to tailor pricing according to the specific needs and value of each customer. By combining direct factors like customer value, purchase volume, negotiation outcomes, customization demands, market segmentation, and payment terms, CPP offers a strategic approach to optimizing revenue and fostering stronger customer relationships. With robust CRM systems, clear pricing guidelines, skilled sales teams, and regular data analysis, businesses can effectively implement this model to remain competitive and profitable.